Deep Dive: A Guide to Modernizing Core Banking Systems

In this Deep Dive edition of Fintech Wrap Up, I explored the complex world of modernizing core banking systems—and why it’s becoming more critical than ever

TL;DR:

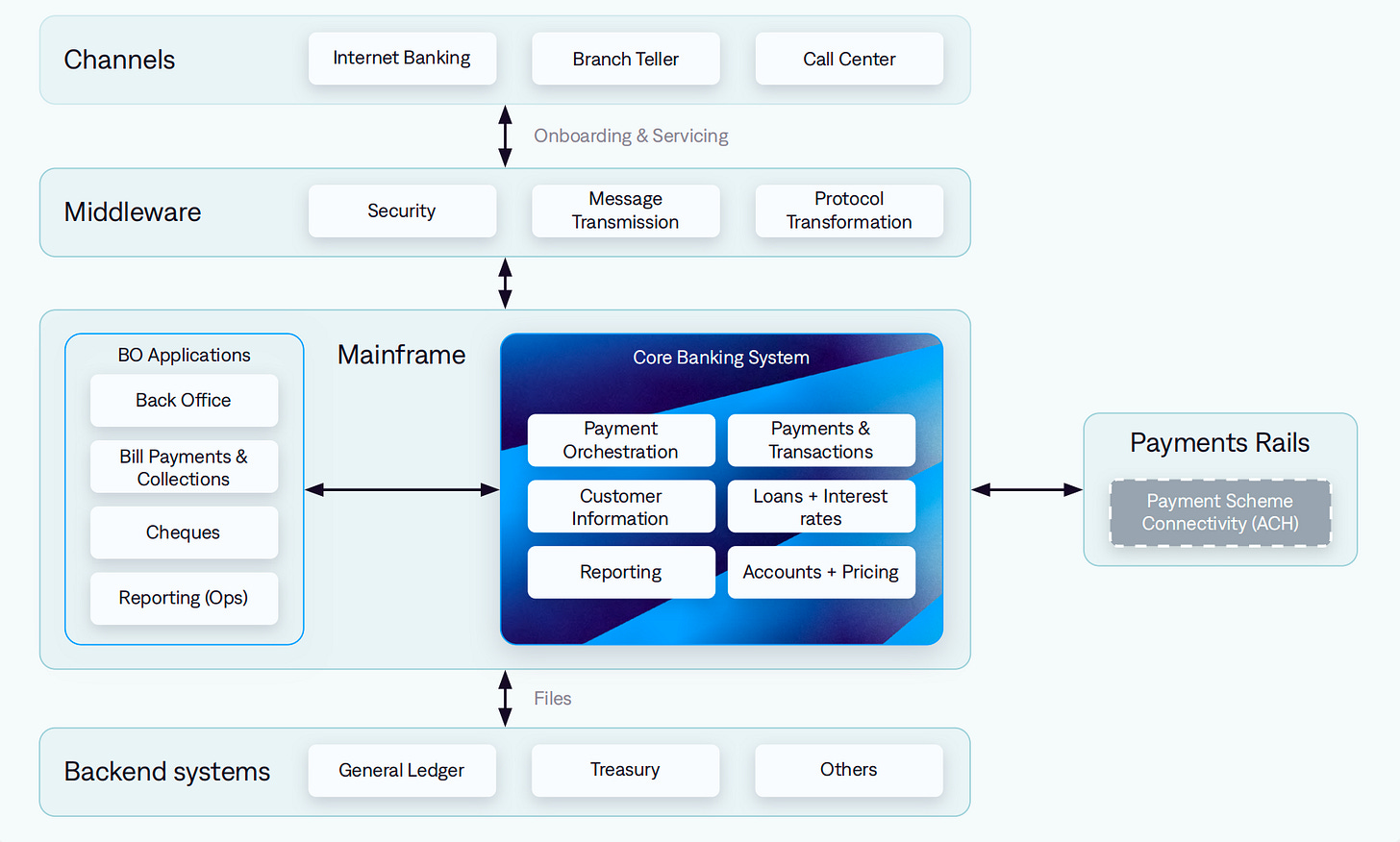

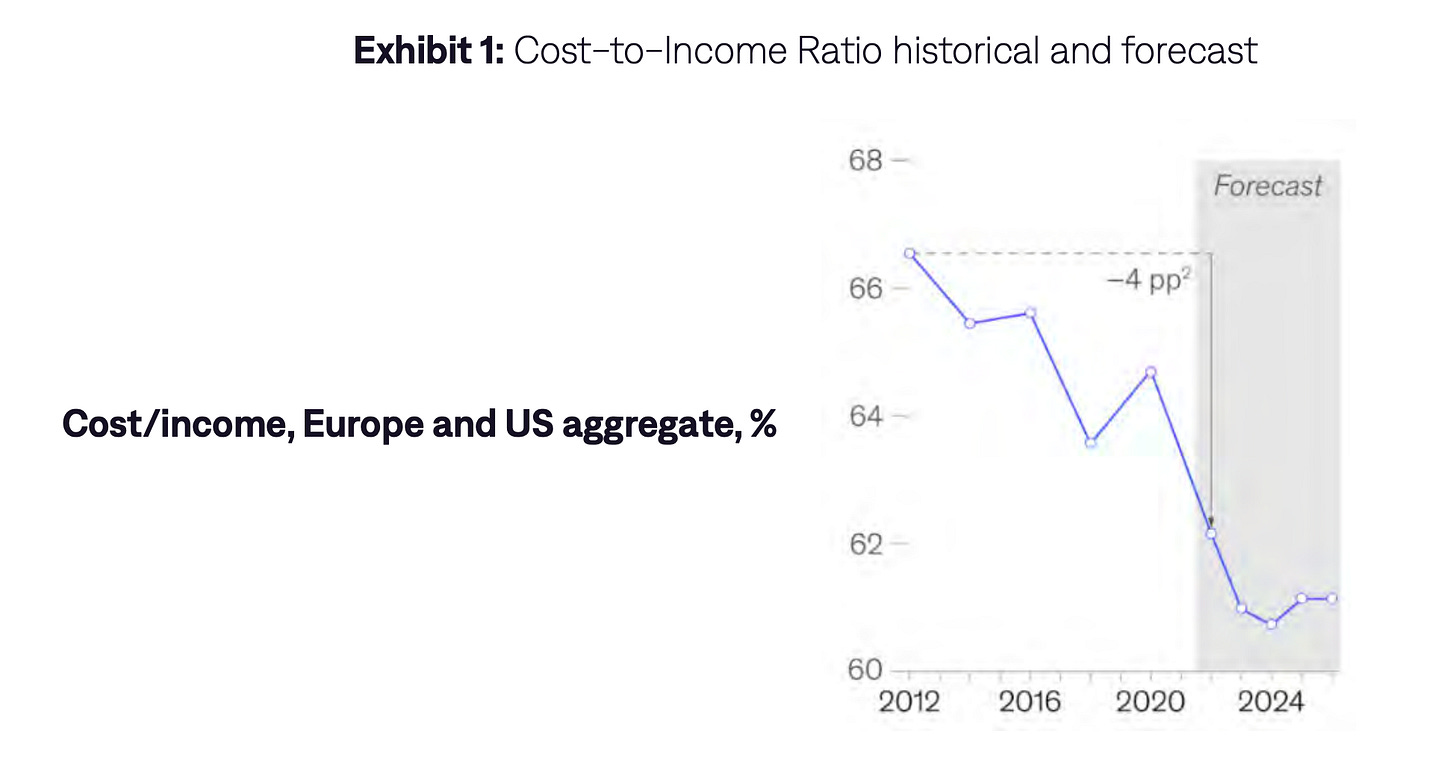

In this Deep Dive edition of Fintech Wrap Up, I explored the complex world of modernizing core banking systems—and why it’s becoming more critical than ever, based on the experience of Tuum. Banks today are grappling with mounting economic pressures, outdated technology, and fierce competition. With cost-to-income ratios hovering around 60%, there’s a growing urgency to rethink operations and core infrastructure.

What really stood out is how top-performing banks—the true tech leaders—are cracking the code by shifting the bulk of their IT budgets toward innovation instead of just keeping legacy systems on life support. These forward-thinking players are allocating up to 75% of their tech spend to “build the bank” initiatives, allowing them to launch products faster, enhance customer experiences, and operate far more efficiently.

One of the biggest questions banks face is how to actually approach modernization. Full core replacements are expensive and high-risk, while greenfield builds don’t always solve existing legacy issues. That’s where Progressive Migration comes in—it offers a middle path, allowing banks to transition gradually off outdated systems without disrupting business as usual.

A real-life case study from Tuum brings this approach to life. It shows how a mid-sized bank migrated accounts, lending, and reporting to a modern core platform—all while maintaining service continuity. By leveraging smart APIs and data lakes, they not only stayed on budget but also automated key processes and eliminated years of technical debt.

If you’re navigating a digital transformation—or just curious about the future of core banking—this one’s packed with insight. 🚀

Cracking the Cost-to-Income Code

Today’s mid-market bank must navigate a complex and challenging landscape: cloudy macroeconomic and geopolitical conditions, interest rate uncertainty, increased competition from both market heavyweights and disruptive fintech upstarts, and rapidly evolving customer expectations. These factors exert considerable pressure on banks’ financial performance. The outlook from 2024+ suggests that cost-to-income ratios for the sector are expected to remain flat in the low 60% range, ending a decade-long period of sustained improvement that saw this figure decline globally by roughly 4 percentage points on average.

Both sides of the cost-to-income equation must be considered going forward. Business unit leaders need to innovate product offerings and expand their reach into valuable customer segments. At the same time, CTOs and leaders in supporting functions will need to “do more with less.”

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.