Deep Dive: BVNK vs. Bridge vs. Zero Hash - Stablecoin Payment Infrastructure

This deep dive offers a comparative narrative of their capabilities across payments, wallets, custody, technology, compliance, security, and global reach.

Stablecoins are rapidly transforming how money moves globally, blurring the lines between traditional finance and crypto. At the heart of this shift are platforms like BVNK, Bridge, and Zero Hash, offering the rails that connect traditional finance to digital assets.

All three offer APIs that help fintechs and enterprises send, receive, convert and store value globally, while abstracting away blockchain complexity, regulatory burden, and custody risk.

In this piece, I compare these providers across six key dimensions:

Payments (speed, flexibility, use cases)

Wallets and custody (integrated vs modular models)

Technology stack (developer UX and orchestration capabilities)

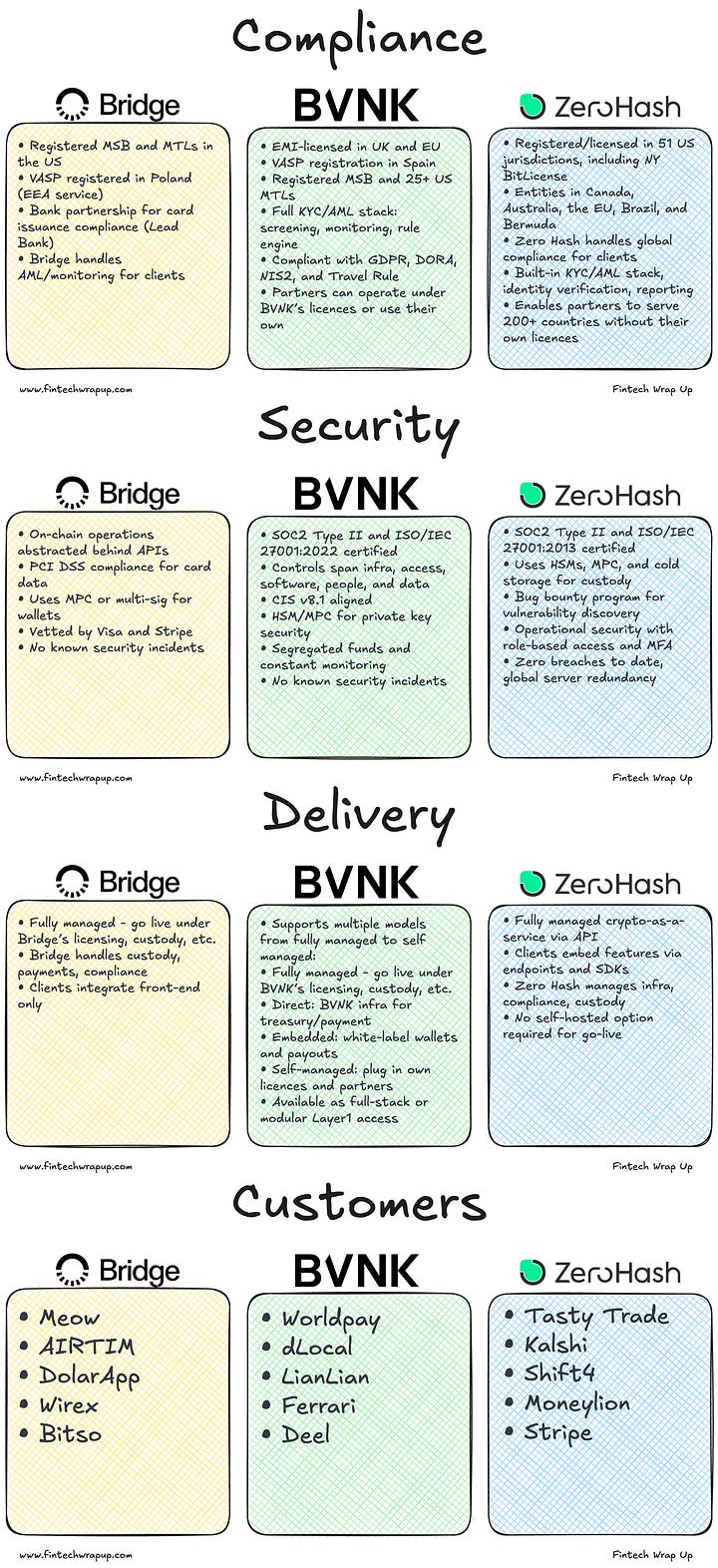

Licensing and compliance (jurisdictional reach and regulatory protections)

Security (certifications, controls, architecture)

Customer footprint (clients, volumes, trust signals)

The goal is to help fintech teams make an informed decision based on their needs, whether you’re building global payouts, launching a stablecoin wallet, or embedding crypto into your product.

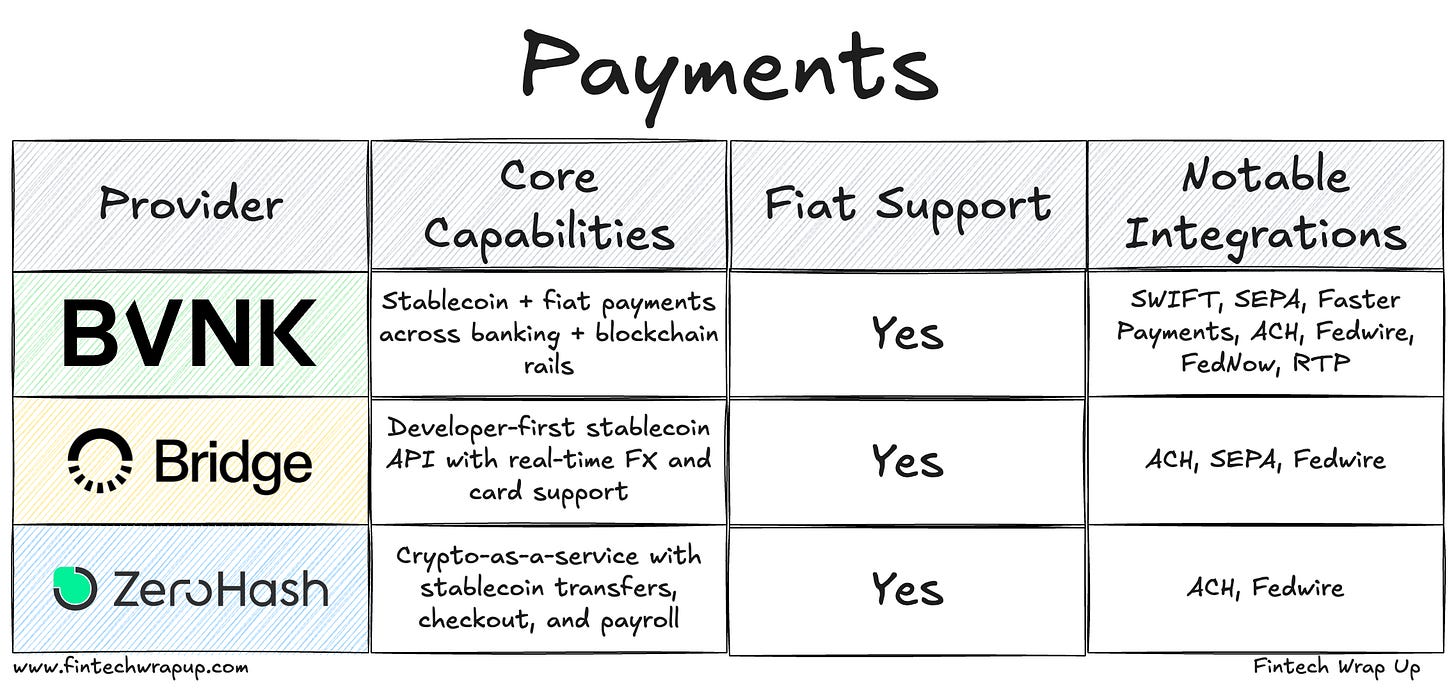

Comparison Table

Below is a side-by-side summary of the three companies’ offerings across key categories:

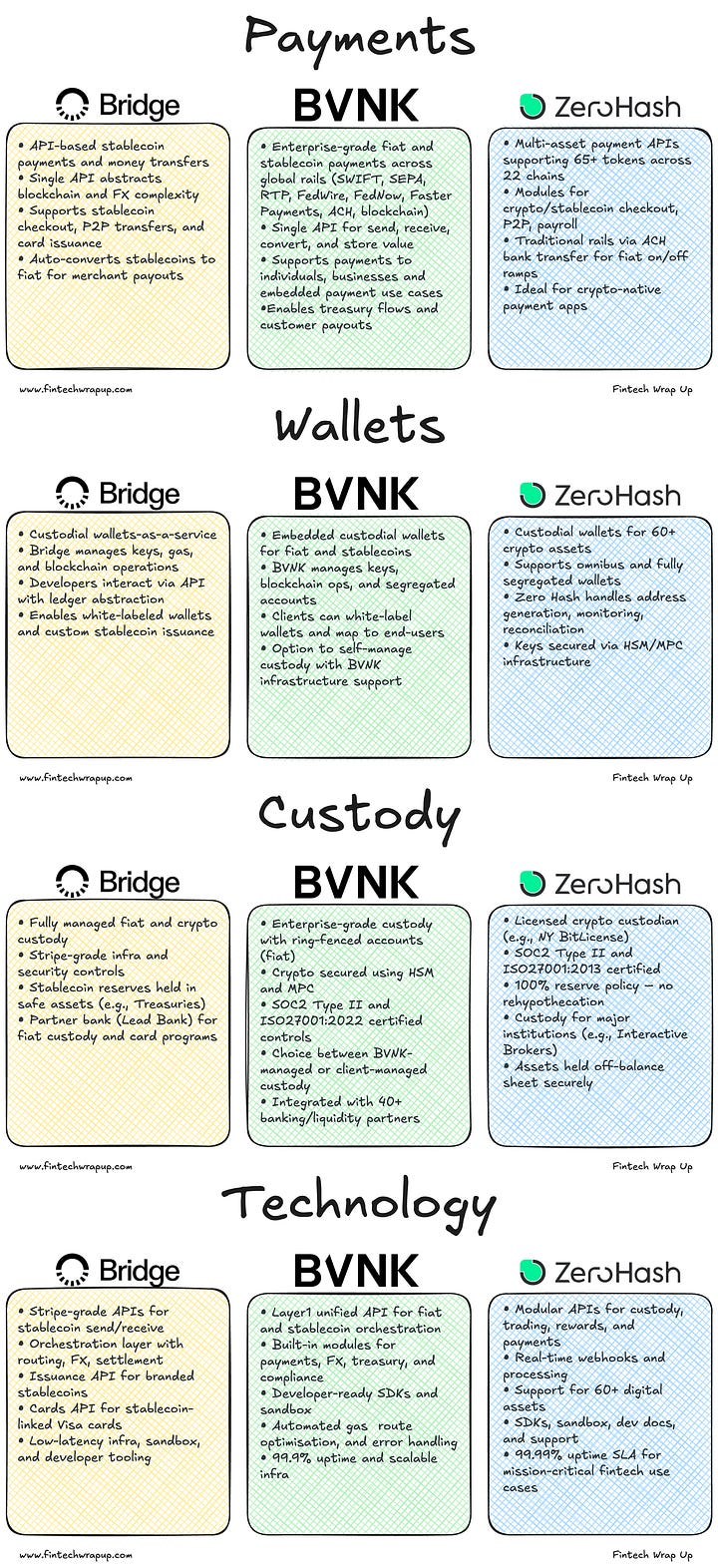

Payments

BVNK is purpose-built for enterprise and fintech-grade payments infrastructure. It supports both fiat and stablecoin flows through a unified ledger and enables businesses to open virtual multi-currency accounts (EUR, GBP, USD, stablecoins). Payments can move across SWIFT, SEPA, Faster Payments, FedWire, and ACH and blockchain networks. BVNK’s flexibility stands out, clients can launch under BVNK’s licensing or operate their own infrastructure via Layer1. Trusted by Worldpay, Deel and dLocal, it handles high-value, high-frequency treasury, payroll, and PSP use cases with bank-grade compliance and 24/7 payment automation.

Bridge delivers a best-in-class developer experience for building stablecoin-native payments into digital products. Its Orchestration API abstracts away blockchain complexity, offering instant, low-cost cross-border transfers with automatic USDC-to-fiat conversion at settlement. It powers Visa cards, P2P transfers, stablecoin checkout, and embedded wallets. Examples include Meow and Starlink, who rely on Bridge for treasury automation and emerging market commerce. Now part of Stripe, it combines crypto-native flexibility with global scale and regulatory reach.

Zero Hash supports broad crypto payment use cases across 65+ assets and 22 blockchains. Its APIs enable stablecoin checkout, on-chain payments, P2P transfers, and crypto payroll. While less tailored to fiat and compliance-heavy enterprise flows, it shines in crypto-first use cases. Integration with ACH and a global funding network makes it a strong choice for wallets and trading apps embedding crypto rails without building infrastructure.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.