Deep Dive: Visa - Beyond the Card

Visa isn’t just about cards anymore—it’s evolving into a global payments tech powerhouse, and in this Deep Dive edition, I break down exactly how

TL: DR

Visa isn’t just about cards anymore—it’s evolving into a global payments tech powerhouse, and in this Deep Dive, I break down exactly how. Visa’s Network of Networks strategy connects over 11 billion endpoints across 200+ countries, making it the largest payments ecosystem in the world. With nearly $200 trillion in untapped payment flows, Visa is expanding beyond consumer card payments into B2B transactions, remittances, government disbursements, and P2P transfers. The company is also unbundling its payments stack, offering services like fraud detection, tokenization, and risk management as standalone products—helping banks, fintechs, and businesses secure payments beyond just Visa cards.

AI has been a game-changer for Visa, and it’s doubling down on GenAI-powered tools to enhance fraud prevention, streamline transactions, and even automate customer support. Visa Direct, its real-time money movement platform, has grown sixfold in five years, enabling faster gig economy payouts, cross-border remittances, and business payments. Meanwhile, Visa’s “Tap to Everything” initiative is driving new payment experiences, from Tap to Pay and Tap to Phone for merchants to Tap to Confirm for secure online purchases.

With its growing focus on value-added services, Visa is embedding itself deeper into financial institutions, merchants, and fintech ecosystems, offering analytics, cybersecurity, and even open banking solutions. In short, Visa isn’t just processing transactions—it’s shaping the future of payments. This edition takes a closer look at Visa’s transformation, where it’s headed next, and what this means for the fintech landscape.

Let me know what you think—where do you see Visa heading next? 👀

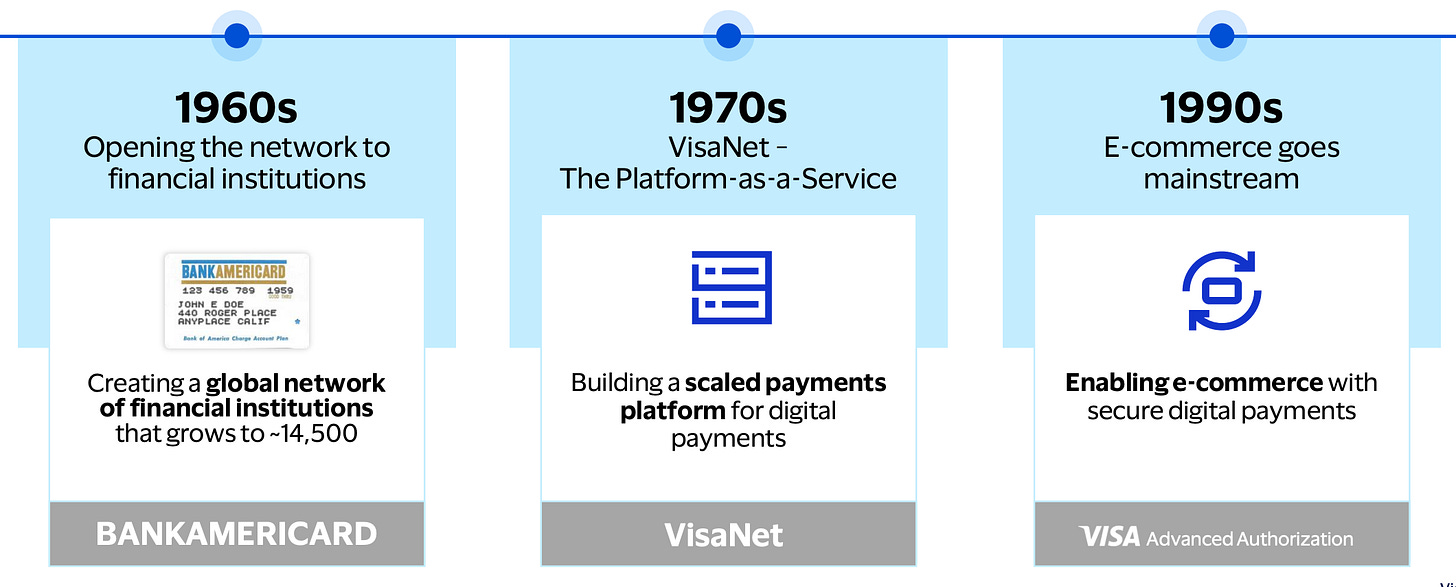

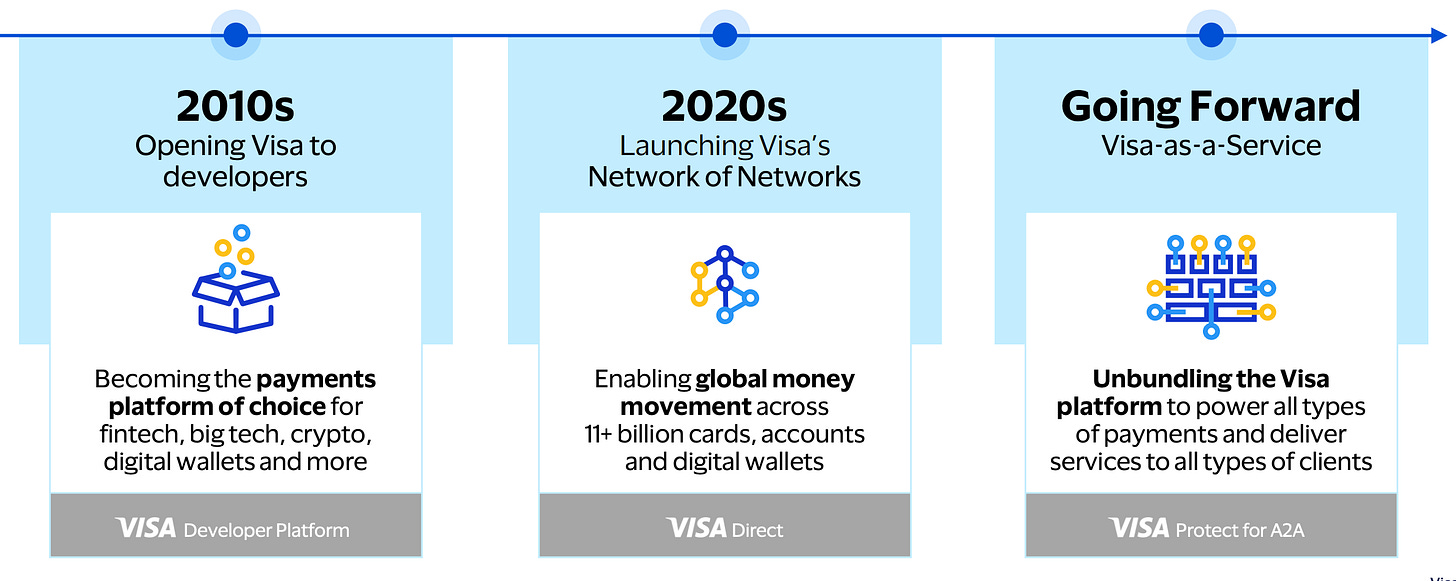

Visa’s Corporate Strategy and Vision

Visa’s overarching mission is “to uplift everyone, everywhere by being the best way to pay and be paid” This purpose reflects Visa’s role as a global network that connects buyers and sellers, removes payment barriers, and enables commerce for individuals, businesses, and communities worldwide Over the past six decades, Visa has steadily advanced this mission, evolving from a simple idea of connecting buyers and sellers with secure digital payments into a centerpiece of the modern payments ecosystem. As CEO Ryan McInerney noted, Visa’s journey has been one of continuous innovation – from launching the first general-purpose credit card network in the 1960s, to building the VisaNet platform in the 1970s, to pioneering e-commerce payments in the 1990s Along the way, Visa established itself as the “go-to” enabler of new payment trends, deploying innovations like the first AI-powered fraud detection system (Visa Advanced Authorization) and tokenization to secure online payments Each wave of industry change has prompted Visa to adapt its strategy and expand its network to maintain its leadership.

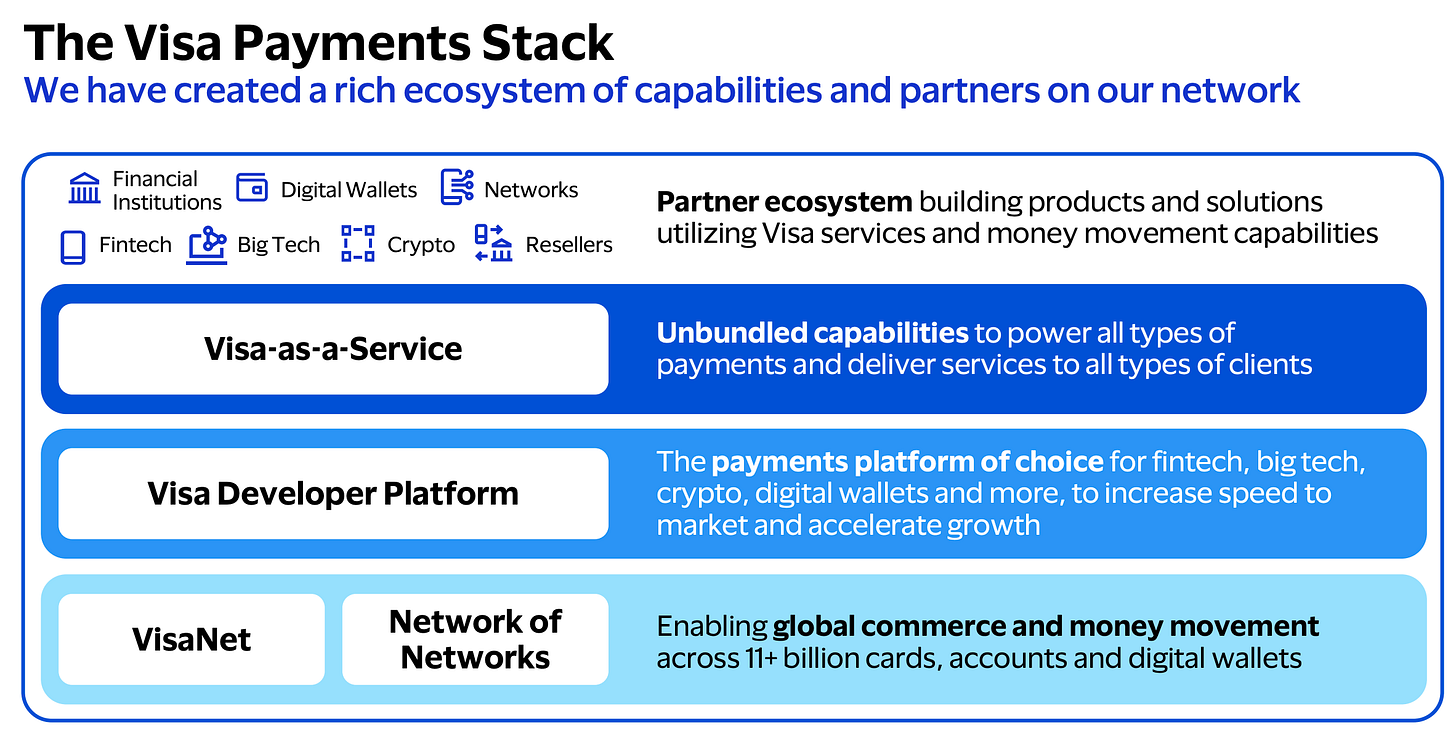

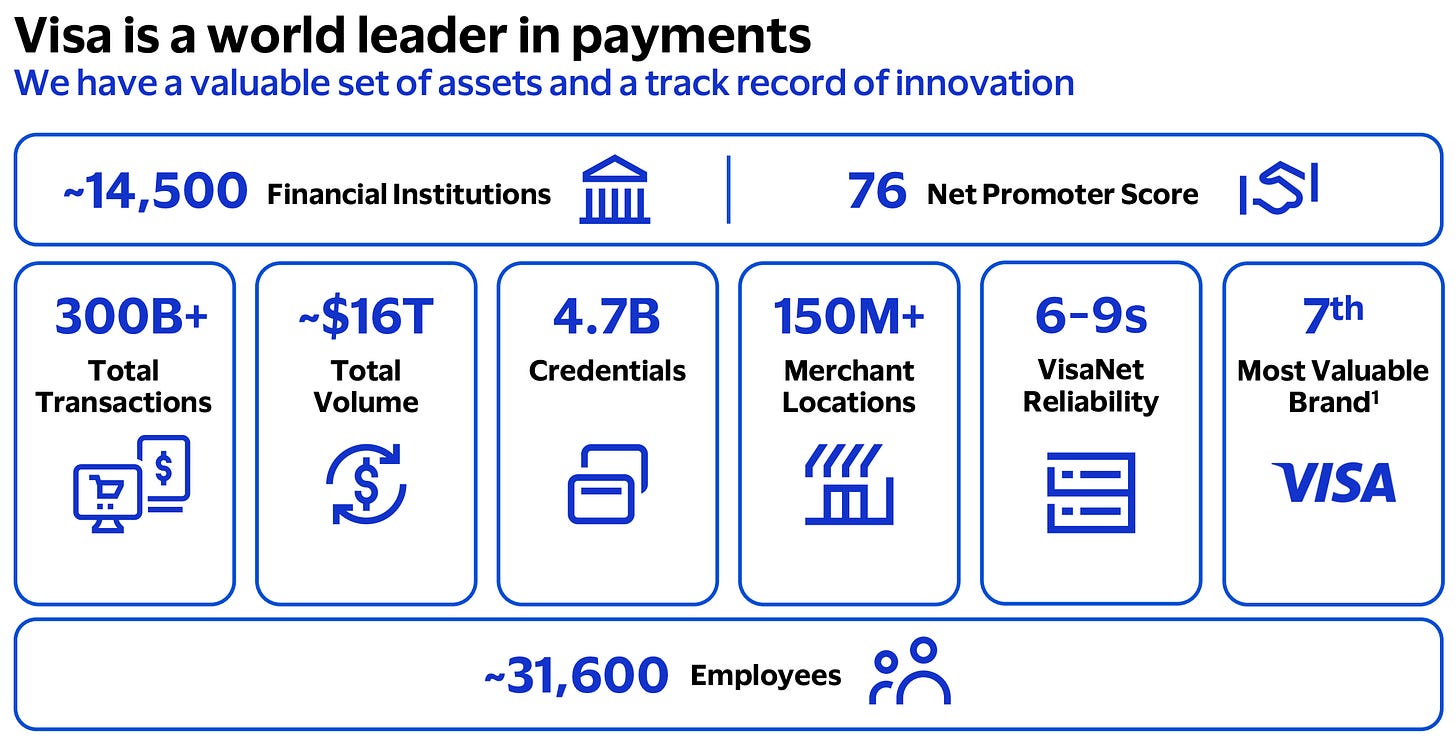

Today, Visa positions itself not just as a card network, but as a “network of networks” at the center of an evolving payments landscape. In 2020, Visa began transforming from a single network (VisaNet) into a multi-network architecture that connects 15+ card networks, 75 domestic schemes, 15 real-time payment (RTP) networks, and multiple payment gateways This Network of Networks strategy has massively extended Visa’s reach – creating “the largest global money movement network” with over 11 billion endpoints (cards, bank accounts, and digital wallets) worldwide In practice, this means Visa can move money across a far broader range of payment systems and geographies than ever before, partnering with banks, fintechs, governments, and alternative networks in 200+ countries and territories Visa’s global scale is unparalleled – it serves ~14,500 financial institutions, 150+ million merchant locations, and 4.7+ billion credentials (cards/accounts) with 99.9999% (“six 9s”) network reliability and sub-second transaction speed These capabilities cement Visa’s position as a trusted platform for ubiquitous, always-on commerce on a global basis.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.