Deep Dive: Unwrapping FIS’s Technology Stack and Architecture

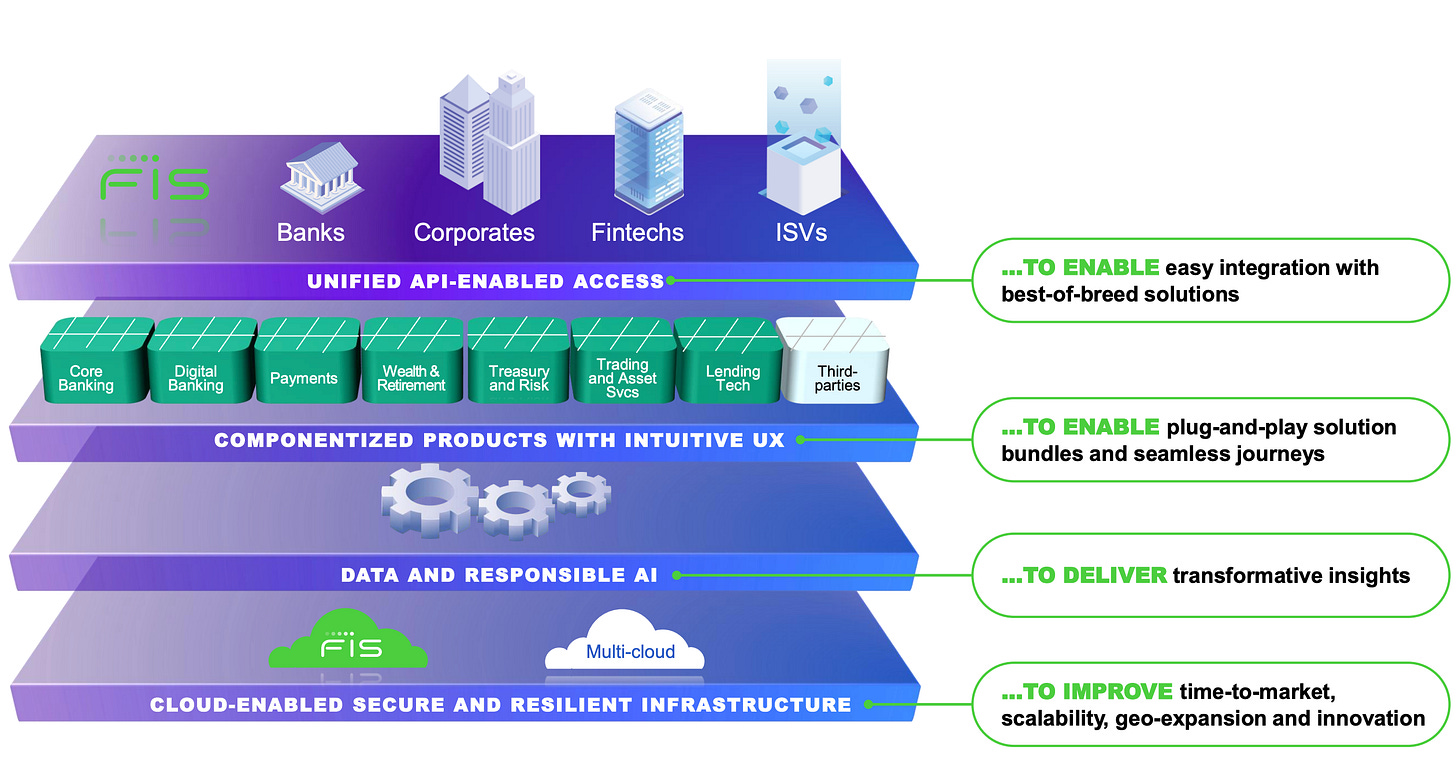

FIS is building a banking platform that treats the bank like a set of interoperable services, not a monolithic core. The stack is structured in layers: cloud-native infrastructure, a common data and AI layer, componentized product modules, and a unified API access layer that abstracts the underlying cores. The architectural goal is simple: decouple channels from processing, decouple products from the core, and make integration the default state. If you want to understand where FIS is going, ignore product names and follow the mechanics: a universal ledger and orchestration layer, reusable platform services for account opening and money movement, a marketplace for third parties, and delivery tooling designed to ship changes safely at a global scale.

Systems-Level Platform Structure

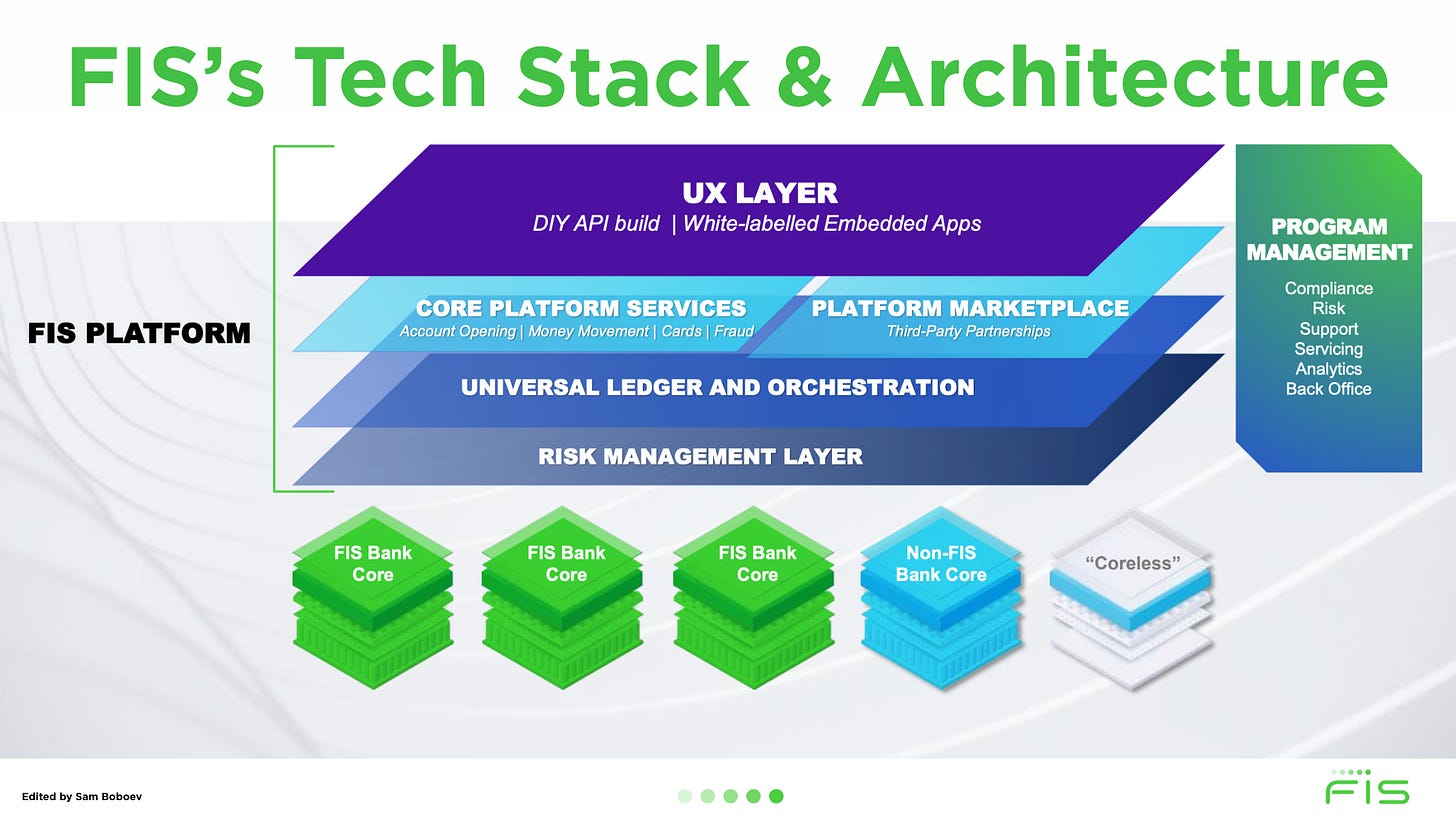

FIS is evolving its technology into a unified platform that abstracts and orchestrates core banking functions at a systems level. The architecture is organized into layers, from foundational ledgers up to customer-facing interfaces. At the base is a universal ledger and orchestration layer that underpins core processing across products. Above this sit core platform services for key banking functions (e.g. account opening, money movement, cards, fraud) exposed as modular components. A risk management layer and program management functions (compliance, servicing, analytics, etc.) provide cross-cutting controls and back-office support. At the top, a unified API-enabled access layer serves as the single integration point for all channels and partners. This allows banks, fintechs, and corporates to access FIS’s services through a consistent interface, whether via their own DIY applications or FIS’s white-labeled front-ends. Crucially, the platform is core-agnostic it can integrate with FIS’s own core systems or a client’s existing (non-FIS) core, or even operate “coreless” by using the built-in ledger for new digital banks. In essence, FIS’s platform acts as a middleware and banking-as-a-service hub, enabling FIS or third-party products to plug in beneath a common architecture.

Cloud-Native, Multi-Cloud Infrastructure

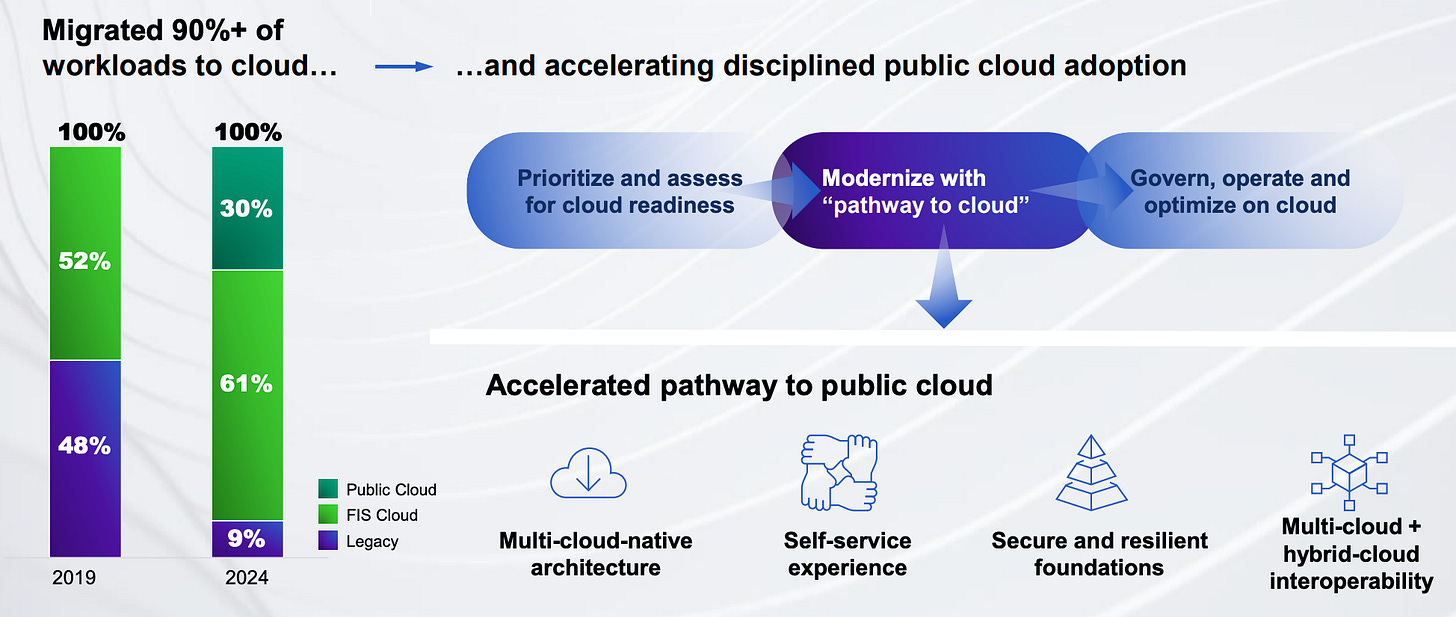

FIS’s infrastructure is firmly oriented toward cloud-native operation across multiple clouds. Over the past few years, FIS has migrated more than 90% of its workloads off legacy systems and into cloud environments. As of 2024, its footprint is roughly split between public cloud providers and FIS’s own private cloud, effectively achieving a fully cloud-based (100% cloud) operation with zero remaining “legacy” footprint. This hybrid multi-cloud setup allows interoperability between environments and avoids dependence on any single cloud platform. FIS’s stack is built with a multi-cloud-native architecture, workloads are containerized and portable, making them agnostic to the underlying cloud. An internal “FIS Cloud” layer provides common tooling, security, and automation across both public and private clouds. The company emphasizes an accelerated pathway to public cloud for new and modernized workloads, using a structured approach: assess readiness, modernize with a “pathway to cloud,” then govern and optimize on cloud. This disciplined cloud adoption has given FIS global scale: its systems process on the order of tens of billions of transactions annually and handle 1.5 billion+ API calls per month, running on hundreds of thousands of virtual CPU cores in the cloud. By leveraging elastic cloud infrastructure, FIS can deliver scalability and geographic expansion on demand, while maintaining high resilience and performance.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.