Deep Dive: JPMorgan’s Payments Strategy and Systems-Level Integration Analysis

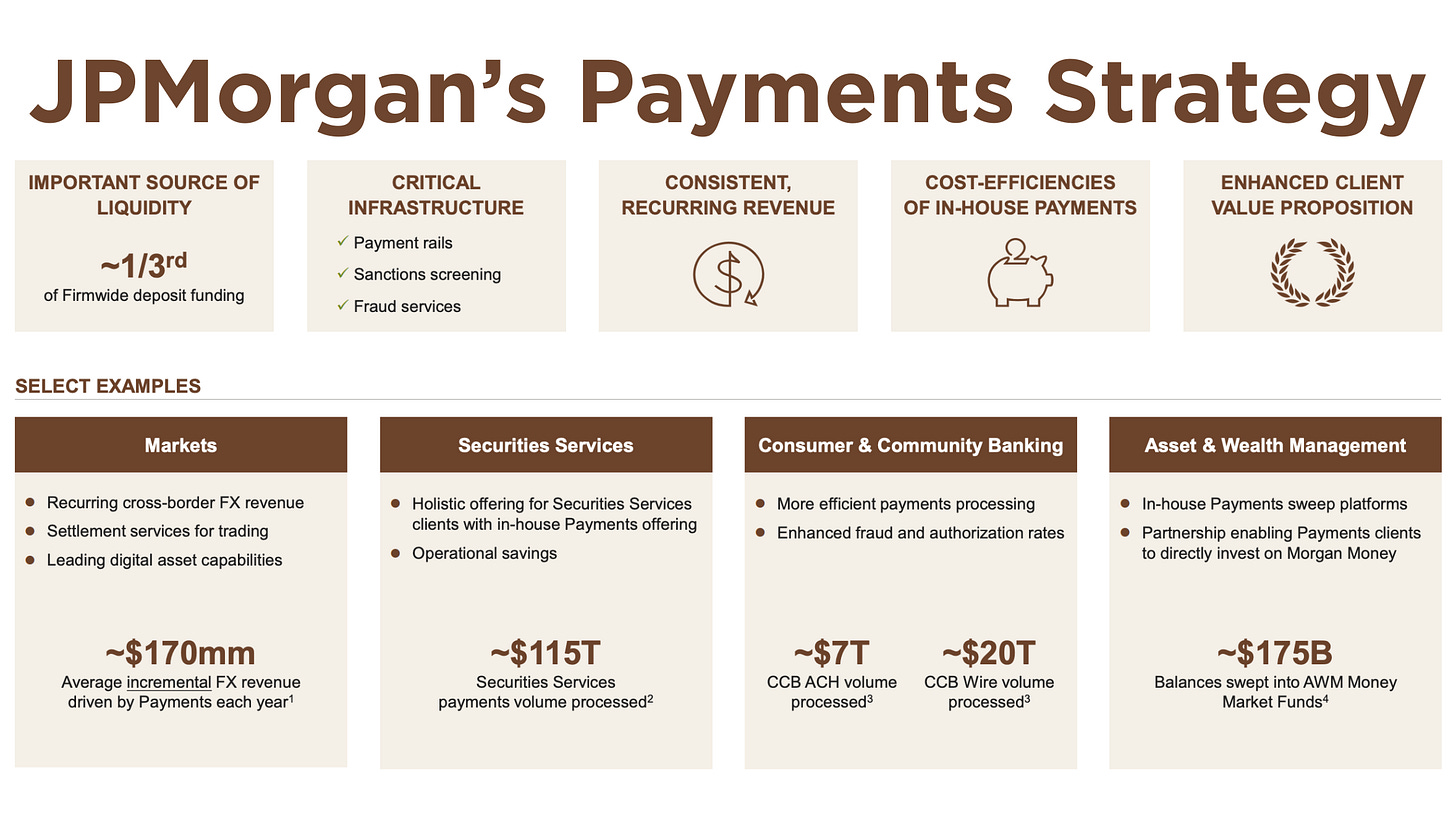

I’ve been following JPMorgan’s methodical buildout of a payments empire. The firm has quietly integrated every layer of the payments stack from corporate treasury to merchant acquiring into a unified infrastructure. In this report, I break down how JPMorgan segments its payments business, the technology platforms underpinning it, and the long-term moat the bank is fortifying.

Segmenting a Payments Stack

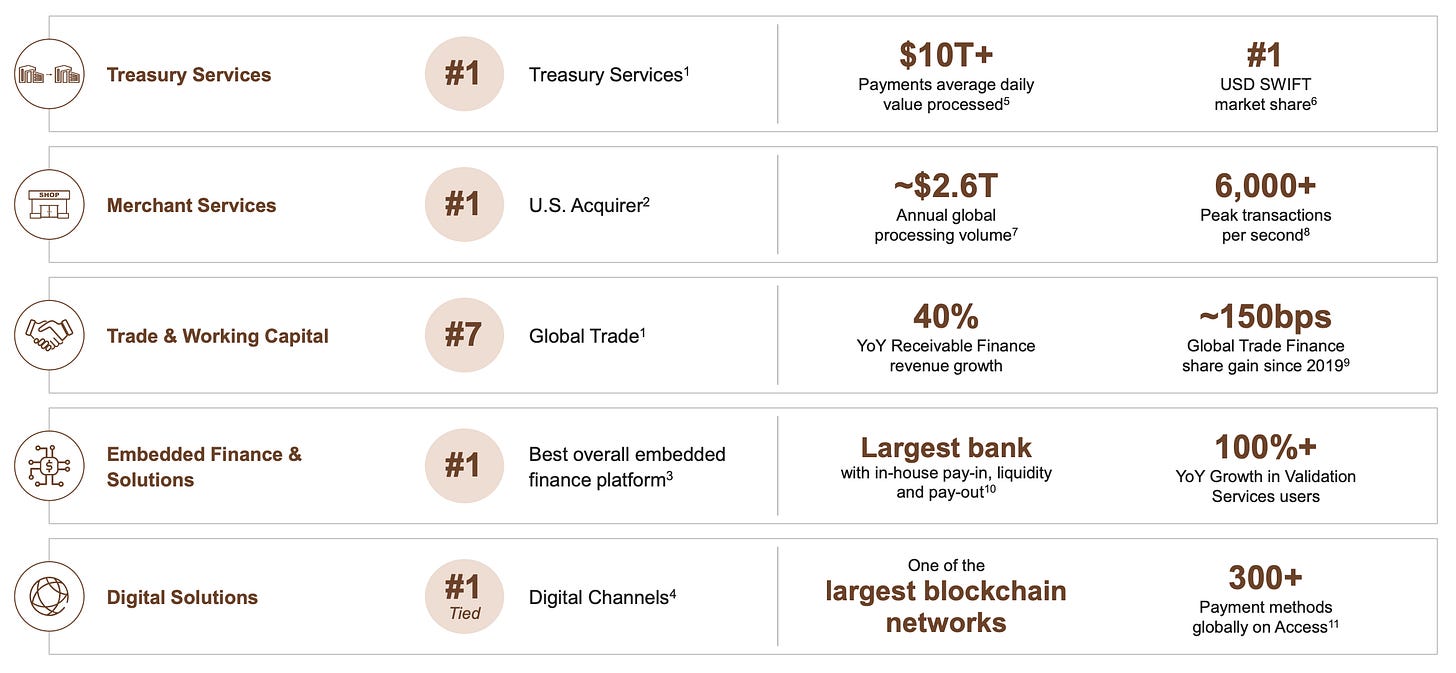

JPMorgan Payments is organized into five key segments, each targeting a different slice of client needs:

Treasury Services (TS): Corporate cash management at massive scale. TS processes over $10 trillion in payments per day, giving JPMorgan the largest USD clearing share globally. This is the backbone for multinationals’ wires, ACH, and global treasury operations with JPM aiming to be clients’ “#1 primary operating bank.” All 20 of the world’s 20 largest companies are JPM Payments clients, a testament to TS’s dominance.

Embedded Finance & Solutions: Banking-as-a-service and API-driven offerings that let fintechs and corporates embed JPMorgan’s payments, accounts, and compliance services directly into their own products. JPMorgan touts having the “best overall embedded finance platform” and is the largest bank with in-house pay-in, liquidity, and pay-out capabilities. Notably, they built a single consolidated data lake to unify data across products and created an intelligent Trust & Safety (fraud prevention) platform for clients.

Trade & Working Capital: Trade finance, supply chain payments, and working capital solutions. This includes tools like receivables finance, supply chain payment platforms, and cross-border trade services. JPMorgan has gained ~150 bps of global trade finance market share since 2019, and this segment saw 40% YoY growth in receivables finance revenue. The tech focus here is linking into clients’ systems, e.g., allowing customers to tap JPMorgan’s working capital products from their preferred ERP software.

Merchant Services: End-to-end payment acceptance for merchants (online and in-store). JPMorgan is the #1 U.S. merchant acquirer and handled about $2.6 trillion in merchant processing volume in 2024. Historically, JPMorgan’s acquiring was via partnerships, but now they’ve built a full-stack omnichannel commerce platform (internally called Helix) that’s live across the U.S., EU, Canada, and Australia. This lets merchants get everything gateway, processing, terminals, fraud tools from one provider (JPMorgan). The goal: eliminate the disjointed experience of juggling multiple payment vendors. Non-bank players like Stripe and Adyen also offer full-stack payments, so what sets JPM’s apart? The difference is integration into a bank’s infrastructure (we’ll get to that).

Digital Solutions: Client-facing digital channels and APIs that tie it all together. This includes J.P. Morgan Access (the corporate portal) and Chase Connect for SMEs, which aggregate 300+ payment methods globally for clients in one interface. Digital Solutions also encompasses blockchain networks – JPMorgan runs one of the industry’s largest blockchain platforms for payments (more on “Kinexys” below). In short, this segment ensures clients have a unified digital experience to interact with all the above services.

Organizing by these segments allows JPMorgan to cover the waterfront of payments. Startups, middle-market firms, large corporates, public sector entities, banks all find relevant solutions under the JPM umbrella. The segmentation is strategic: each unit can specialize (e.g. Trade finance vs. Merchant acquiring) while sharing common infrastructure and cross-selling into each other’s client base.

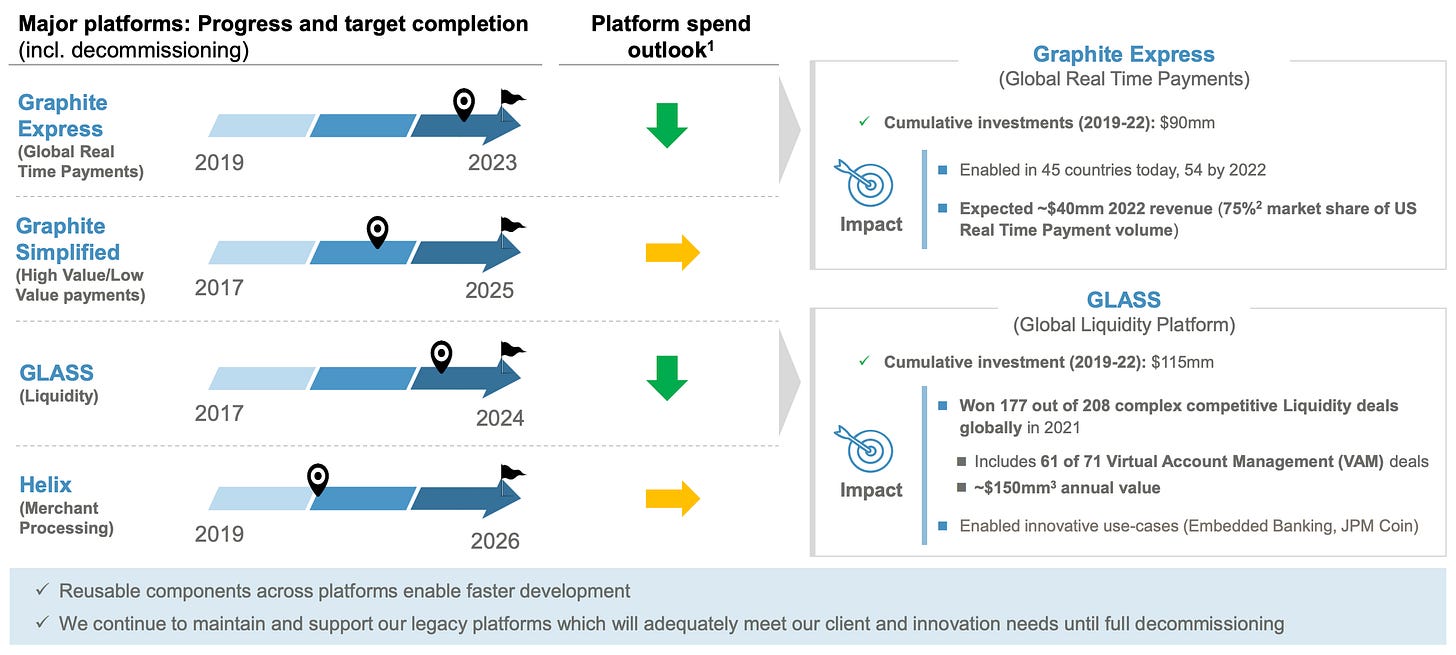

Integrated Architecture: Graphite and the Full-Stack Approach

JPMorgan’s real strength comes from its systems-level integration across those segments. Rather than bolting on third-party processors or isolated platforms, they’ve spent years building a unified payments infrastructure in-house:

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.