Deep Dive: The Great Bank Unbundling

Fintech is redefining banking by breaking traditional models and embedding financial services into everyday experiences.

TL;DR:

This Deep Dive edition of Fintech Wrap Up explores the great bank unbundling offering a comprehensive analysis of how the financial services industry has evolved through technological innovation and regulatory shifts. Analyses by Contrary Research, break down fintech's transformation into three major phases:

Digitization – The transition from traditional banking to online services, driven by innovations like online banking in the 1990s and early digital financial tools.

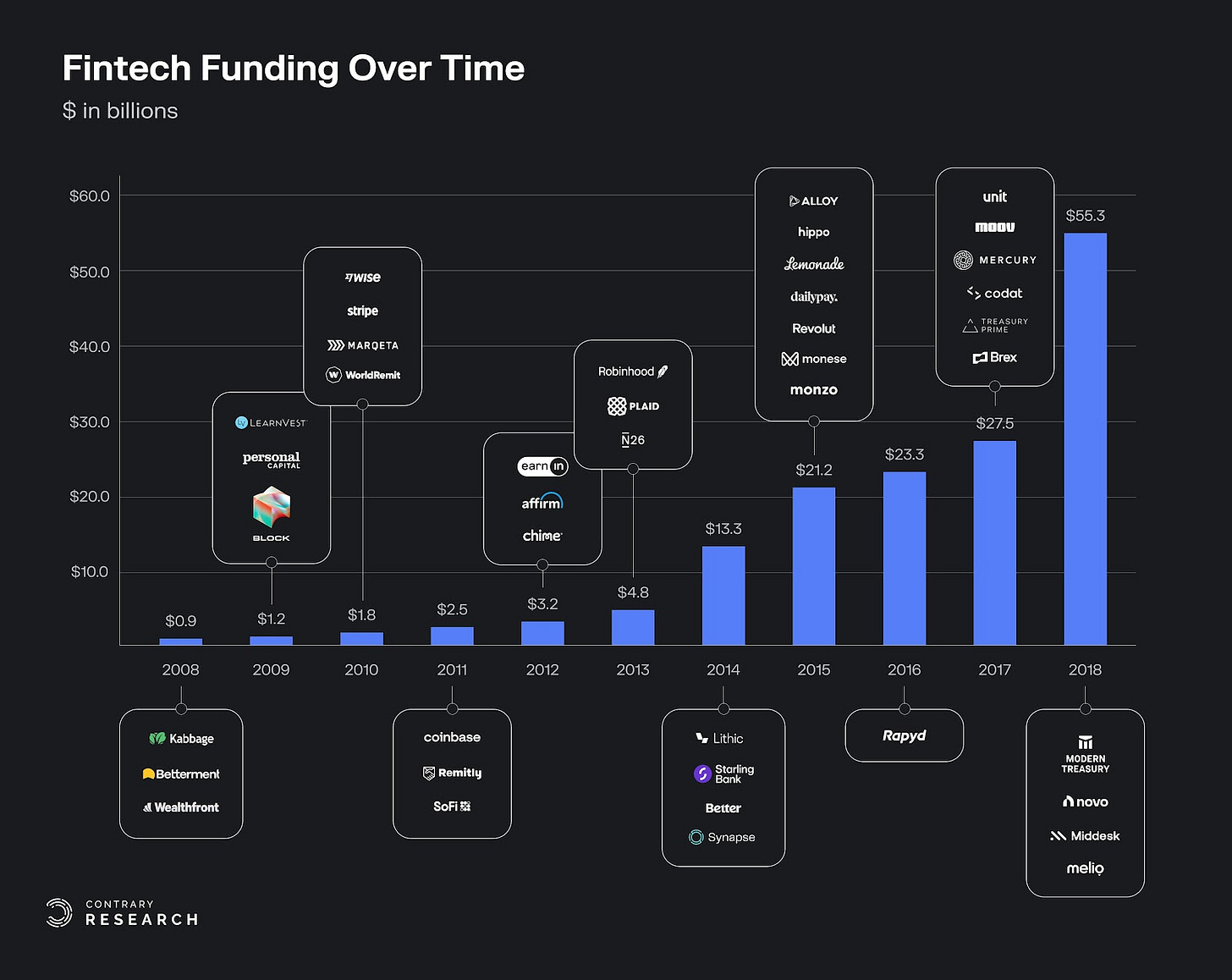

Disintermediation – Post-2008 financial crisis distrust in large banks and the rise of smartphones led fintech startups to disrupt traditional banking with digital payments and simplified infrastructure.

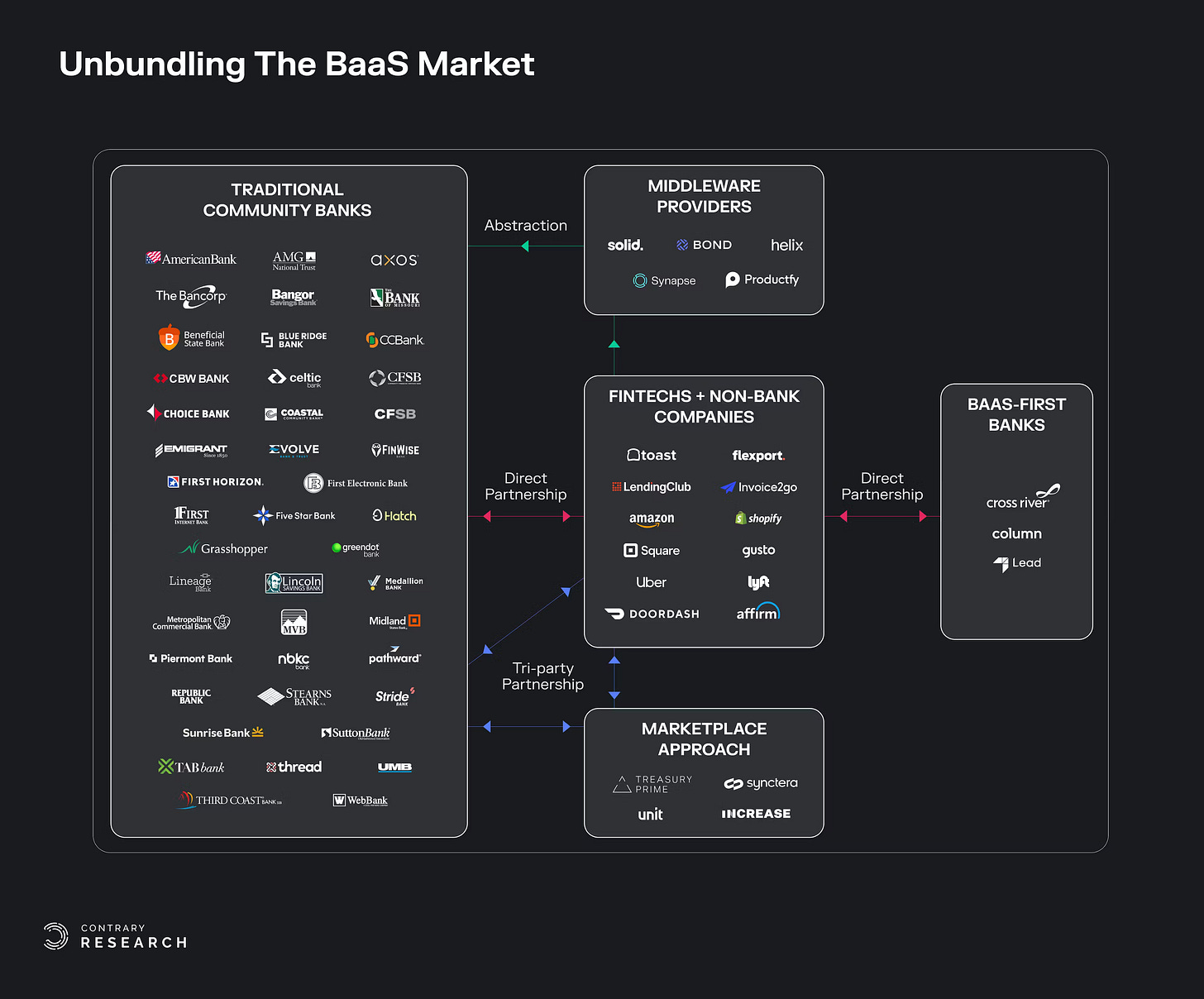

Embedded Infrastructure – Platforms like Stripe and Plaid enabled fintechs to deliver financial services more efficiently, fueling the growth of Banking-as-a-Service (BaaS).

The article also highlights how community banks partnered with fintechs to stay competitive, taking advantage of regulatory changes like the Durbin Amendment. Companies like Uber leveraged embedded finance to unlock new revenue streams and improve customer retention, while BaaS providers empowered non-bank companies to launch financial products faster and more affordably.

However, the piece also underscores the growing regulatory scrutiny and compliance challenges in BaaS, stressing the importance of balancing innovation with regulatory compliance.

The Rise of Fintech

Innovation in finance didn’t just begin with the rise of digital payments and consumer apps. Instead, technology first started shaping financial markets as far back as 1865, when the first transatlantic cable reduced the amount of time it took to send a message between Europe and North America from 10 days down to mere minutes. That evolution continued on through other advances in communication technology, like the telegraph and Morse code, before the introduction of credit cards in the 1950s.

Next came the advent of ATMs in 1967, the establishment of cross-border payment protocols like SWIFT in the 1970s, and the first wave of banks using mainframe computers in the 1980s. These innovations all set the stage for banking to enter the digital age during the dotcom boom. Fintech, as it is known today, started to take shape at the turn of the 21st century. The evolution of fintech has played out in three acts: (1) digitization, (2) disintermediation, and (3) embedded infrastructure.

Act 1: Digitization

One of the first digital banking entrants was Stanford Federal Credit Union, which became the first institution in the US to offer online banking in 1994. Wells Fargo followed suit in 1996, becoming one of the first major national banks to move online. Yet, while the dotcom era ushered in an increasing number of financial services companies using technology, the use of financial technology itself was still in its infancy.

By the end of the 20th century, the first wave of fintech was gaining steam as financial services started to move online. In 1999, Elon Musk was building the original X.com. Its pitch was to become “a full-service online bank that provided checking and savings accounts, brokerages, and insurance.” Musk believed people were ready to begin “to use the Internet as their main financial repository.”

Yet while early tools like X.com and PayPal enabled early online payments, such payment solutions were a far cry from a full digital bank. Instead, the first meaningful digital banks grew out of some of the traditional players. Capital One and ING were founded in 1988 and 1991 respectively. Both played an important role in pushing digital banking forward. ING experimented with “direct banking” in the 1990s by offering services that didn’t require a customer to go to a bank branch, and could instead be accessed over the phone, or eventually online. ING launched the concept as ING Direct in the US in 2000.

From 2000 to 2011, ING Direct grew to 7.6 million users and $83 billion in deposits before it was acquired by Capital One for $9 billion. In part, the deal was driven by required restructuring resulting from the global financial crisis (GFC) in 2008. After the GFC, public sentiment shifted drastically against large banks. As a result, the opportunity for disintermediation began to increase.

Act 2: Disintermediation

The combination of factors like meaningful distrust in large banking institutions post-2008, the release of the iPhone in 2007, and the creation of Bitcoin in 2008 created a prime environment for the “era of the startup” and the rise of fintech as we know it. Between consumer distrust and increased competition from digital banking, banks began to see rising customer acquisition costs into the early 2010s.

From the end of the dotcom era to the early 2010s, consumer-facing financial apps like Mint.com, Pageonce, and BillTracker were also becoming popular. At the same time, issuer processors, like Galileo and Marqeta, founded in 2000 and 2010 respectively, realized they could provide fintechs with direct access to services from Visa and Mastercard. This meant they could help consumer-facing financial apps simplify their infrastructure, and expand to offer services like card programs. As a result, a wave of new banking products emerged and began to attract an increasing amount of venture capital.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.