Deep Dive: Mastercard’s Shift - From Plastic to Platforms

In an era where digital payments are surging and new technologies like artificial intelligence are redefining commerce, Mastercard’s role has never been more crucial

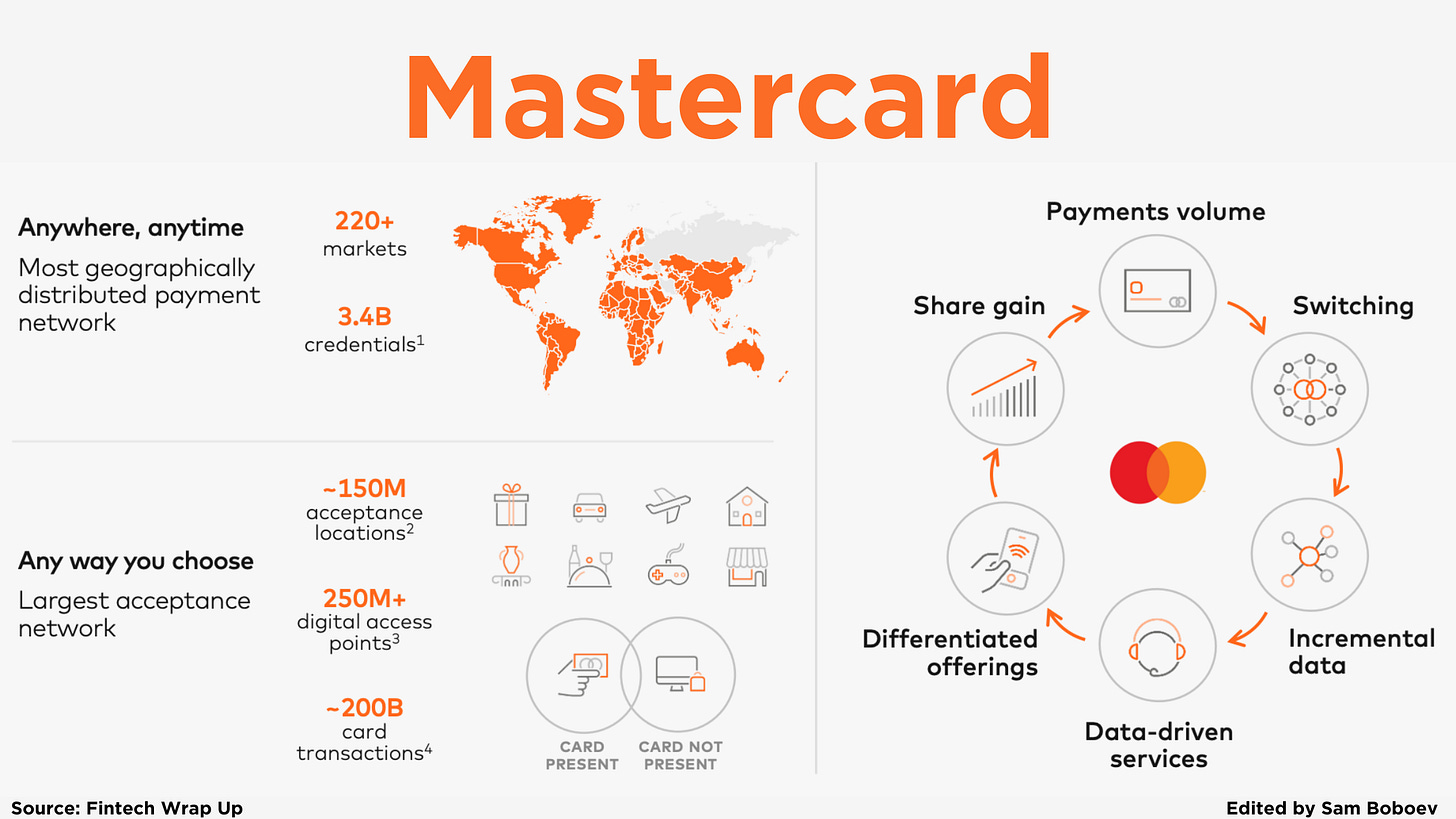

Mastercard is far more than a credit card company – it’s a lynchpin of the modern financial system and a bellwether in fintech’s evolution. In an era where digital payments are surging and new technologies like artificial intelligence are redefining commerce, Mastercard’s role has never been more crucial. The company operates a massive global network that quietly powers transactions for billions of consumers and millions of businesses, across over 210 countries and territories. Indeed, Mastercard’s worldwide reach – with 3.4 billion Mastercard cards in circulation and acceptance at some 150 million merchant locations – underpins the daily flow of commerce on a breathtaking scale. Even today, a large majority of transactions globally are still done in cash (around 85% by some estimates), which highlights why Mastercard matters: it sits at the forefront of the secular shift toward cashless, digital payments. As fintech readers know, who enables and captures this shift is key – and Mastercard, with its vast network and adaptive strategy, has positioned itself as an indispensable platform in the fintech landscape.

But scale is only part of the story. What makes Mastercard truly interesting now is how it has transformed its business beyond traditional card swipes. Over the past decade, the company has aggressively diversified – expanding into new payment rails, new markets, and new value-added services. It’s innovating in areas like open banking, real-time bank transfers, and even AI-driven payments. In short, Mastercard is no longer just a payments processor; it’s becoming a broad fintech solutions provider. This deep dive explores Mastercard’s business model evolution, its strategic priorities (from digitization to B2B payments), its latest innovations such as Agent Pay in AI commerce, the rise of its services business, and its financial performance and global positioning. The picture that emerges is of a company leveraging its heritage and network strengths while reinventing itself to stay ahead in a rapidly changing fintech world.

From Card Network to Multi-Rail Payments

Mastercard’s core business model has long been that of a network orchestrator – connecting banks, merchants, and consumers to enable electronic payments. Every time you tap or swipe a Mastercard, the company earns fees by routing the transaction through its network and facilitating authorization, clearing, and settlement between the merchant’s bank and the cardholder’s bank. This fundamental network model (shared with its main rival Visa) has proven enormously scalable and resilient. Mastercard operates one of the world’s fastest payment processing networks, acting as the intermediary for electronic funds transfers on debit, credit, and prepaid cards. In essence, it provides the rails and rules that allow money to move securely between parties worldwide.

What’s changed in recent years is the breadth of that network and the products riding on it. Mastercard has deliberately evolved “beyond the card” to support a much wider range of payment types and use cases. Its infrastructure, built for interoperability and scale, now handles everything from business-to-business (B2B) payments to person-to-person (P2P) transfers across different currencies. For example, Mastercard’s network and partnerships facilitate not only consumer card purchases, but also B2B transactions, corporate disbursements, and peer payments – domains traditionally outside the scope of card networks.

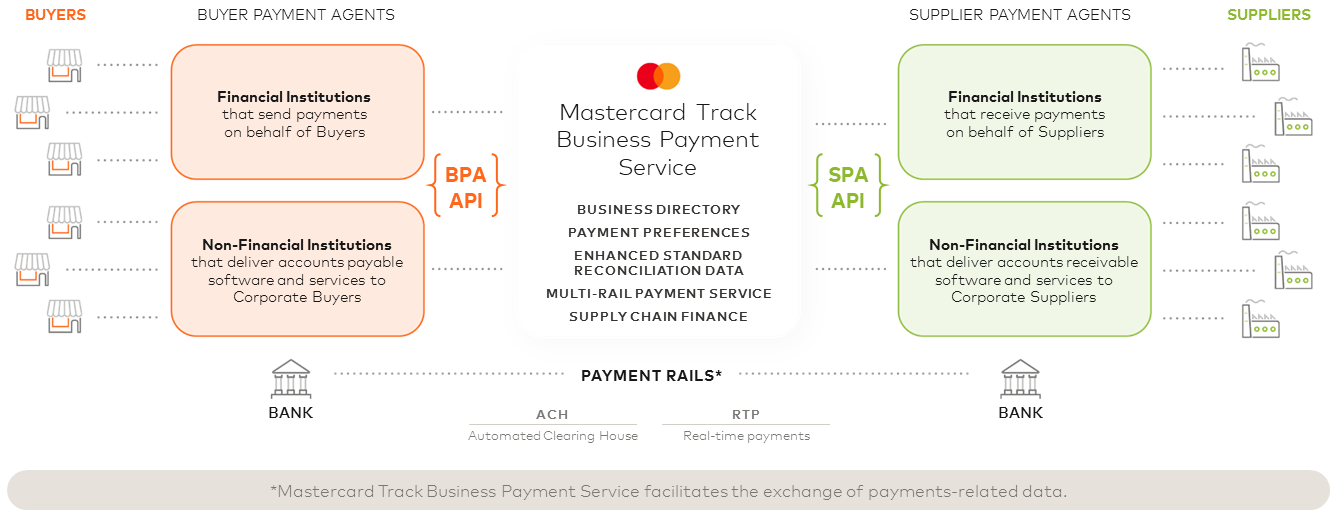

Crucially, Mastercard has added new payment rails alongside the card rail. The company often talks about its strategy as “multi-rail” – meaning it wants to enable payment flows over cards, bank accounts, real-time payment networks, and more. Through acquisitions and technology investments, Mastercard now connects to ACH and real-time bank transfer systems, open banking networks, payment gateways, and other platforms. For instance, Mastercard acquired Vocalink in 2017 to enter the ACH and real-time payments space (today it directly participates in or powers multiple domestic bank transfer schemes). It also bought Finicity in 2020 to build out open banking capabilities, enabling account-to-account data sharing and payments. As a result, Mastercard’s offerings include things like account-based payments, open banking APIs, and payout services in addition to its traditional card network. A slide from Mastercard’s 2024 investor presentation highlights these new areas – listing open banking rails, SaaS platforms, gateways, and processing platforms as part of its expanded network toolkit.

Importantly, Mastercard’s business model now encompasses more than moving money – it also sells a suite of complementary technology and analytics services. The company leverages its network data and infrastructure to provide fraud detection tools, credit decisioning analytics, loyalty program services, consulting, and more. Many of these services are delivered via APIs on the Mastercard Developers platform and through partnerships. For example, Mastercard offers payment gateway solutions for e-commerce, “Buy Now Pay Later” enablement, and advanced fraud management powered by AI. It also provides data analytics and consulting (through its “Data & Services” arm), helping banks or merchants glean insights from transactions. In short, Mastercard’s network has evolved into a fintech platform – not only processing payments but also providing value-added services on top of those payments.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.