Card Networks Are Winning Big in Fintech’s Expansion Race; What are the Capabilities of Ledger-as-a-Service Solutions?; Agentic AI: Loan Documentation & Credit Workflow

Welcome to the latest edition of Fintech Wrap Up, where we decode the pulse of modern financial innovation.

Insights & Reports:

1️⃣BVNK vs. Bridge vs. Zero Hash - Stablecoin Payment Infrastructure

2️⃣Emerging Fintechs Set to Drive the Next Wave of Growth in B2B(2X), Infrastructure, and Lending

3️⃣What are the Capabilities of Ledger-as-a-Service Solutions?

4️⃣Money vs Credit and the Hierarchy of Money

5️⃣Agentic AI: Loan Documentation & Credit Workflow

6️⃣Card Networks Are Winning Big in Fintech’s Expansion Race

7️⃣What will your finance team look like in 3 years?

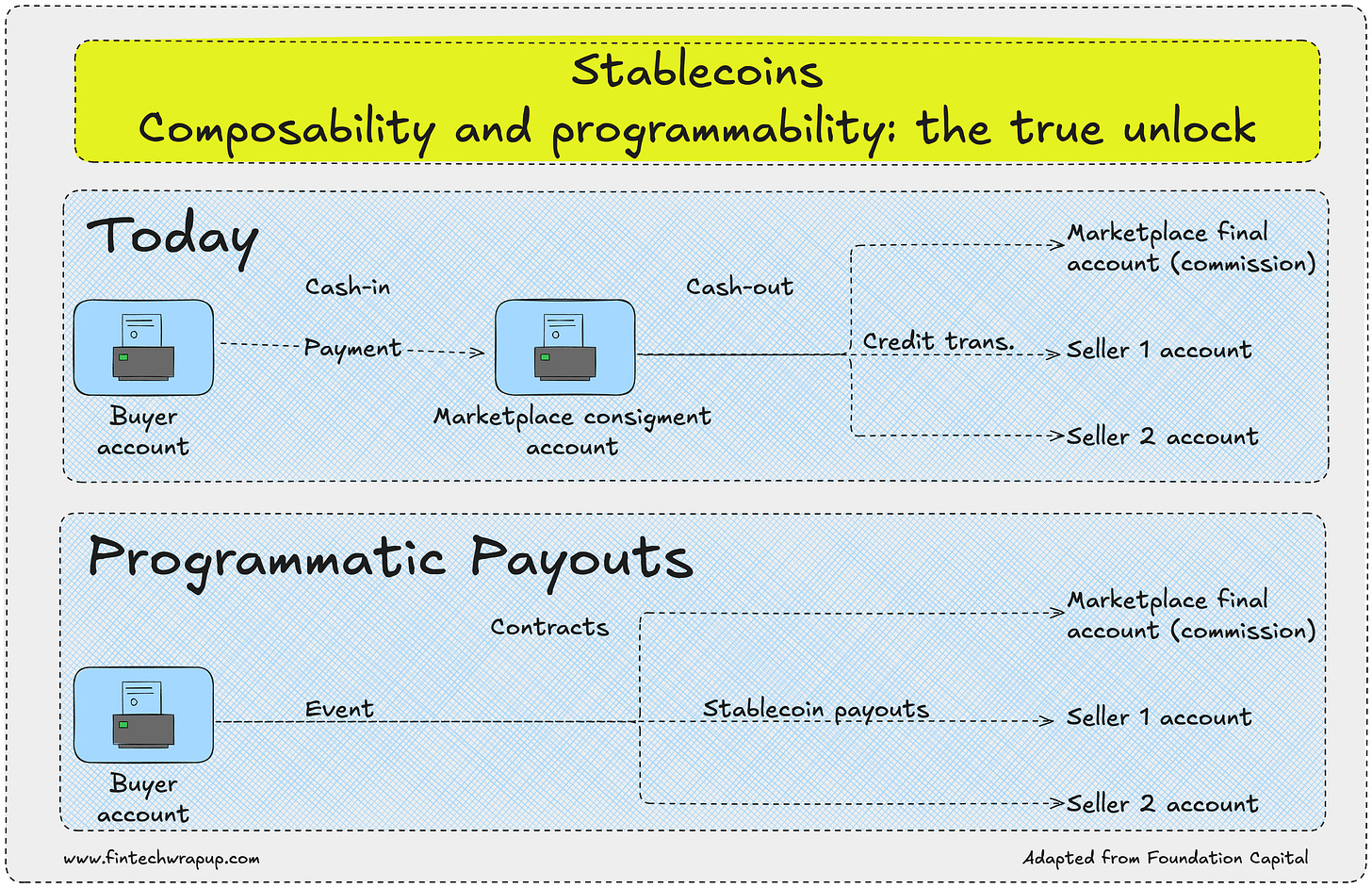

8️⃣Composability and programmability: the true unlock of Stablecoins

9️⃣PingPong Payments gets onboard with ClearBank

TL;DR:

Welcome to this week’s edition of Fintech Wrap Up—your quick dive into the biggest fintech stories.

This week’s roundup paints a sharp picture of where fintech is heading—and what’s powering its next wave. Stablecoins are more than just crypto assets now—they’re programmable money infrastructure. Whether it’s intra-company treasury ops or agent-triggered micropayments, composability is turning stablecoins into the backbone of future money movement. Visa’s expansion into onchain settlement with stablecoins like PYUSD and EURC underscores the shift.

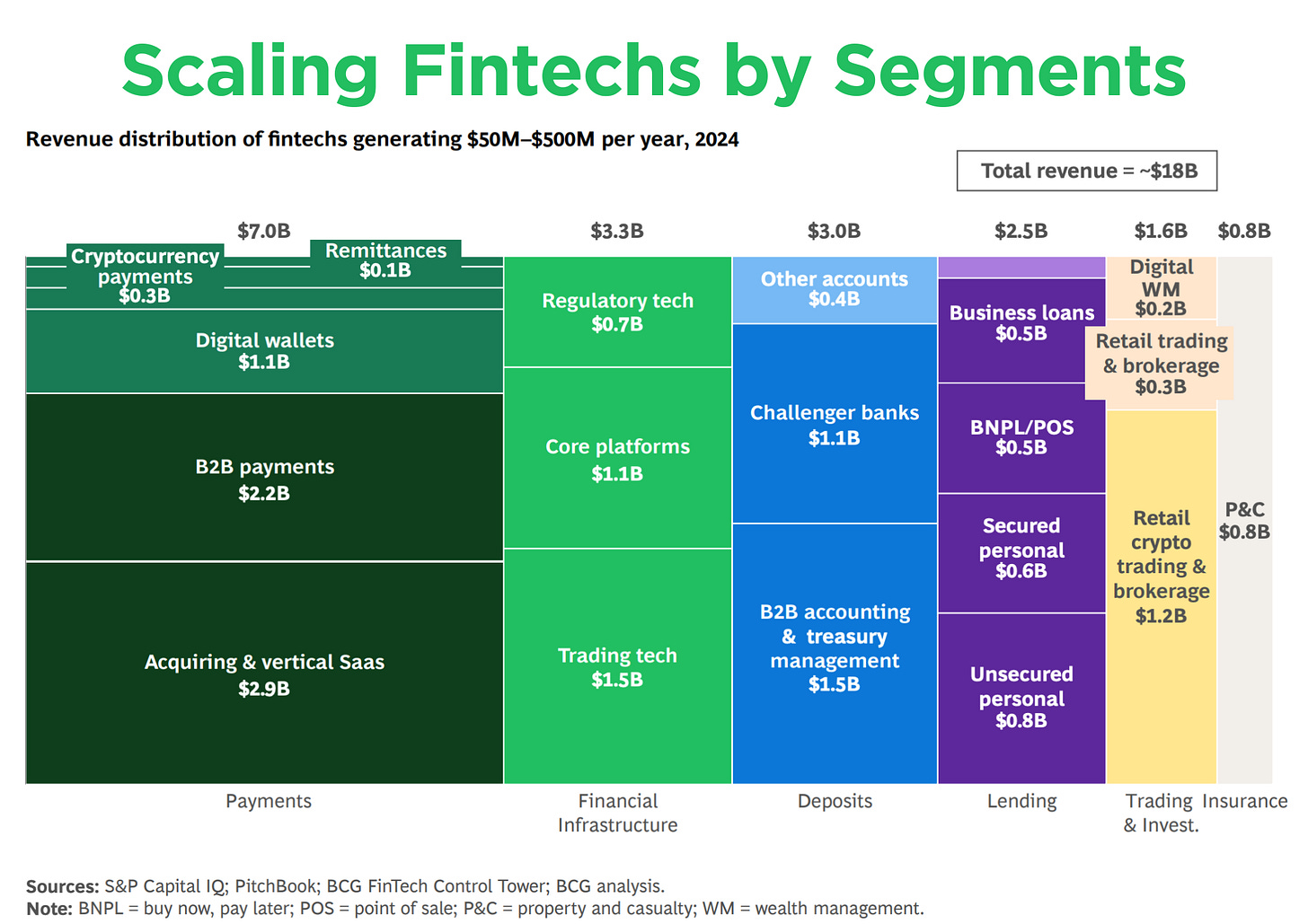

Meanwhile, B2B(2X), financial infrastructure, and lending are shaping up as fintech’s next growth engines. BCG reports B2B(2X) players already account for 39% of scaling fintech revenue, fueled by the urgent need to modernize clunky business workflows. With $32B in venture capital pouring into this vertical, expect more innovation around automation and embedded finance.

On the plumbing side, Ledger-as-a-Service (LaaS) is quietly becoming essential. As fintechs adopt more hybrid models, purpose-built ledgering platforms like Modern Treasury, Twisp, and Formance are gaining traction—unlocking agility and precision in managing fund flows.

In infrastructure, BVNK, Bridge, and Zero Hash are duking it out to become the default stablecoin rails. Their API-driven platforms promise global value transfer without the blockchain headache.

And yes, AI is going full throttle. Ramp’s vision of a 2028 finance team leans heavily on autonomous agents doing the grunt work while humans steer strategy. SLM-powered agentic AI is already transforming credit underwriting, memo drafting, and more.

Here’s the takeaway: The future of fintech is programmable, composable, and increasingly autonomous. If you're still building on legacy logic, you’re already behind.

Until next time—thanks for reading Fintech Wrap Up!

Reports

Insights

BVNK vs. Bridge vs. Zero Hash - Stablecoin Payment Infrastructure

Stablecoins are rapidly transforming how money moves globally, blurring the lines between traditional finance and crypto. At the heart of this shift are platforms like BVNK, Bridge, and Zero Hash, offering the rails that connect traditional finance to digital assets.

All three offer APIs that help fintechs and enterprises send, receive, convert and store value globally, while abstracting away blockchain complexity, regulatory burden, and custody risk.

In this piece, I compare these providers across six key dimensions:

Payments (speed, flexibility, use cases)

Wallets and custody (integrated vs modular models)

Technology stack (developer UX and orchestration capabilities)

Licensing and compliance (jurisdictional reach and regulatory protections)

Security (certifications, controls, architecture)

Customer footprint (clients, volumes, trust signals)

The goal is to help fintech teams make an informed decision based on their needs, whether you’re building global payouts, launching a stablecoin wallet, or embedding crypto into your product.

Emerging Fintechs Set to Drive the Next Wave of Growth in B2B(2X), Infrastructure, and Lending

While early fintech successes focused on digital wallets, challenger banking, retail crypto, vertical SaaS, and BNPL lending, many of these categories are now maturing. The top players have solidified their positions through scale, acquisitions, and market expansion, leaving limited room for new entrants. So where will the next generation of scaled fintechs emerge?

BCG identifies three key indicators that point to where future winners are likely to rise:

Revenue distribution of fintechs earning $50M–$500M

Equity investments by vertical over the past three years

Persisting customer and business pain points

Based on this analysis, three verticals are expected to power the next phase of fintech growth:

1. B2B(2X) – 39% of Scaling Fintech Revenues

B2B(2X) fintechs—those serving businesses or enabling others to serve them—represent the largest share of revenues among scaling fintechs. While consumers have seen much of the fintech innovation to date, businesses still face outdated, manual, and fragmented workflows, especially in payments, treasury, and accounting.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.