Embedded Lending: Architectural Foundations for a Robust Model; A Brief History of Pay Later and Credit Innovation; Can US Banks Protect Their Card-Issuing Business?;

In this edition of Fintech Wrap Up, I’m unpacking Stripe’s API evolution, the rise of embedded lending, and how AI is reshaping the payments landscape.

Insights & Reports:

1️⃣ Deep Dive: Stripe’s payments APIs - The first 10 years

2️⃣ Embedded Lending: Architectural Foundations for a Robust Model

3️⃣ A Brief History of Pay Later and Credit Innovation

4️⃣ Drivers of Open Banking in Africa

5️⃣ Can US Banks Protect Their Card-Issuing Business?

6️⃣ Fintech is showing early signs of a potential comeback

7️⃣ Which Areas of AI Are Payments Companies Focusing On?

8️⃣ How banks can boost productivity through simplification at scale

9️⃣ Sweden's Klarna puts US IPO plans on hold as tariffs rattle markets

We’re now ready to start doing product demos.

Over the past few months, my co-founder and I have been working on Wraap Up — an AI-powered financial infrastructure platform for fintechs.

Wraap Up helps simplify financial operations like reconciliation, close management, payouts, and vendor expenses — all with automation and real-time visibility.

If you operate in the fintech industry, we'd love to show you what we’ve built.

Feel free to reach out to me on LinkedIn or our website.

TL;DR:

Hey fintech fam! 👋 In this edition of Fintech Wrap Up, I’m diving into everything from Stripe’s legendary API evolution to the rise (and pause) of Klarna’s IPO. I kicked things off with a deep dive into Stripe’s first decade—remember those iconic “seven lines of code”? Well, it turns out their journey from simple card payments to a unified PaymentIntents model is a masterclass in scaling APIs for global payments. We also explore the architectural playbook behind embedded lending—breaking down how banks and fintechs can build modular, API-first systems that handle everything from origination to servicing.

Speaking of credit, did you know “Buy Now, Pay Later” has roots in the 1900s? We traced the timeline from GM’s early auto financing to the BNPL boom powered by Affirm and Klarna. On the open banking front, Africa’s got momentum thanks to mobile money and fintech dynamism—but regulatory gaps still hold things back. Meanwhile, US banks are facing tough questions: can they hold onto card-issuing dominance as digital wallets and A2A payments steal the spotlight?

AI continues to be the hot topic, with payment companies doubling down on fraud detection, onboarding, and transaction optimization. Visa’s reimagined Authorize.net, Stripe’s AI-driven fraud rules, and Swift’s anomaly detection are just a few examples of how genAI is reshaping the landscape. And on the funding side, Plaid raised $575M despite a lower valuation, Klarna hit pause on its US IPO due to tariffs, and fintech exits are creeping upward—signaling potential signs of a rebound.

Lots more packed in, including insights on boosting banking productivity, so scroll down and let’s unpack the future of fintech—together. 💸🚀

Insights

Deep Dive: Stripe’s payments APIs - The first 10 years

Deep Dive: Stripe’s payments APIs - The first 10 years

TL: DR Hey folks! In this Deep Dive, I took a walk through Stripe’s last decade of payments API evolution based on Stripe’s explanation on their blog—and wow, what a journey it’s been.

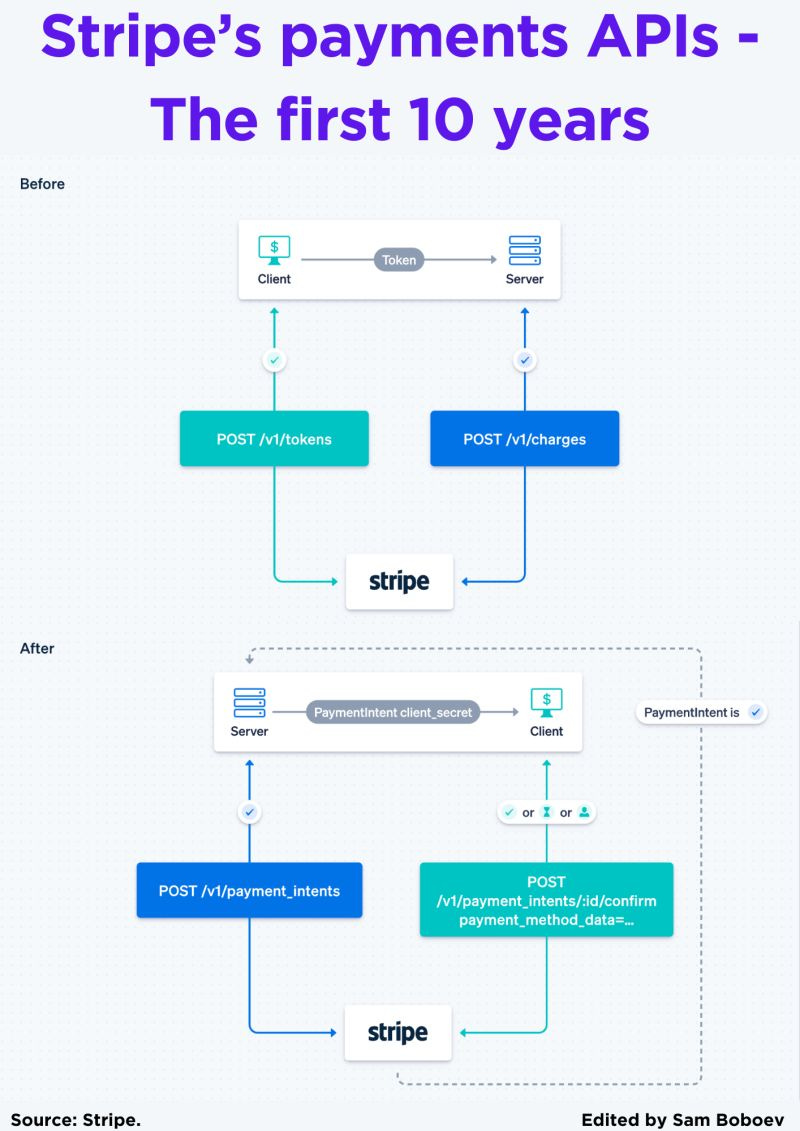

Hey folks! In this Deep Dive edition of Fintech Wrap Up, I took a walk through Stripe’s last decade of payments API evolution based on Stripe’s explanation on their blog—and wow, what a journey it’s been. Remember the legendary “seven lines of code”? That tiny snippet became a symbol for just how easy Stripe made payments look back in 2011. But as the company grew, so did the complexity of its API. From supporting just US card payments, they expanded to ACH, Bitcoin, and global methods like SEPA and iDEAL—which meant wrestling with asynchronous flows, state machines, and all sorts of integration nightmares.

Stripe’s big “aha” moment came when they realized patching the old Charges and Tokens model wasn’t going to cut it. So, they started from scratch. Enter PaymentIntents and PaymentMethods—two new abstractions that finally unified all payment methods under one consistent API. This redesign wasn’t just technical; it was a two-year marathon involving docs rewrites, Stripe CLI tools, and smart packaging to help devs adopt the new model without breaking a sweat.

If you’re building or working with payment integrations, this story is gold. It’s a rare peek into how thoughtful API design—and a lot of humility—can lead to something scalable, flexible, and powerful. Stripe didn’t just build APIs; they redefined how we think about accepting payments.

Embedded Lending: Architectural Foundations for a Robust Model

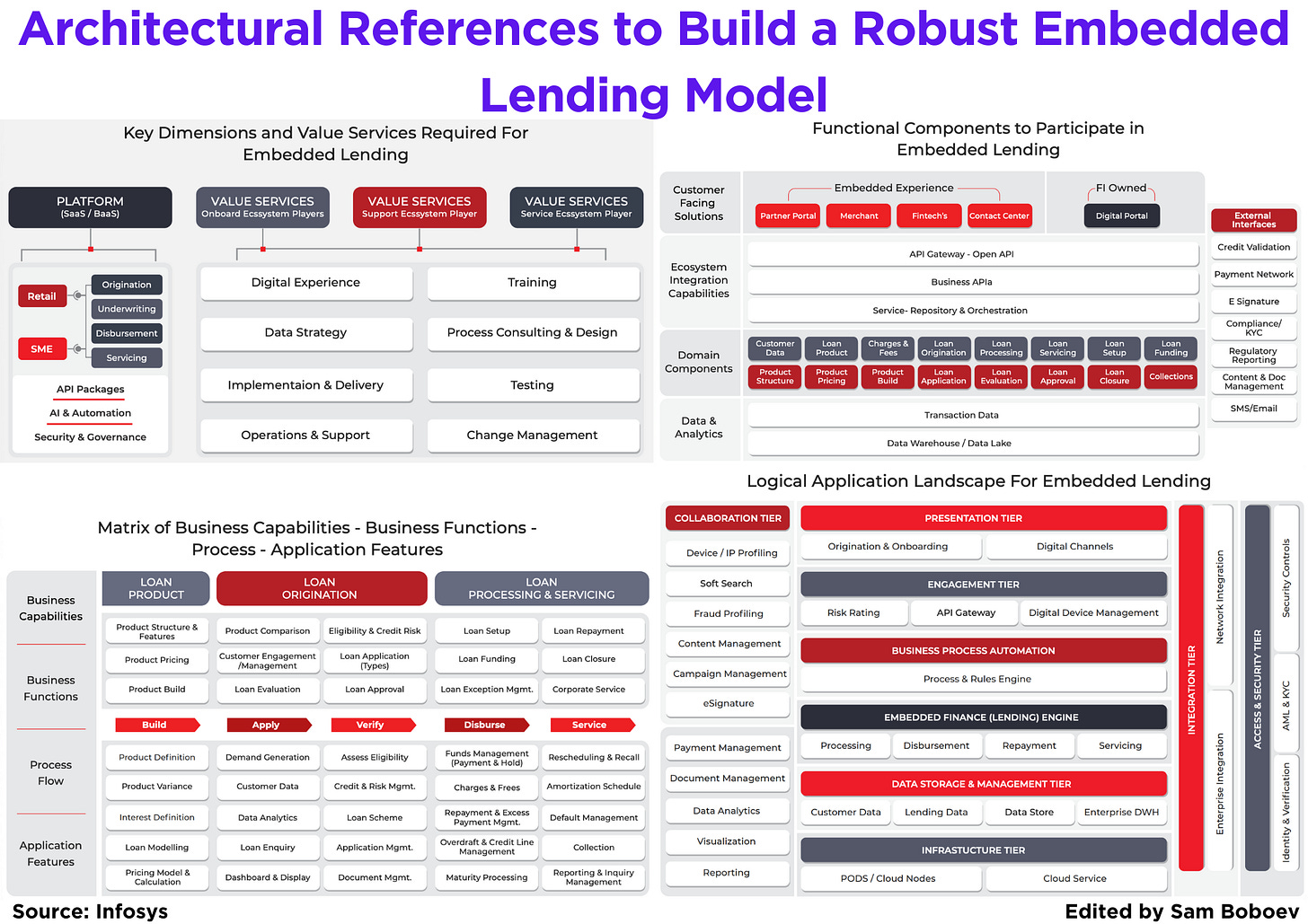

Embedded lending refers to the seamless integration of loan origination, approval, and servicing functionalities directly within the user journeys of non-financial platforms.

🔹 Solution Dimensions

To deliver an embedded lending experience, financial institutions must build a flexible ecosystem composed of:

- A robust technology platform to support lending functions

- Value-added services that enhance customer journeys

- Seamless integration with external systems (KYC, payments, transaction rails)

Traditional models rely on direct channels (e.g., branches or retail partners), but embedded lending demands a more agile, API-first architecture aligned with modern distribution methods.

🔹 Business Capability Matrix

The business capability model outlines the core competencies and strategic enablers required to support embedded lending:

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.