Discovering how AI reshapes bank functionalities; Emerging Open Banking Monetization Models; The Stablecoin Stack, explained simply

Video of the Week

Deep Dive of the Week

UK Money Licenses - Payment, E-Money, Banking, MSB, and AR Models

The UK fintech and payments ecosystem runs on a mosaic of license types. Each comes with specific permissions and limits. As a founder or product strategist, I needed a clear map of these options. Therefore, I have decided to break down the key UK money licenses: Payment Institution, Electronic Money Institution, Bank (Credit Institution), Money Service Business, Cryptoasset Registration, and the Appointed Representative/agent model, explaining what each allows, what it doesn’t, who regulates it, and when to choose one over the other. The focus is on first-principles clarity and how things work in practice, not legal trivia.

This week’s reports

𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐓𝐡𝐞 𝐑𝐞𝐚𝐥 𝐁𝐨𝐭𝐭𝐥𝐞𝐧𝐞𝐜𝐤 𝐢𝐧 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐄𝐱𝐞𝐜𝐮𝐭𝐢𝐨𝐧

1️⃣𝐄𝐱𝐩𝐥𝐨𝐫𝐢𝐧𝐠 𝐓𝐡𝐞 𝐑𝐞𝐚𝐥 𝐁𝐨𝐭𝐭𝐥𝐞𝐧𝐞𝐜𝐤 𝐢𝐧 𝐅𝐢𝐧𝐭𝐞𝐜𝐡 𝐄𝐱𝐞𝐜𝐮𝐭𝐢𝐨𝐧

2️⃣𝐁𝐍𝐏𝐋 𝐢𝐬 𝐬𝐭𝐢𝐥𝐥 𝐛𝐨𝐨𝐦𝐢𝐧𝐠, 𝐛𝐮𝐭 𝐭𝐡𝐞 𝐫𝐢𝐬𝐤𝐬 𝐚𝐫𝐞 𝐛𝐞𝐜𝐨𝐦𝐢𝐧𝐠 𝐢𝐦𝐩𝐨𝐬𝐬𝐢𝐛𝐥𝐞 𝐭𝐨 𝐢𝐠𝐧𝐨𝐫𝐞

4️⃣𝐒𝐭𝐫𝐞𝐚𝐦𝐢𝐧𝐠 𝐂𝐡𝐚𝐧𝐠𝐞𝐝 𝐌𝐞𝐝𝐢𝐚. 𝐓𝐡𝐞 𝐒𝐚𝐦𝐞 𝐈𝐝𝐞𝐚 𝐈𝐬 𝐀𝐛𝐨𝐮𝐭 𝐓𝐨 𝐂𝐡𝐚𝐧𝐠𝐞 𝐌𝐨𝐧𝐞𝐲 𝐌𝐨𝐯𝐞𝐦𝐞𝐧𝐭.

5️⃣𝐓𝐡𝐞 𝟐𝟎𝟐𝟓 𝐆𝐞𝐨𝐠𝐫𝐚𝐩𝐡𝐲 𝐨𝐟 𝐂𝐫𝐲𝐩𝐭𝐨 𝐑𝐞𝐩𝐨𝐫𝐭

6️⃣𝐄𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝: 𝐓𝐨𝐤𝐞𝐧𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐌𝐨𝐧𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐅𝐮𝐧𝐝𝐬

7️⃣𝐃𝐨 𝐘𝐨𝐮 𝐒𝐞𝐞 𝐀𝐠𝐞𝐧𝐭𝐢𝐜 𝐂𝐨𝐦𝐦𝐞𝐫𝐜𝐞 𝐀𝐬 𝐀𝐧 𝐈𝐧𝐟𝐫𝐚𝐬𝐭𝐫𝐮𝐜𝐭𝐮𝐫𝐞 𝐑𝐞𝐬𝐞𝐭 𝐎𝐫 𝐉𝐮𝐬𝐭 𝐀𝐧𝐨𝐭𝐡𝐞𝐫 𝐈𝐧𝐭𝐞𝐫𝐟𝐚𝐜𝐞 𝐋𝐚𝐲𝐞𝐫?

This week’s insights

1️⃣𝐄𝐦𝐞𝐫𝐠𝐢𝐧𝐠 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐨𝐧𝐞𝐭𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐌𝐨𝐝𝐞𝐥𝐬

2️⃣𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝𝐢𝐧𝐠 𝐇𝐨𝐰 𝐋𝐢𝐠𝐡𝐭𝐬𝐩𝐚𝐫𝐤 𝐆𝐫𝐢𝐝 𝐈𝐬 𝐑𝐞𝐝𝐞𝐟𝐢𝐧𝐢𝐧𝐠 𝐁𝐢𝐭𝐜𝐨𝐢𝐧 𝐏𝐚𝐲𝐦𝐞𝐧𝐭𝐬

3️⃣𝐃𝐢𝐬𝐜𝐨𝐯𝐞𝐫𝐢𝐧𝐠 𝐡𝐨𝐰 𝐀𝐈 𝐫𝐞𝐬𝐡𝐚𝐩𝐞𝐬 𝐛𝐚𝐧𝐤 𝐟𝐮𝐧𝐜𝐭𝐢𝐨𝐧𝐚𝐥𝐢𝐭𝐢𝐞𝐬

4️⃣𝐇𝐨𝐰 𝐁𝐢𝐥𝐭 𝐪𝐮𝐢𝐞𝐭𝐥𝐲 𝐛𝐮𝐢𝐥𝐭 𝐚 𝐫𝐞𝐧𝐭 𝐩𝐚𝐲𝐦𝐞𝐧𝐭𝐬 𝐞𝐜𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐭𝐡𝐚𝐭 𝐥𝐨𝐨𝐤𝐬 𝐦𝐨𝐫𝐞 𝐥𝐢𝐤𝐞 𝐚 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐧𝐞𝐭𝐰𝐨𝐫𝐤

5️⃣𝐀 𝐒𝐢𝐦𝐩𝐥𝐞 𝐅𝐫𝐚𝐦𝐞𝐰𝐨𝐫𝐤 𝐭𝐨 𝐔𝐧𝐝𝐞𝐫𝐬𝐭𝐚𝐧𝐝 𝐄𝐦𝐛𝐞𝐝𝐝𝐞𝐝 𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬

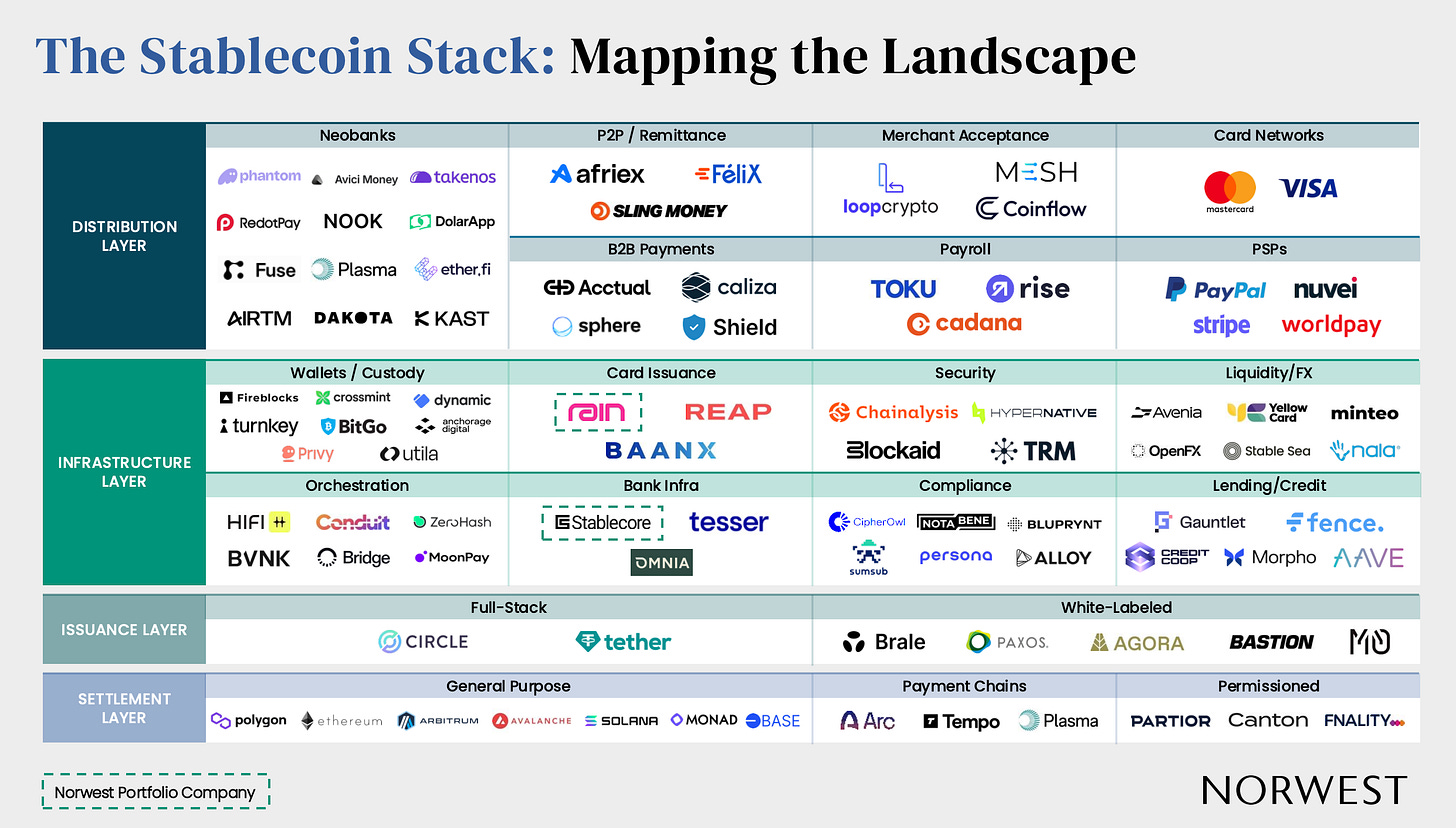

6️⃣𝐓𝐡𝐞 𝐒𝐭𝐚𝐛𝐥𝐞𝐜𝐨𝐢𝐧 𝐒𝐭𝐚𝐜𝐤, 𝐞𝐱𝐩𝐥𝐚𝐢𝐧𝐞𝐝 𝐬𝐢𝐦𝐩𝐥𝐲

7️⃣𝐑𝐞𝐚𝐥-𝐖𝐨𝐫𝐥𝐝 𝐔𝐬𝐞 𝐂𝐚𝐬𝐞𝐬 𝐋𝐢𝐠𝐡𝐭𝐬𝐩𝐚𝐫𝐤 𝐆𝐫𝐢𝐝 𝐔𝐧𝐥𝐨𝐜𝐤𝐬

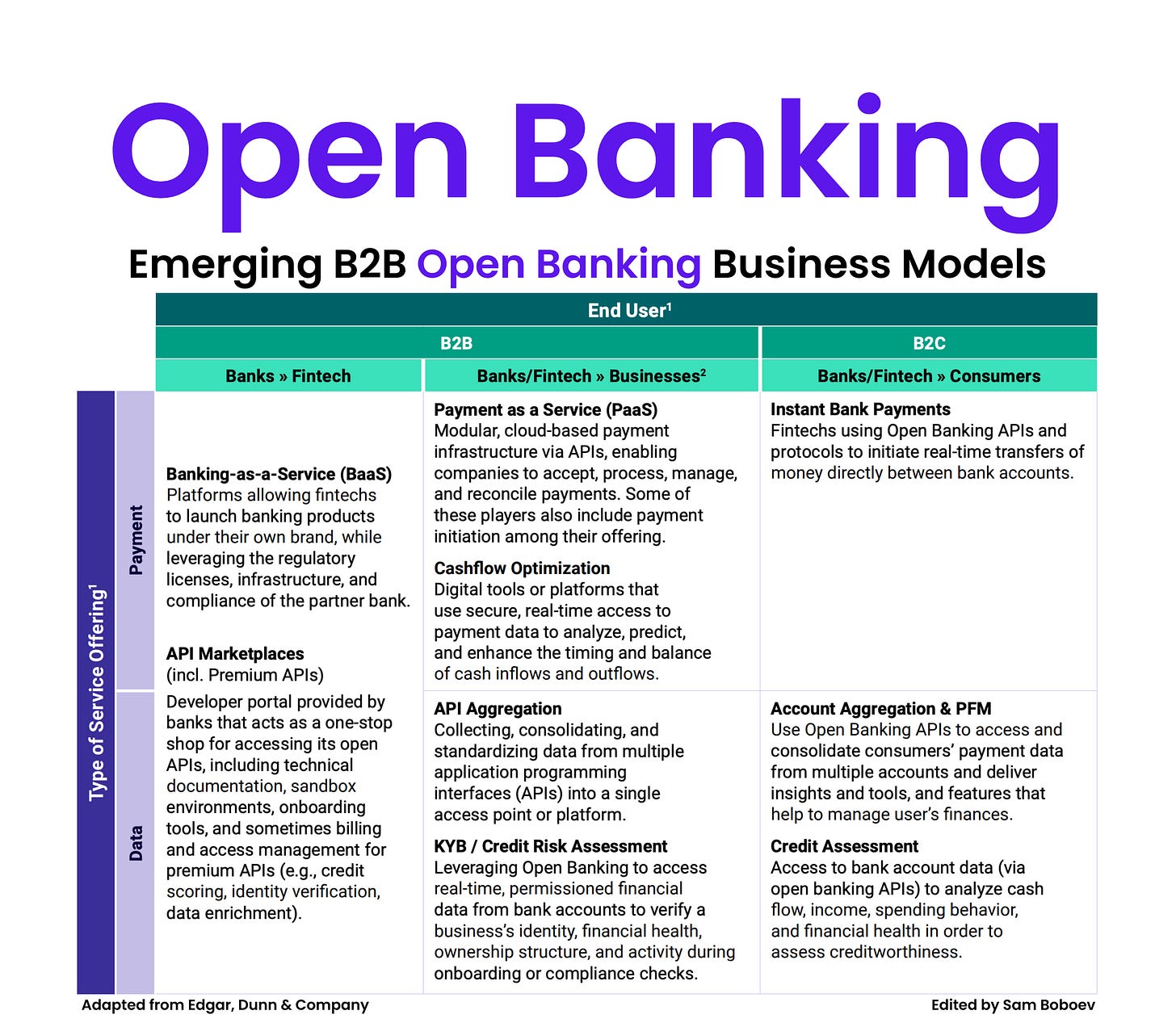

𝐄𝐦𝐞𝐫𝐠𝐢𝐧𝐠 𝐎𝐩𝐞𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐌𝐨𝐧𝐞𝐭𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐌𝐨𝐝𝐞𝐥𝐬

The B2C side is still a tough market. Consumers do not want to pay for services powered by Open Banking, and that makes it difficult for providers to build sustainable revenue models.

The momentum is happening in B2B. Businesses value better data, faster onboarding, and improved risk intelligence. They are willing to pay for tools that solve operational problems. This is why we are seeing a rise in new Agents beyond traditional TPPs and why banks are expanding their API catalog far beyond what regulation requires.

____

Here is the shift I am seeing.

🔹 𝐁𝐚𝐧𝐤𝐬 𝐚𝐫𝐞 𝐭𝐮𝐫𝐧𝐢𝐧𝐠 𝐀𝐏𝐈𝐬 𝐢𝐧𝐭𝐨 𝐫𝐞𝐯𝐞𝐧𝐮𝐞 𝐥𝐢𝐧𝐞𝐬

Banks are opening up premium APIs that go beyond simple account access. Credit scoring, identity verification, data enrichment and other value-added streams are becoming commercial products. The logic is simple. Banks already hold rich consumer data. The question now is how to package it in a way that businesses will pay for.

____

🔹 𝐁𝟐𝐁 𝐮𝐬𝐞 𝐜𝐚𝐬𝐞𝐬 𝐚𝐫𝐞 𝐬𝐜𝐚𝐥𝐢𝐧𝐠 𝐟𝐚𝐬𝐭𝐞𝐫 𝐭𝐡𝐚𝐧 𝐁𝟐𝐂

This is where the real commercial opportunity sits. Business customers adopt Open Banking tools when these tools reduce cost, reduce fraud or increase revenue. Some of the strongest traction is in:

• KYB and credit risk assessment

• API marketplaces and premium data access

• Payment as a Service platforms

• Cashflow analytics and optimization

• Real time account to account payments

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.