Deep Dive: The Great Bank Unbundling; Stablecoins can have bank runs; Embedded finance enabling platform business models;

In edition of Fintech Wrap Up, where we explore “The Great Bank Unbundling”, the challenges facing community banks in a digital-first world, and the rapid rise of embedded finance models

Insights & Reports:

1️⃣ Deep Dive: The Great Bank Unbundling

2️⃣ Embedded finance enabling platform business models

3️⃣ Types of SEPA Access

4️⃣ Stablecoins Can Have Bank Runs

5️⃣ Mapping the B2B Payments Landscape – Order to Cash & Accounts Receivable Automation

6️⃣ Personal banking service quality – Great Britain

7️⃣ 15 Fintech Companies That Produced the Most Founders

8️⃣ The Embedded Lending Opportunity in Japan

9️⃣ Synapse’s collapse has frozen nearly $160M from fintech users — here’s how it happened

TL;DR:

Hey everyone, welcome to the latest edition of Fintech Wrap Up! We’ve got a lot to cover, so let’s jump right in.

In this edition, we’re diving deep into what I’m calling *The Great Bank Unbundling*. Fintech has evolved in three distinct phases: the initial wave of digitization, where traditional banks went online; followed by disintermediation, with apps and platforms like peer-to-peer lending and digital wallets reducing our reliance on conventional banks; and now, we’re in the thick of the embedded infrastructure phase. Companies like Toast and Shopify are embedding financial services directly into their platforms, and it’s paying off—Toast alone made 83% of its revenue in 2021 from financial services. This shift is reshaping the landscape and creating significant revenue opportunities for non-fintech businesses.

But it’s not all smooth sailing, especially for community banks. These smaller institutions, which once thrived on local relationships and physical branches, are struggling to compete in this digital-first world. The 2010 Durbin Amendment gave them a temporary edge, but now, the high costs and complexities of digital transformation are forcing them into tricky partnerships with tech companies.

We’re also exploring the intricate web of embedded finance models. From B2C scenarios where e-commerce platforms offer buy-now-pay-later options at checkout, to B2B2C models like a bank partnering with a smartphone company to embed credit card offerings within an app, these models are enabling seamless financial interactions at every level. The possibilities are vast, and we’re only just scratching the surface.

On a different note, stablecoins are drawing attention for all the wrong reasons. Imagine a bank run, but in the crypto world—stablecoins, without traditional banking safeguards like deposit insurance or a lender of last resort, are vulnerable to sudden collapses. We’ve seen this with players like Tether and TerraUSD, and it’s a reminder that with great innovation comes great risk.

Meanwhile, the fintech ecosystem continues to spawn new ventures, much like the legendary "PayPal Mafia." Recent research shows that a handful of fintech companies have produced nearly 2,600 founders, many of whom are now leading the next wave of fintech startups across the Americas. Even in a cooling investment climate, 2023 saw the highest number of fintech founders launching new companies, signaling that the entrepreneurial spirit in this space is far from waning.

And finally, we can’t ignore the growing importance of automation in payments and accounts receivable. Automating the Order-to-Cash cycle is helping companies slash Days Sales Outstanding (DSO) and boost working capital. With platforms reducing invoice processing costs from $11.50 to just $0.71, the efficiency gains are substantial—especially for businesses handling thousands of invoices each month.

That’s it for this edition! As always, I’m excited to hear your thoughts and continue the conversation. Stay tuned for more insights, and let’s keep pushing the boundaries of what fintech can do!

Insights

Deep Dive: The Great Bank Unbundling

Fintech’s evolution can be divided into three key phases:

🔹 Act 1: Digitization

This phase involved the transformation of traditional banking into digital platforms. The focus was on making banking services available online and through mobile devices, laying the groundwork for further innovations in the financial industry.

🔹 Act 2: Disintermediation

The next phase saw a shift towards decentralizing financial services, with apps and platforms providing banking functions independent of traditional banks. This period marked the rise of peer-to-peer lending, digital wallets, and robo-advisors, which reduced the reliance on conventional financial institutions.

🔹 Act 3: Embedded Infrastructure

The current phase focuses on integrating financial services directly into non-fintech products through Banking-as-a-Service (BaaS). This has allowed companies across various sectors, like Toast and Shopify, to embed financial services into their offerings, creating new revenue streams. For example, Toast generated 83% of its 2021 revenue from financial services.

✅ The Rise of Embedded Finance

Embedded finance involves integrating financial services into software platforms, representing a significant revenue opportunity for technology companies. Financial infrastructure companies enable these capabilities, allowing non-fintech businesses to offer services like payments and lending.

✅ Challenges for Community Banks

Community banks, traditionally reliant on physical branches, have struggled in the digital era. The 2010 Durbin Amendment, part of the Dodd-Frank Act, provided these banks with a competitive edge by exempting them from interchange fee caps. This led to partnerships with software companies as a way to distribute financial products efficiently, despite the high costs and complexity of building the necessary infrastructure.

✅ Banking-as-a-Service (BaaS) Emergence

BaaS has simplified the process of embedding financial services by providing the technological backbone that non-bank companies need. Instead of building their own banking infrastructure, these companies can partner with BaaS providers, facilitating faster and more cost-effective integrations.

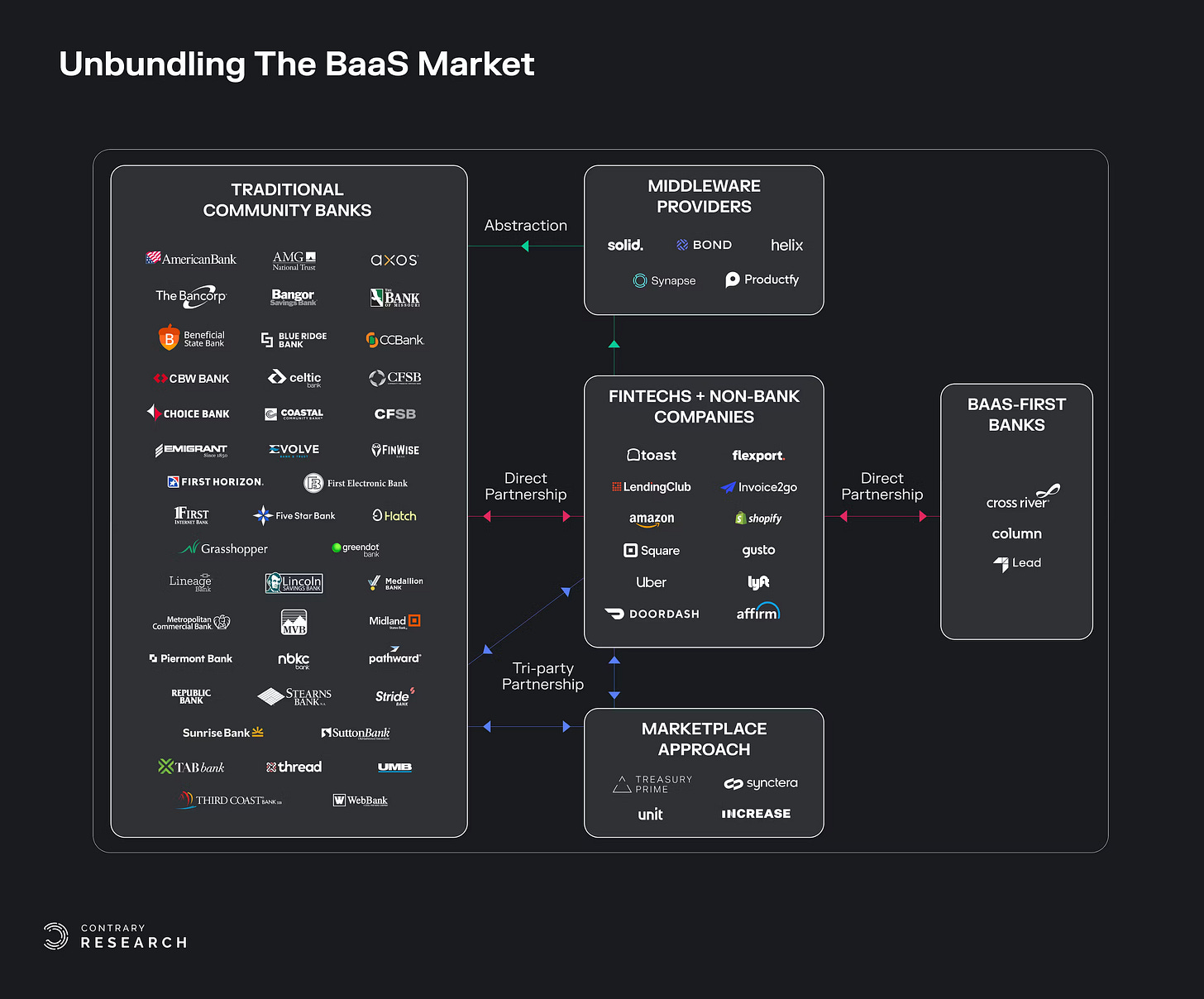

BaaS models include:

1. Traditional Community Banks: Smaller banks engaging in BaaS without a tech-first approach.

2. Middleware Providers: Companies that act as intermediaries between banks and non-bank companies, managing compliance.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.