Fintech isn’t dead. AI is driving a new beginning; What is SEPA Instant Credit Transfer?; Typical business model of superapps;

In this edition of Fintech Wrap Up, we explore how AI is revolutionizing the fintech space, the rise of real-time payments with SEPA Instant Credit Transfers, and the growing influence of superapps.

Insights & Reports:

1️⃣ Fintech isn’t dead. AI is driving a new beginning

2️⃣ What is SEPA Instant Credit Transfer?

3️⃣ How will banks embed AI across the value chain?

4️⃣ Typical business model of superapps

5️⃣ The Building Blocks of BaaS & Embedded Finance

6️⃣ G20: Payment Systems Interoperability and Extension

7️⃣ Open Banking Implementation Demystified

8️⃣ TD Bank hit with record $3 billion fine over drug cartel money laundering

9️⃣ Stripe deepens collaboration with NVIDIA to enhance Stripe’s AI-powered capabilities

TL;DR:

Welcome to this edition of Fintech Wrap Up! As always, I’m excited to share the latest updates and insights from the world of fintech, payments, and banking.

Let’s start with a big one: fintech isn’t dead—it’s actually entering a whole new phase powered by AI. We’ve seen fintech innovation shift across different tech cycles, from the internet to mobile, and now AI is transforming the space. We’re talking about AI copilots in banking, especially in compliance, helping institutions like Vesta and Valon shake things up with more efficient processes. AI might just be the key to solving those “too difficult to replace” legacy systems.

On the payments front, if you haven’t started tracking payments in real time, now’s the time. SEPA Instant Credit Transfer has made real-time payments a reality in Europe, but the challenge is balancing the short-term costs with long-term benefits like better cash flow and customer experience. It’s all about that speed—transactions are completed in under 10 seconds!

We also dove into how AI is embedding itself across the banking value chain, from reducing risks to boosting customer experience. Banks focusing on cost efficiency should explore areas like compliance and data management where AI can drive significant savings.

And then there’s superapps—these platforms continue to dominate in markets like India, integrating a range of services across verticals. It’s fascinating to see how their business models streamline costs and boost revenue through cross-selling, while the regulatory landscape, especially in the EU, ensures healthy competition and data protection.

Also, if you’re following the evolution of Embedded Finance and BaaS, the building blocks like License-as-a-Service and Balance Sheet-as-a-Service are crucial for non-banks to offer financial products without their own licenses. It’s all about scaling with speed and efficiency.

Finally, in curated news, we saw Stripe deepening its collaboration with NVIDIA to boost AI capabilities, and Zeal raising $15M to revolutionize payroll for modern work. Meanwhile, TD Bank faced a record $3 billion fine over money laundering—ouch!

That’s it for this roundup! Stay tuned for more insights in the next edition.

Insights

Fintech isn’t dead. AI is driving a new beginning

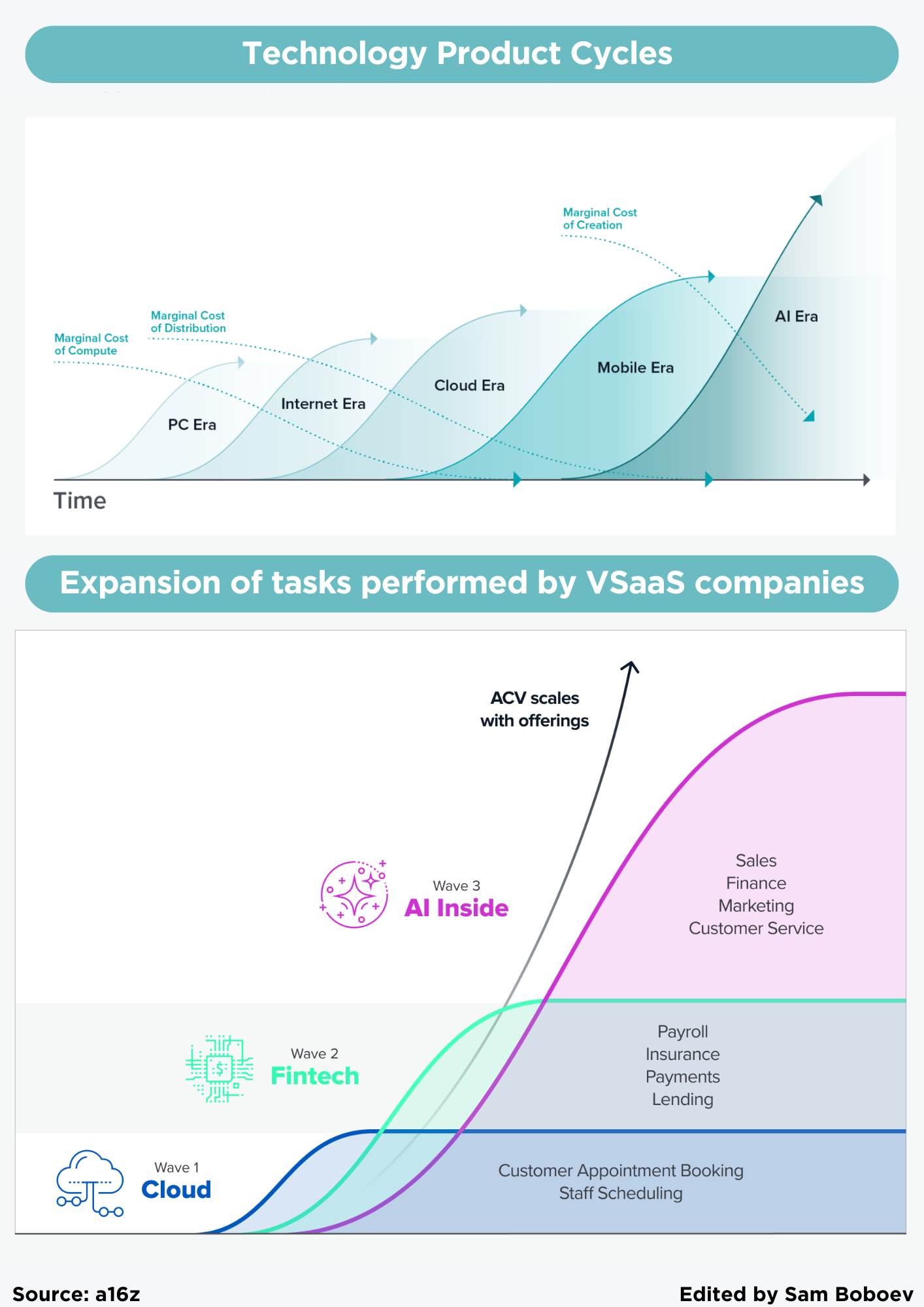

Over the past 20 years, almost all innovation in the fintech sector has occurred in line with wider product cycles.

In the early internet and PC eras, fintech companies created new experiences by taking existing financial products and “putting them on a website.” For example, LendingClub started to make loans on the internet instead of in bank branches; PayPal enabled users to send money over email instead of writing a check.

During the cloud era, every layer of the fintech stack became available “as a service.” This led to our thesis that “Every company will become a fintech company,” as fintech became a key source of monetization for every software company. Companies like Moov offer payments, Sardine and Sentilink offer fraud and compliance solutions, and Spade offers real-time merchant intelligence.

In the mobile era, winning fintechs took advantage of being in their customers’ pockets. Chime’s app, for example, brought banking to users’ fingertips with a full stack bank and attracted customers with a “get your paycheck early” wedge. Robinhood built a commission-free mobile trading app that enabled users to trade fractional shares.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.