Deep Dive: CB Insights’ Fintech 100 2025 — Decoded for Builders

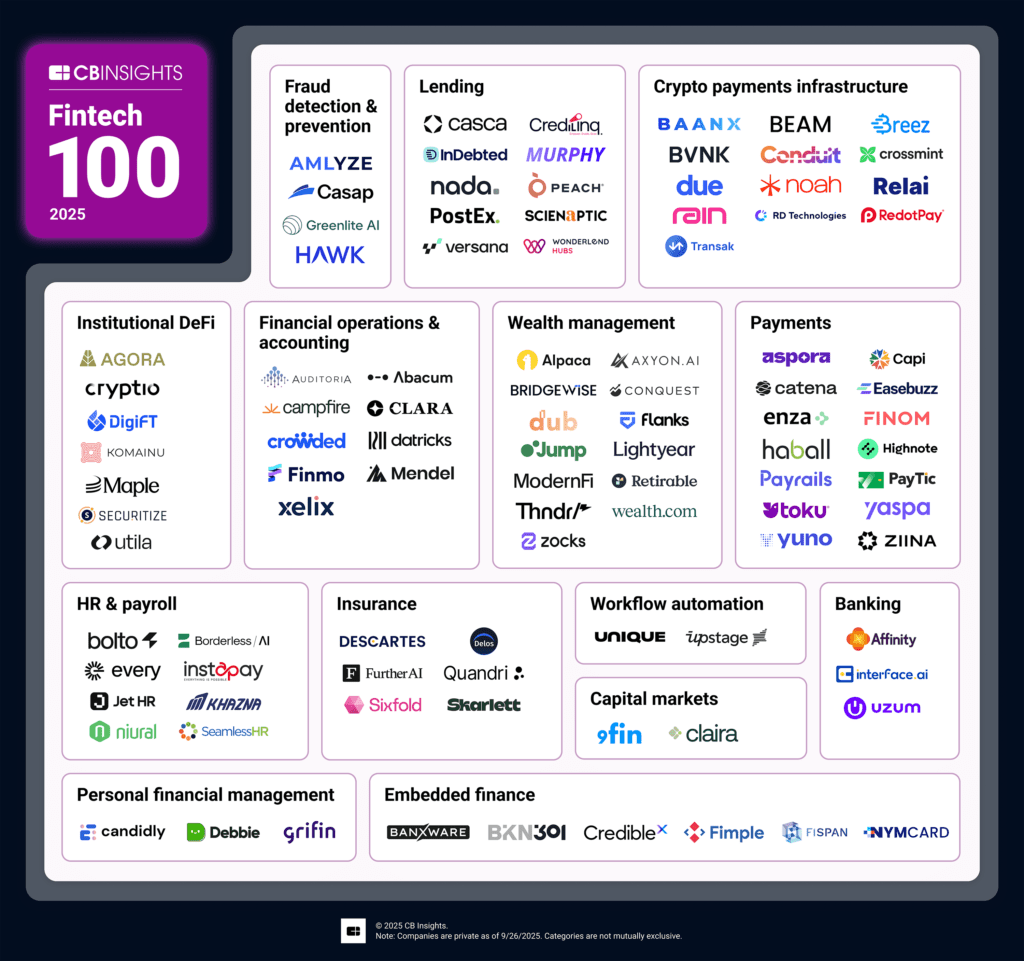

In this edition of Fintech Wrap Up, I’m digging into CB Insights’ Fintech 100 — not to applaud shiny logos, but to decode what this year’s picks actually say about where money and product are moving. Fintech in 2025 isn’t about flashy apps anymore. The era of cheap money and consumer buzz has given way to a focus on building the bedrock of financial services. As CB Insights warns, momentum has “shifted from the front end to the foundation” – think data plumbing, compliance robots, and payment rails – rather than another Curve or Revolut clone. Under the hood, AI has become table stakes. Bots are no longer just cute chat interfaces; they’re doing real work (reconciling books, scanning for fraud, doling out loans). At the same time crypto is maturing: stablecoins and tokenization are creeping into everyday business finance, far from the speculative frenzy of 2017. The 2025 Fintech 100 winners – 26 countries, 60 outside the US – spotlight this “boring” shift, with an average headcount growth of 61% versus a fintech norm of 13% (good luck catching up!).

Funding Frenemies - Crypto and AI Crash the Party

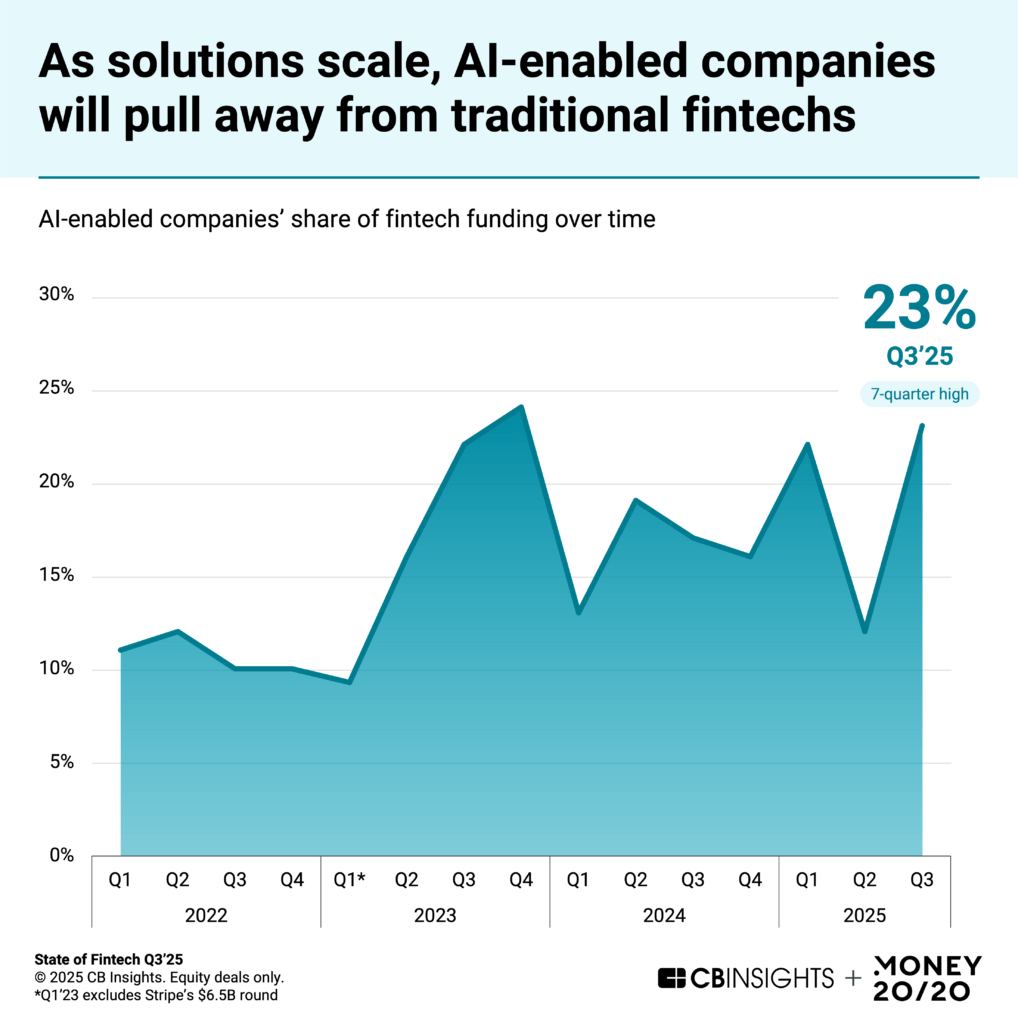

Forget Tiktoks of 2021 – investors’ flirtations have pivoted dramatically. In Q1’25, over half of the largest seed/A deals targeted blockchain and crypto infrastructure startups. (Yes, crypto – not the cute puppy coins – just massive cryptobanks and trading rails.) At the same time, fintech-focused AI companies are gobbling up a record share of funding: 16% of all deals in Q1, and jumping to 23% of funding dollars by Q3. Five of the top 10 deals in Q3 even went to AI-enabled finance platforms like Ramp and AppZen, cementing this trend.

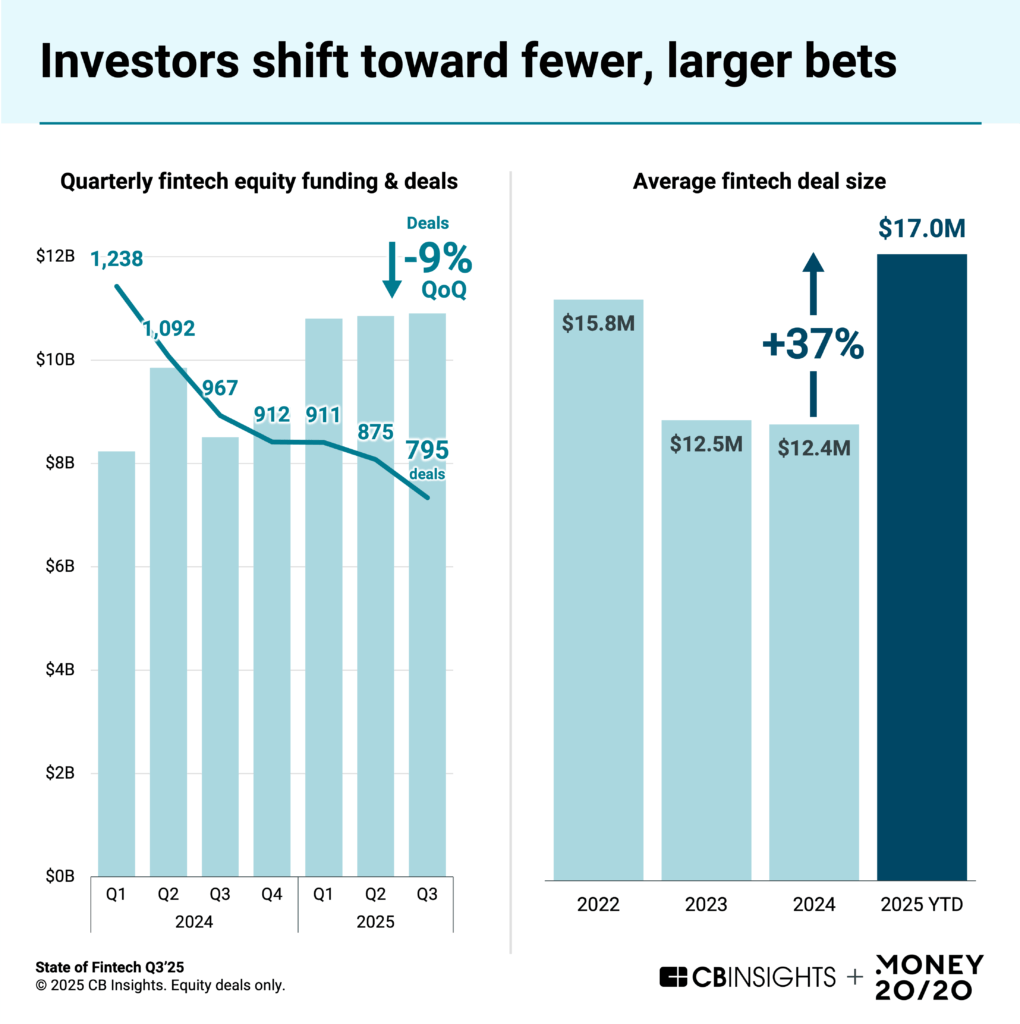

Another clear trend: bigger bets on fewer companies. After steady decline, total fintech funding actually perked back up to $10.3B in Q1’25 (its highest since early 2023), thanks largely to one $2B Binance megadeal. By Q3, funding was flat at ~$10.9B but mega-rounds (>$100M) made up a whopping 40% of that pile. In plain English, investors are flush with IPO regret, so they’re pouring more cash into fewer, later-stage deals. Indeed, mid-/late-stage rounds hit their highest deal share since 2022, while early-stage funding dipped below 70% of deals for the first time since 2020. (The median late-stage deal size is up 50% vs. 2024 – all those spreadsheet-crunching CFOs insisting on clear paths to profit.)

Regionally, Silicon Valley still commands the lion’s share (US was ~39% of Q3 deals), but “unsexy” sectors have global players. Corporate VCs are all over crypto fintech: Coinbase Ventures led Q1 with 6 deals, OKX Ventures had 5. Meanwhile Asia, Latin America, and Africa are represented by success stories, even if their funding slices are smaller. (CB Insights’ Fintech 100 lists Uzum in Uzbekistan and Affinity in Ghana – so yes, fintech unicorns are popping up in “surprising” places.)

The New Finance Workforce

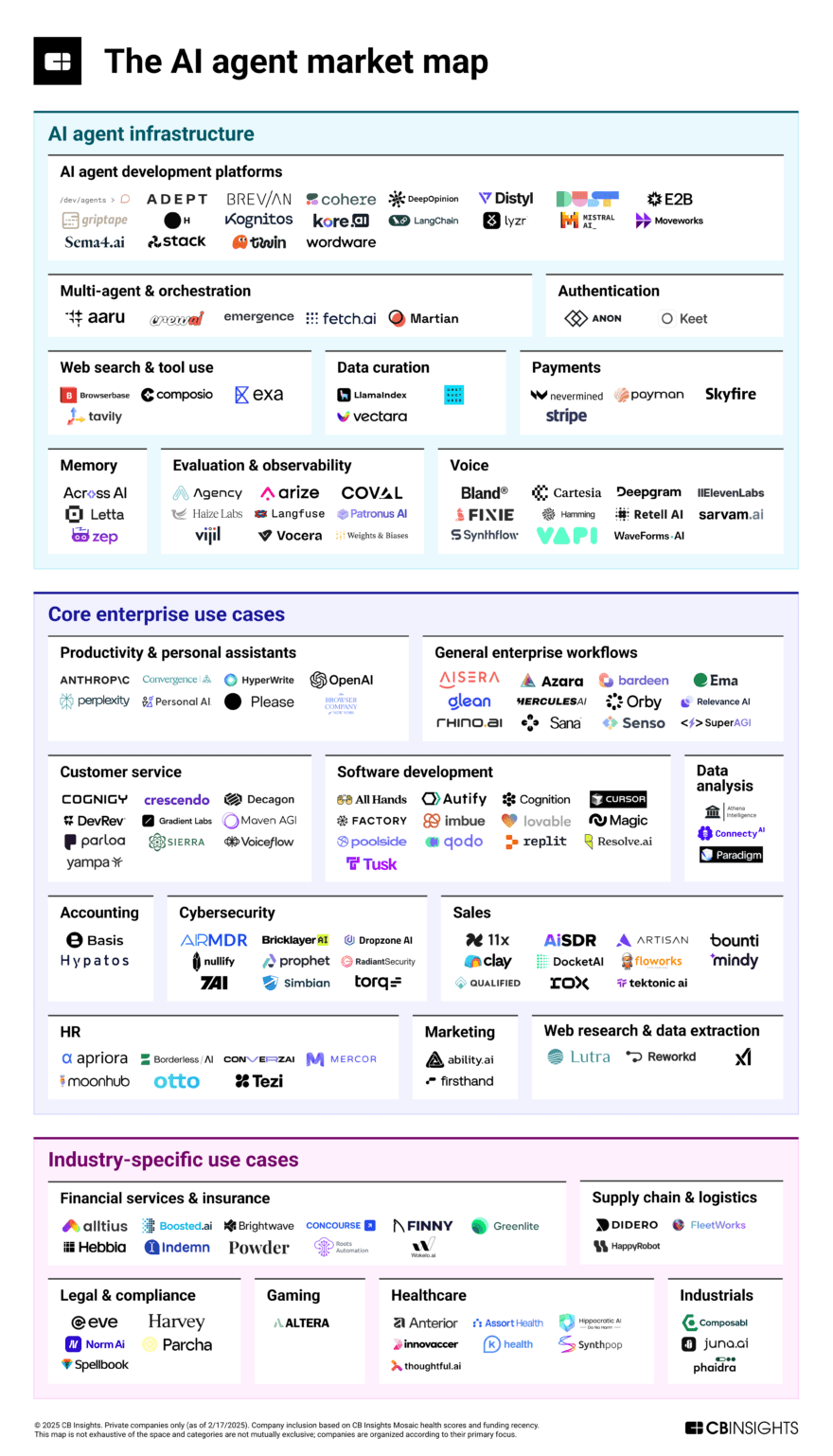

If you thought “AI in fintech” meant chatty bots for customer service, think again. Fintech 100 firms show that the real action is automating complex workflows.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.