Exploring the Implications of AI Agents in Crypto; Key growth drivers for B2B BNPL; Accounts Payable (AP) Automation;

This week in Fintech Wrap Up, we’re diving into the shifting fintech funding landscape, the rise of AI in financial services, and the growing impact of instant payments on banking

Insights & Reports:

1️⃣ State of Fintech 2024

2️⃣ AI Landscape in Financial Services

3️⃣ Lessons from Zing’s closure

4️⃣ Instant payments will disrupt end-to-end enterprise capabilities

5️⃣ Key growth drivers for B2B BNPL

6️⃣ Accounts Payable (AP) Automation

7️⃣ Key AI Trends for Financial Services in 2025

8️⃣ Exploring the Implications of AI Agents in Crypto

9️⃣ Succeeding with Super Apps

TL;DR:

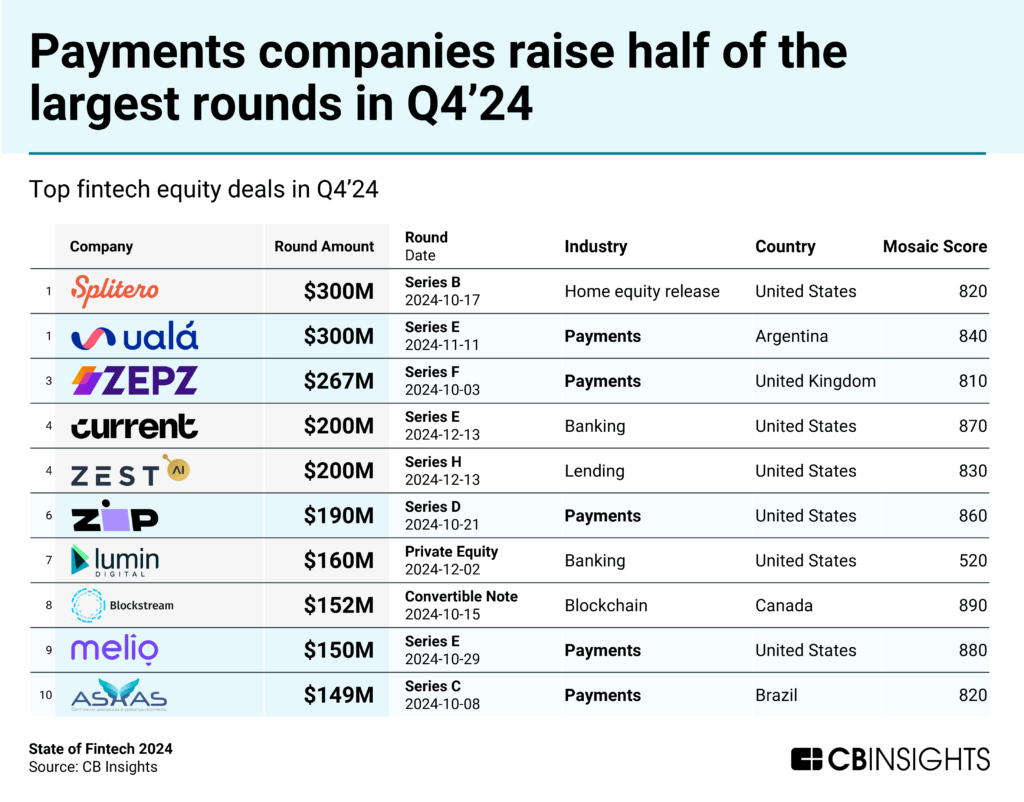

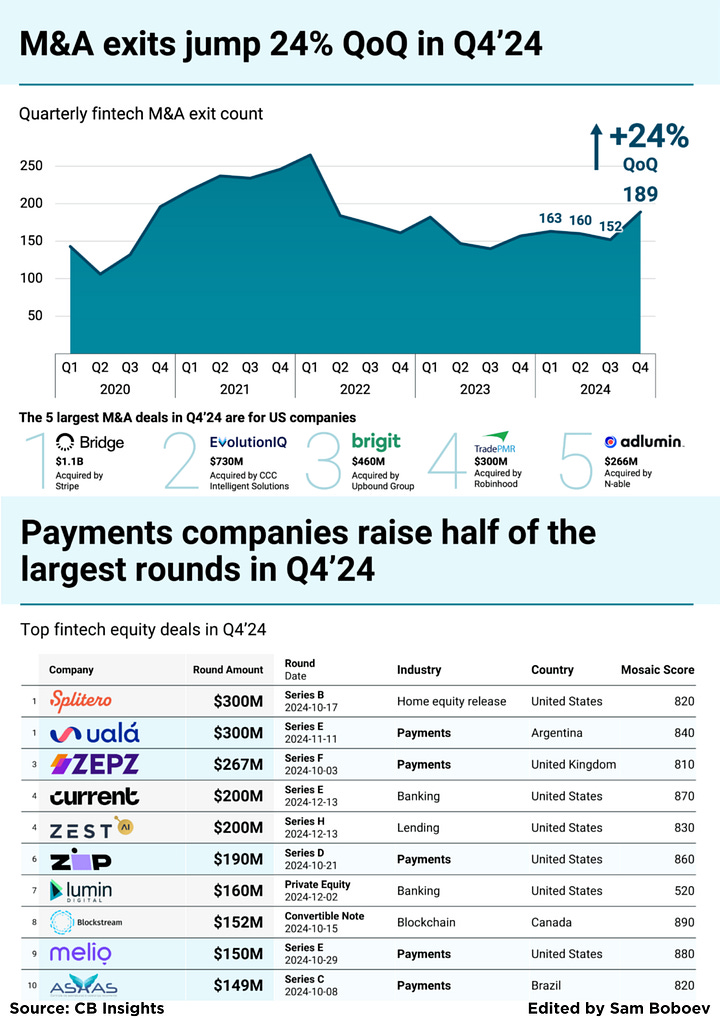

This week’s fintech landscape is a mixed bag of challenges and bright spots. The State of Fintech 2024 report paints a cautious picture—funding has hit a seven-year low, with deal volume down 17% year-over-year. But there’s a silver lining: bigger checks are being written for high-potential companies, particularly in banking and payments. Speaking of payments, five of the top 10 fintech equity deals last quarter went to payments companies, reinforcing its position as a key driver of digital commerce. Meanwhile, fintech M&A is heating up, with Stripe’s $1.1B acquisition of Bridge making waves.

AI continues to dominate financial services, with firms expected to pour nearly $100B into AI-driven innovation by 2027. Banks, capital markets, and payments companies are leveraging AI to boost efficiency, reduce fraud, and enhance customer experience. Notably, generative AI is now the second-most-used AI workload in finance, with firms seeing significant cost savings and revenue boosts.

On the payments front, instant payments are poised to shake up banking as we know it. With 24/7 settlement becoming the norm, banks must rethink liquidity management, compliance, and fraud prevention. The transition won’t be easy, but those who modernize their infrastructure will gain a competitive edge.

In the BNPL world, B2B BNPL is emerging as the real game-changer. Unlike its consumer counterpart, B2B BNPL serves a much larger market, helping businesses optimize liquidity while boosting supplier relationships. However, providers must tread carefully—managing debt burden, ensuring transparency, and mitigating risk remain key challenges.

One of the biggest fintech closures this year? HSBC’s Zing. The UK-based cross-border payments app never stood a chance against Wise and Revolut, struggling with limited reach, low brand awareness, and bank-backed constraints that prevented it from scaling. The lesson? Market timing, funding flexibility, and global expansion are crucial in the cross-border space.

Meanwhile, Plaid is reportedly working with Goldman Sachs on a tender offer deal worth up to $400M, allowing early investors and employees to cash out. Klarna is expanding its BNPL footprint by teaming up with J.P. Morgan Payments, and Stripe is eyeing an employee share sale at an $85B valuation—still below its 2021 peak but a significant boost from last year’s $70B.

Finally, AI and crypto are becoming an interesting duo. The rise of autonomous AI agents is pushing blockchain innovation forward, with new use cases in DeFi, digital influencers, and financial advisory. Could we see AI-driven smart contracts managing crypto transactions in real time? The potential is massive.

That’s it for this week! As always, hit reply with your thoughts—what trends are you watching?

Insights

State of Fintech 2024

Key takeaways from the report include:

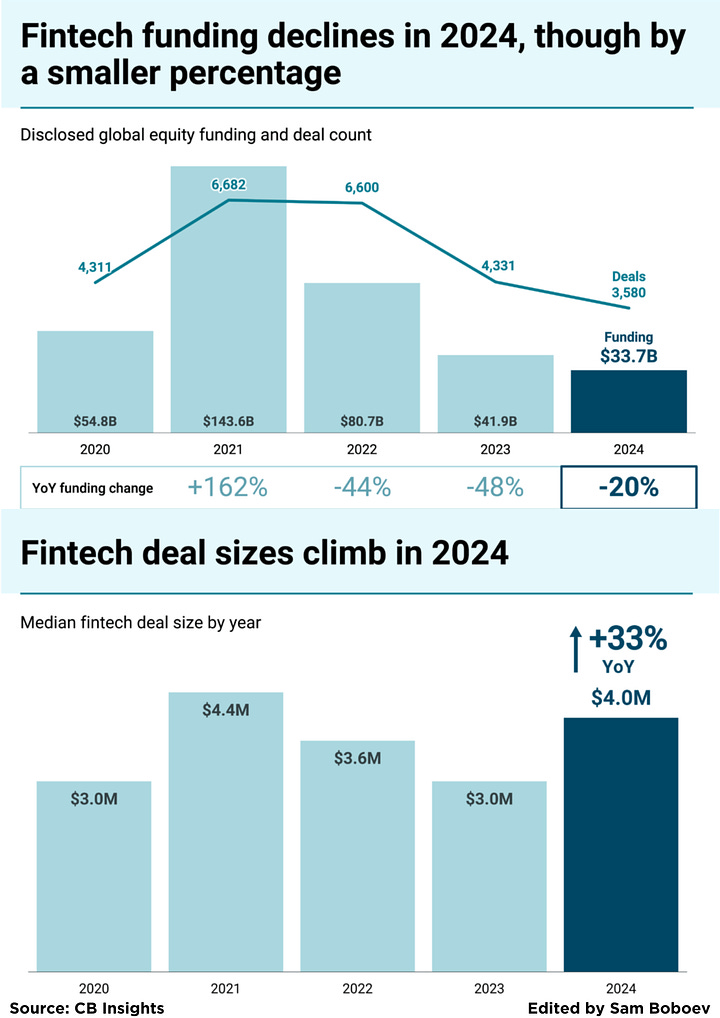

- Fintech dealmaking continues downward trend in 2024. Annual fintech deals and funding both dropped to 7-year lows in 2024. While deals dropped by 17% YoY to a total of 3,580, funding fell by 20% to $33.7B.

- One positive signal: bigger deals. The median fintech deal size increased to $4M in 2024 — marking a 33% jump YoY — with deal sizes rising across every major global region. Across fintech sectors, the biggest jump occurred in banking, where the median deal size rose by 70% YoY to reach $8.5M. Though fintech saw fewer deals overall in 2024, the increase in deal sizes suggests that investors are writing bigger checks for companies with compelling growth potential.

- M&A activity is also picking up. Fintech M&A exits jumped 24% quarter-over-quarter (QoQ) to 189 in Q4’24, with Stripe’s $1.1B purchase of stablecoin platform Bridge marking the quarter’s largest deal. Overall, fintech saw a total of 664 M&A exits in 2024 (up 6% YoY) as financial services companies sought to diversify their capabilities and build full-service platforms.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.