Deep Dive: What a16z’s “State of Crypto 2025” Really Says About Stablecoins and AI

Crypto in 2025 is looking less like a rebellious teenager and more like a young adult at the big kids’ table (albeit one still wearing a hoodie). Andreessen Horowitz’s “State of Crypto 2025” report dubs this “the year crypto went mainstream,” and for good reason. From stablecoins suddenly acting as the fastest money on the internet to AI and crypto teaming up in unexpected ways, the once-fringe industry is stepping into the spotlight.

In this Fintech Wrap Up, we’ll dive into two major themes from the report – the mainstreaming of stablecoins and the convergence of AI and crypto – with a conversational (and occasionally irreverent) spin. Buckle up: 2025 was the year crypto got comfortable in the mainstream, but not without raising a few new questions along the way.

Stablecoins: From Niche to New Normal

Just a couple of years ago, stablecoins – cryptocurrencies pegged to stable assets like the US dollar – were mostly used by crypto traders shuffling funds between exchanges. How times have changed. In 2025, stablecoins “became the backbone of the onchain economy”, transforming into the fintech equivalent of a room-temperature superconductor for money (to quote Stripe’s CEO). In plain English: moving dollars across the world has never been faster, cheaper, or more open.

What does mainstream stablecoin adoption look like? Consider these jaw-dropping stats and developments from the past year:

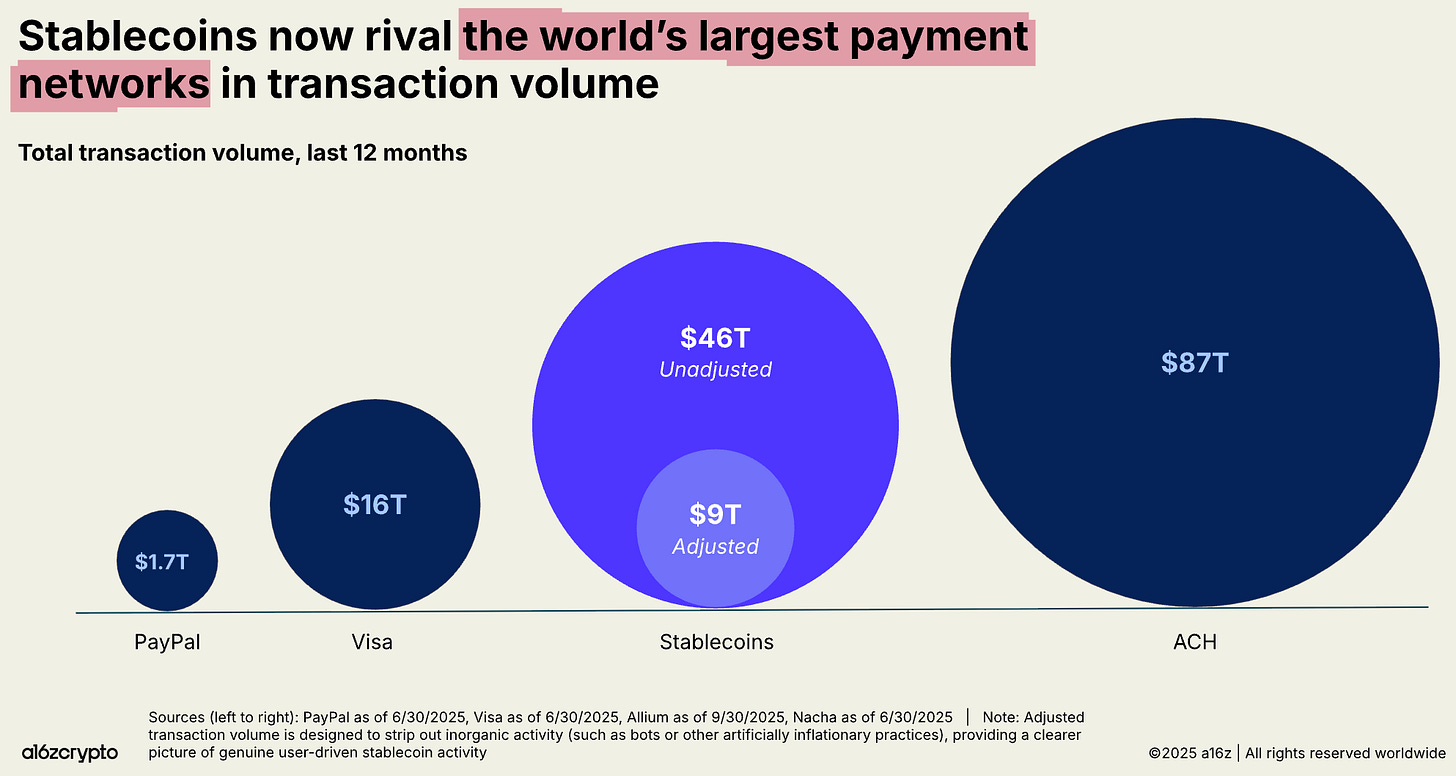

Stablecoins handled about $46 trillion in transaction volume in the last year – a 106% jump from the year prior. For context, that’s nearly 3× Visa’s annual volume, and it’s quickly closing in on the grand total of ACH transfers (the U.S. banking system’s own plumbing). Even on an “adjusted” basis (filtering out things like bots or one exchange shuffling coins between wallets), stablecoins carried $9 trillion in real value – 5× PayPal’s yearly throughput and over half of Visa’s. In short, stablecoins aren’t just playing in the big leagues; by some measures, they’re outpacing the incumbents.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.