Key drivers of open finance in Southeast Asia; Stablecoins have found product-market fit; Types of Consumer Wallets and Funding Types;

This edition of Fintech Wrap Up dives into open finance breakthroughs in Southeast Asia, Europe’s advancements in digital identity, and the growing impact of AI on fintech compliance

Insights & Reports:

1️⃣ Key drivers of open finance in Southeast Asia

2️⃣ Regulatory initiatives to drive European eID expansion

3️⃣ Corporate client onboarding – the benefits of corporate digital identity (CDI)

4️⃣ Open finance vs open banking—what's the difference?

5️⃣ Stablecoins have found product-market fit

6️⃣ Types of Consumer Wallets and Funding Types

7️⃣ Big Ideas by a16z in 2025: Enterprise + Fintech

8️⃣ An overview of the global Embedded Finance landscape

9️⃣ Fintech Startup Chime Submits Confidential Filing for IPO

TL;DR:

I’m thrilled to kick off this edition with an exciting announcement! I’m launching a new initiative to connect top fintech talent with leading companies in the industry. This platform will focus on creating meaningful matches between professionals and organizations, prioritizing quality over quantity. Whether you’re a company seeking skilled candidates or a professional looking for your next big opportunity, I’m here to help make those connections seamless and impactful. If you’re interested, reach out or visit my link to learn more!

In this issue, we explore the transformative strides in open finance across Southeast Asia. Key drivers include regional payment connectivity, with initiatives like PromptPay-PayNow and DuitNow-QRIS leading the charge in cross-border real-time payments. Coupled with advancements in cloud technology, such as Indonesia’s OJK guidelines for core banking and Singapore’s widespread cloud migrations, the region is solidifying its position as a fintech powerhouse. The rapid adoption of digital currencies, including retail CBDCs like Singapore’s Project Orchid and Thailand’s pilot, showcases how innovation is being leveraged for both retail and international settlements. Embedded finance, superapps, and Banking-as-a-Service (BaaS) are also gaining momentum, reshaping user experiences and opening up new revenue streams.

Switching focus to Europe, eIDAS2 regulation is paving the way for interoperable European Digital Identity Wallets (EUDIW), enabling seamless access to public and private services. Standout examples include Estonia’s near-99% eID adoption and Belgium’s daily 1 million eID actions, demonstrating the significant progress being made in digital identity solutions. For corporate clients, the integration of CDI platforms is revolutionizing onboarding processes by reducing manual effort and enhancing efficiency, saving up to 32% of process time.

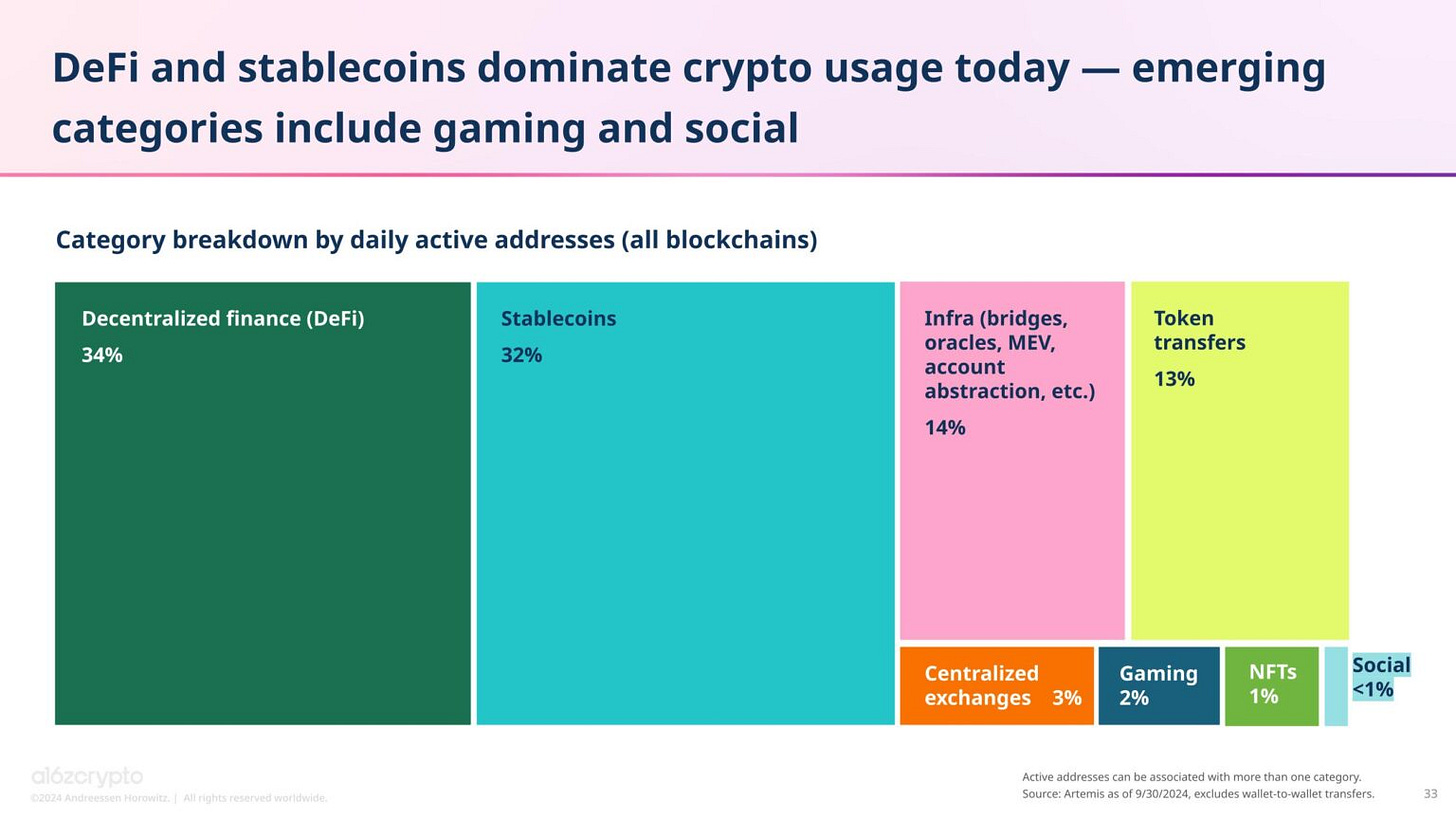

We also demystify the difference between open finance and open banking, highlighting how open finance extends secure data access beyond traditional banking to apps, insurance, and trading platforms, empowering consumers with tools tailored to their financial goals. Stablecoins continue to disrupt global payments, outpacing Visa in transaction volume with their efficiency and cost-effectiveness, and demonstrating their value beyond the crypto trading sphere.

Finally, we delve into the evolving landscape of digital wallets, breaking down technology types—open, closed, and semi-closed systems—and funding models like pass-through and stored value. AI’s role in compliance is spotlighted, showcasing its potential to transform legacy systems and regulatory adherence, enabling businesses to operate with greater efficiency and accuracy.

As always, thank you for being part of the Fintech Wrap Up community. Let’s continue shaping the future of fintech together!

Insights

Key drivers of open finance in Southeast Asia

👉 #1 Regional integration

ASEAN payment connectivity

Five ASEAN countries (Thailand, Singapore, Malaysia, Indonesia, Philippines) launched real-time payment linkages.

✅ Key achievements:

Thailand-Singapore: PromptPay-PayNow linkage successful for 3 years

Malaysia-Indonesia: DuitNow-QRIS integration adopted for 2 years

Singapore-Philippines: PayNow-InstaPay connection announced

Cross-border standards

Project Nexus: Singapore’s MAS leading initiative connecting real-time payment systems,

Regional API standards development:

Singapore has a government backed API Exchange platform

Indonesia’s SNAP (Standard National Open API) adoption by 16 banks

Malaysia’s Financial Sector Blueprint 2022-2026 emphasizing API standardization

👉 #2 Technology advancement

Cloud adoption

Cloud market in SEA is projected to reach USD 12.5 billion by 2025

✅ Key developments:

Singapore: 60% of banks migrating core systems to cloud

Indonesia: OJK guidelines allowing cloud services for core banking

Thailand: BOT cloud guidelines enabling broader adoption

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.