Hotel Payments – Distribution and Flows; The Healthcare Payments Landscape; Omnichannel Orchestration Is Quietly Redefining How Payments Work

Daily news on Payments Wrap Up

This week’s reports

Stablecoins have moved from the fringes of crypto into the heart of global finance — and with new U.S. regulation, their future looks bigger than ever

2️⃣Embedded Finance: Strategic Considerations for Financial Institutions

3️⃣The future of banking won’t be written by humans alone—it will be co-authored by AI

4️⃣The Fintech Effect: Why Consumers Are Steering the Next Chapter of Finance

5️⃣AI Agents and the Next Leap in Payments

6️⃣Demystifying Healthcare Payments: Why This Industry Needs Its Own Playbook

7️⃣AI Agents Are Redefining the Future of Financial Analysis

This week’s insights

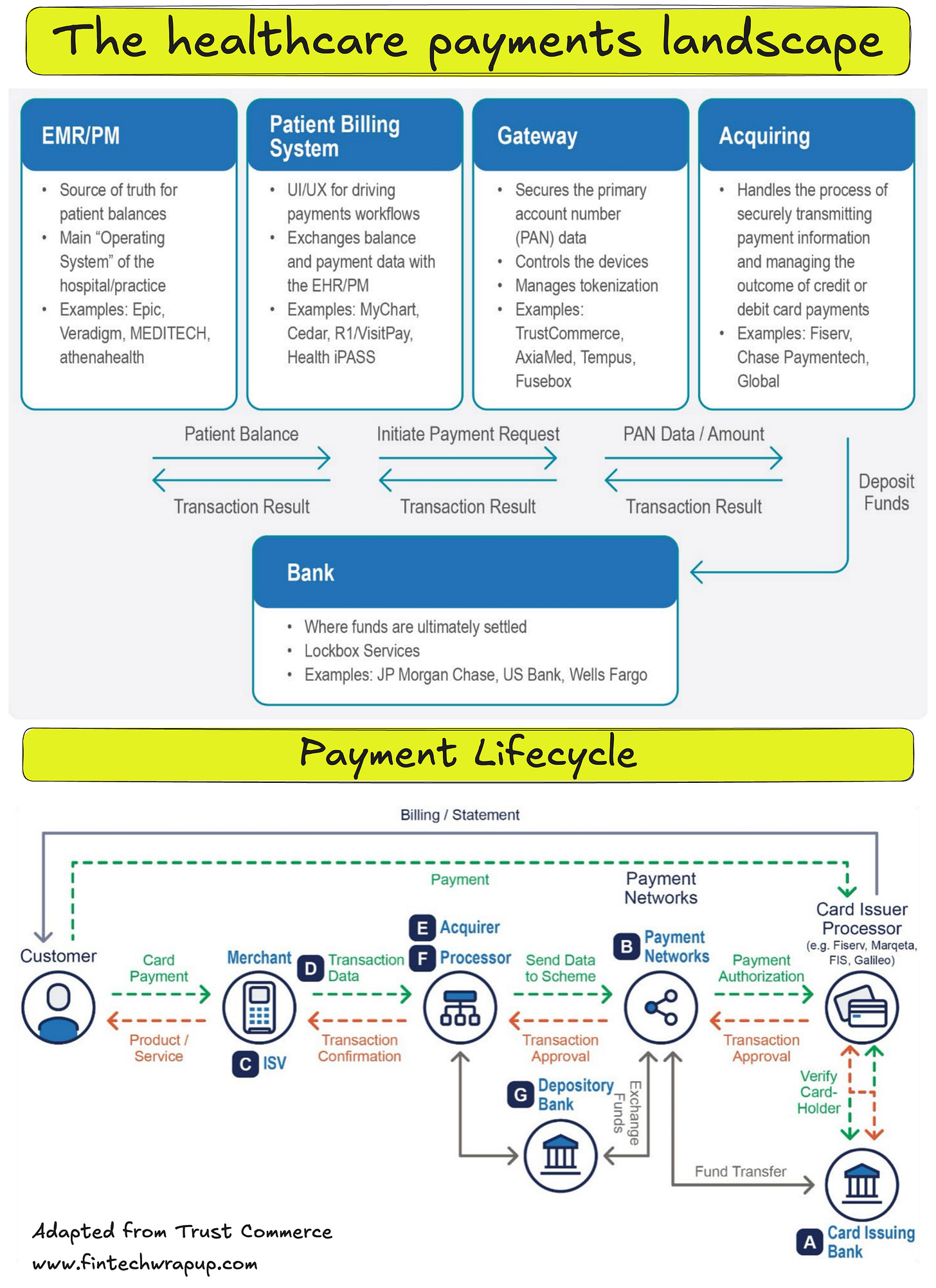

1️⃣The Healthcare Payments Landscape

2️⃣Measuring Growth in Crypto – Core Metrics

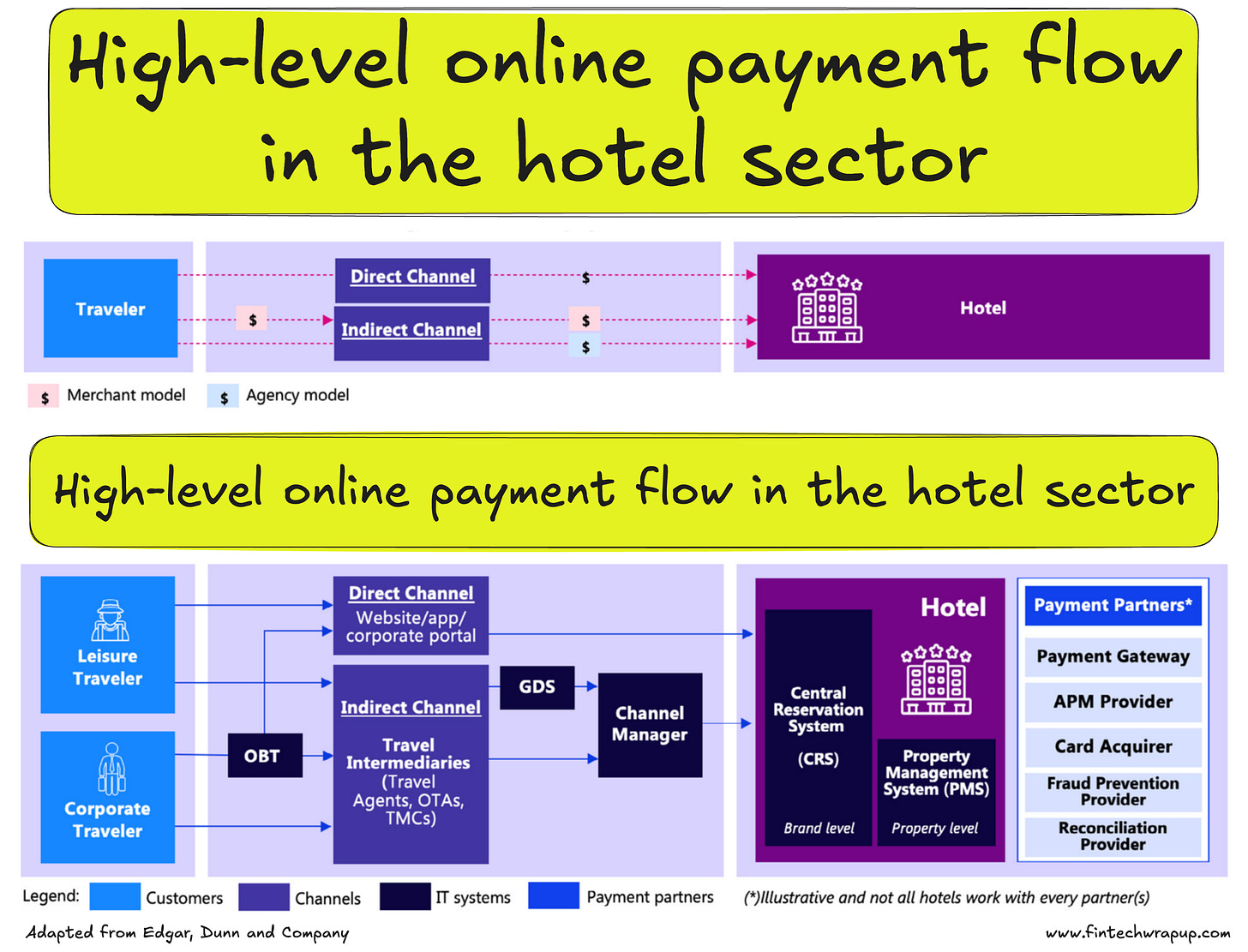

3️⃣Hotel Payments – Distribution and Flows

4️⃣Making Sense of Distributed Ledger Network Archetypes

5️⃣Partnerships Put Payments Leaders Ahead of Banks in Serving SMBs

6️⃣Omnichannel Orchestration Is Quietly Redefining How Payments Work

7️⃣Loan Service Marketplaces

Google’s AP2 Explained - The Rulebook for Agent-Led Payments

Imagine telling your AI assistant to “just buy it for me” and having it actually go through with the purchase – safely, securely, and without you clicking any “Buy Now” button. Google’s new Agent Payments Protocol (AP2) is betting on exactly that future. Announced in September 2025, AP2 is an open standard designed so AI agents can initiate payments on our behalf across different platforms. In other words, it’s a common rulebook that lets your autonomous digital sidekicks not only talk a big game, but also transact – whether that means paying a merchant, subscribing to a service, or even paying another agent. And it’s not just a Google pet project; over 60 organizations (from Mastercard and American Express to Coinbase and Shopify) are collaborating to shape this standard. Why? Because as AI assistants evolve from simple chatbots into full-fledged shopping and task-doing agents, the last missing piece is giving them a wallet – and making sure they don’t run off with it.

The Healthcare Payments Landscape

The healthcare payments industry uses much of the same infrastructure as other sectors but requires specialization to handle the timing and uncertainty of patient responsibility after insurance. Five main groups work together to deliver a comprehensive patient payment experience: EMR/PM platforms, patient billing systems, gateways, acquirers/processors, and banks.

👉 EMR/PM Platforms

Electronic Medical Records (EMR) and Practice Management (PM) systems serve as the “operating system” for providers, managing everything from patient records to billing. They are the source of truth for balances, and many staff workflows (e.g., collecting co-pays at check-in, managing payment plans) occur here. EMRs often embed payment tools or integrate via open APIs, preferred partners, or Payment Facilitation models. Partnerships with EMRs/PMs are strategic for processors due to vendor influence over workflow and buying decisions.

👉 Patient Billing Systems

While balances are calculated in the EMR/PM, providers often use multiple billing systems to actually collect payments:

🔹 Multiple systems: POS in EMR/PM, online via third-party tools.

🔹 Bundled: Some EMRs (e.g., Epic’s MyChart) include billing. RCM providers like R1 use Entri Pay.

🔹 Standalone: Companies like Phreesia, Cedar, and RevSpring provide billing, statements, IVR, payment plans, or digital wallet support.

👉 Gateways

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.