Deep Dive: Citi’s Strategy to Dominate Institutional Payments

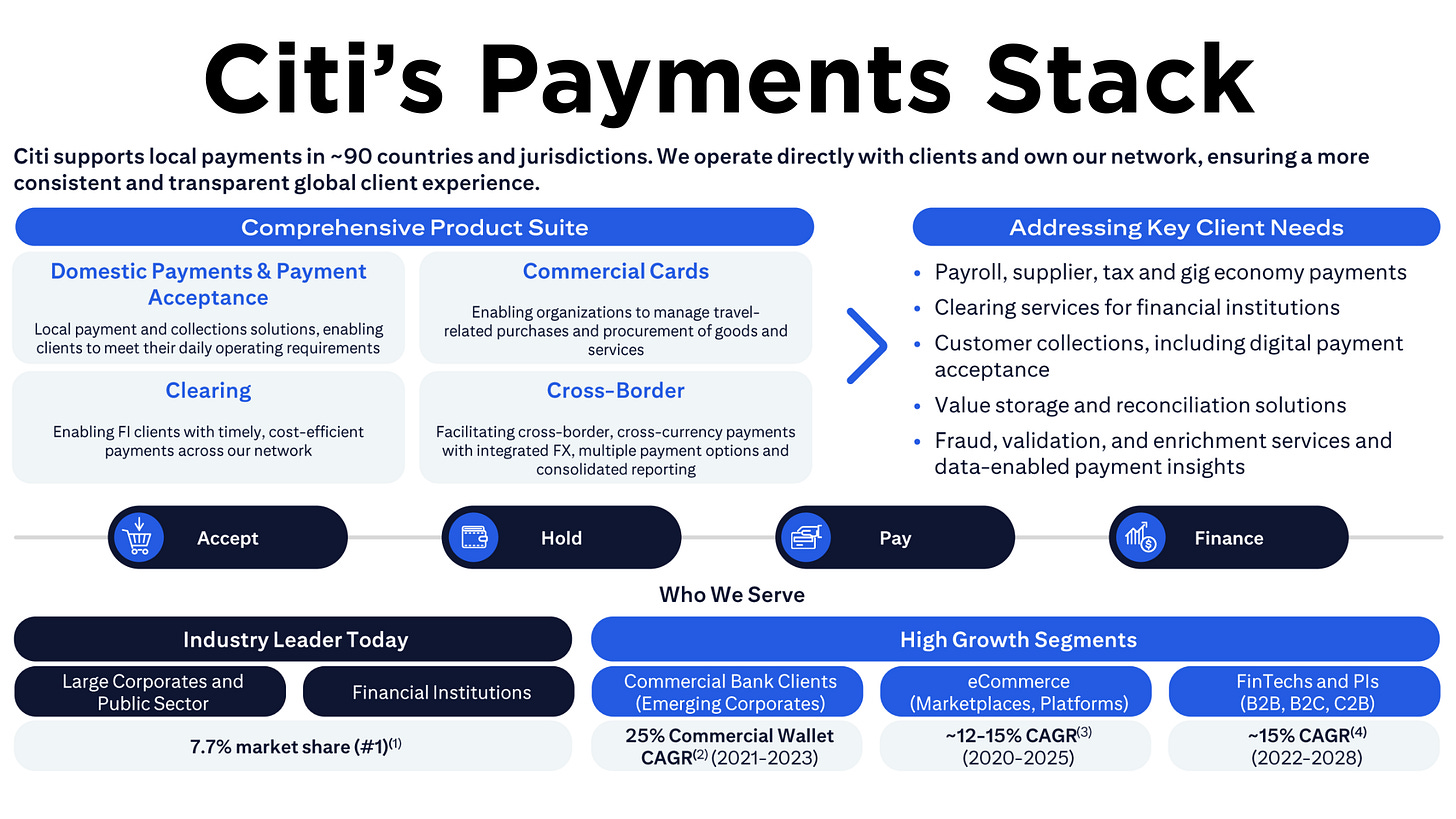

Citi’s core payments thesis is blunt: own and integrate the entire payments value chain globally to stay on top. The bank touts a #1 global market position in institutional payments with an estimated 7.7% market share. That leadership is underpinned by scale and reach. Citi supports local payment flows in ~90 countries through its proprietary network. In practice, this means Citi directly connects to domestic payment systems around the world (290+ clearing system links, by its count) instead of relying solely on partner banks. The thesis is that by “owning the network” end-to-end, Citi can offer clients a more consistent, transparent service globally and capture a disproportionate share of volumes.

This strategy is driven by the structural shift to digital commerce and real-time finance. As transactions move online and instantaneously, Citi is positioning itself as the go-to infrastructure for institutional money movement. Payments already contribute the bulk of Citi’s Treasury and Trade Solutions (TTS) business, roughly three-quarters of TTS non-interest revenue, growing ~13% annually in recent years. The bank processed $358 B in cross-border FX payments in 2023, up from $280 B in 2021 (13% CAGR). It also handled 157 million USD clearing transactions in 2023 and saw explosive growth in instant payments (from ~2 million to ~10 million daily transactions, ~120% CAGR over 2021–2023). In short, Citi’s payments franchise is huge and on an upswing, a high-growth profit engine in an otherwise mature banking landscape.

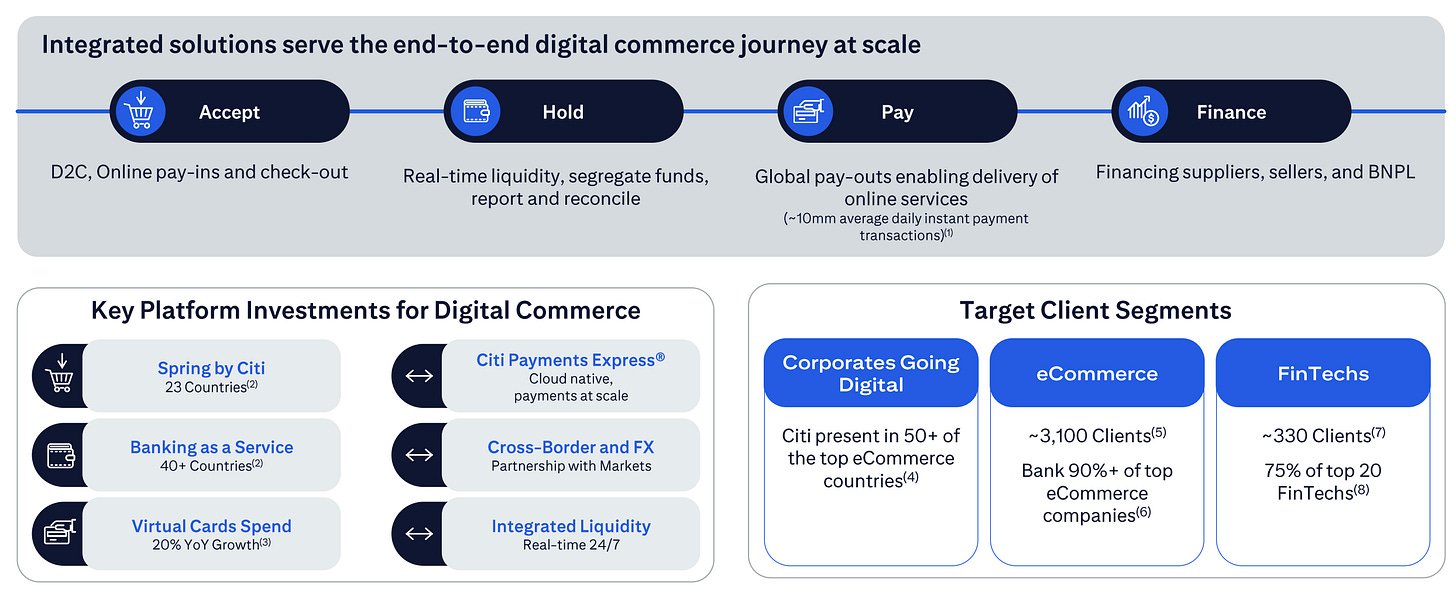

Citi’s thesis is to double down on this momentum by meeting clients’ evolving needs across every leg of a payment’s journey. That journey spans accepting payments, holding liquidity, paying out, and financing transactions. Citi’s strategy explicitly breaks this into “Accept, Hold, Pay, Finance,” ensuring the bank has offerings at each step. The underlying bet: if Citi can embed itself at each link in the chain from checkout to treasury to disbursement, and FX clients will find it compelling to consolidate their flows through Citi’s ecosystem. And with the global footprint already in place, Citi can capture the worldwide shift to electronic payments, e-commerce, and instant funds movement at scale.

Integrated architecture

Citi has re-architected its product suite around the digital commerce lifecycle: “Accept, Hold, Pay, Finance.” Rather than selling standalone products, the bank is packaging an integrated stack that covers end-to-end payment needs:

Accept: This is about helping clients collect money in diverse forms. Citi enables payment acceptance via cards, bank transfers, alternative payment methods (APMs) like mobile wallets, and instant debit solutions. For example, its Spring by Citi platform (now live in 23 countries) provides online checkout and pay-in capabilities for direct-to-consumer sales. In an eCommerce marketplace scenario, Citi’s acceptance tools let a platform take local payments in many forms (cards, real-time bank payments, etc.), with Citi acting as the acquiring backbone in each market. By supporting local collection in ~90 markets, Citi lets global corporates and digital firms sell in multiple countries without stitching together local payment processors.

Hold: Once funds are received, corporates need to manage and deploy liquidity, essentially treasury services. Citi focuses on real-time liquidity and value storage solutions so clients can hold and manage funds seamlessly across currencies and jurisdictions. This includes virtual accounts in 19 countries (digital sub-ledgers for easier reconciliation) and on-demand liquidity structures that move cash to the right place at the right time. Citi emphasizes 24/7 real-time liquidity clients can sweep or fund accounts instantly across its network, even outside traditional banking hours. By integrating holdings with payments, Citi aims to eliminate the classic friction between incoming receipts and outgoing payments. In practical terms, a marketplace can segregate customer funds, earn yield, and instantly redeploy balances for payouts via Citi’s network, all through APIs. Citi even introduced “Citi Token Services” to tokenize deposits for round-the-clock internal transfers, hinting at how seriously they take always-on liquidity.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.