AI’s Impact on Payments & Fintech: Fraud Management; How embedded finance can disrupt the value chain in financial services; The Rise of Vertical AI in Accounting;

This week, we're diving into the future of money mobility, AI’s growing role in fraud prevention, and the latest fintech funding rounds.

Insights & Reports:

1️⃣ The Modern Money Mobility: Ecosystem Providers

2️⃣ The largest US banks' Q4 performance

3️⃣ Factors Influencing SWIFT PaymentProcessing Times

4️⃣ AI’s Impact on Payments & Fintech: Fraud Management

5️⃣ Six dynamics are shaping the emerging African fintech landscape

6️⃣ How embedded finance can disrupt the value chain in financial services

7️⃣ The Rise of Vertical AI in Accounting

8️⃣ The Crypto Theses 2025

9️⃣ Formance raises $21M to build the AWS for fintech infrastructure

TL;DR:

Here’s the latest edition of Fintech Wrap Up, packed with insights on the evolving money mobility ecosystem, big bank earnings, SWIFT payment processing, AI’s role in fraud management, and fintech trends shaping Africa.

The financial ecosystem is more interconnected than ever, with money mobility at its core. Businesses must decide whether to work with a single provider or build a custom network of partners, but either way, real-time payments, AI-driven analytics, and embedded finance are reshaping how funds move globally. Meanwhile, Q4 earnings from major U.S. banks were stronger than expected, thanks to surging investment banking and trading revenues. However, rising credit risks and commercial real estate challenges remain areas to watch in 2025. On the payments front, SWIFT transactions can be delayed by regulatory compliance, outdated banking tech, and country-specific capital controls—highlighting the need for modernization. AI is playing an increasingly crucial role in fraud prevention, reducing manual reviews and making risk management more accessible, even for smaller businesses. Across Africa, fintech partnerships, M&As, and cross-industry integrations are driving the next wave of innovation, though regulatory hurdles still pose challenges.

Embedded finance continues to disrupt traditional financial services, allowing businesses to integrate banking products seamlessly into their ecosystems. While the market is poised for massive growth, legacy infrastructure and regulatory limitations remain roadblocks to widespread adoption. AI is also making waves in accounting, with verticalized AI solutions helping firms automate complex workflows, particularly in Client Advisory Services (CAS), a growing revenue driver for accounting firms. Finally, in crypto, the outlook for 2025 is filled with cautious optimism as investors balance inflation concerns with evolving market conditions.

On the funding front, fintech infrastructure startup Formance secured $21M to build an AWS-like solution for financial services, QED backed stablecoin payments startup Cedar Money with a $9.9M seed round, and embedded finance player Swan extended its Series B with €42M.

Until next time, stay informed and stay ahead! 🚀

Insights

The Modern Money Mobility: Ecosystem Providers

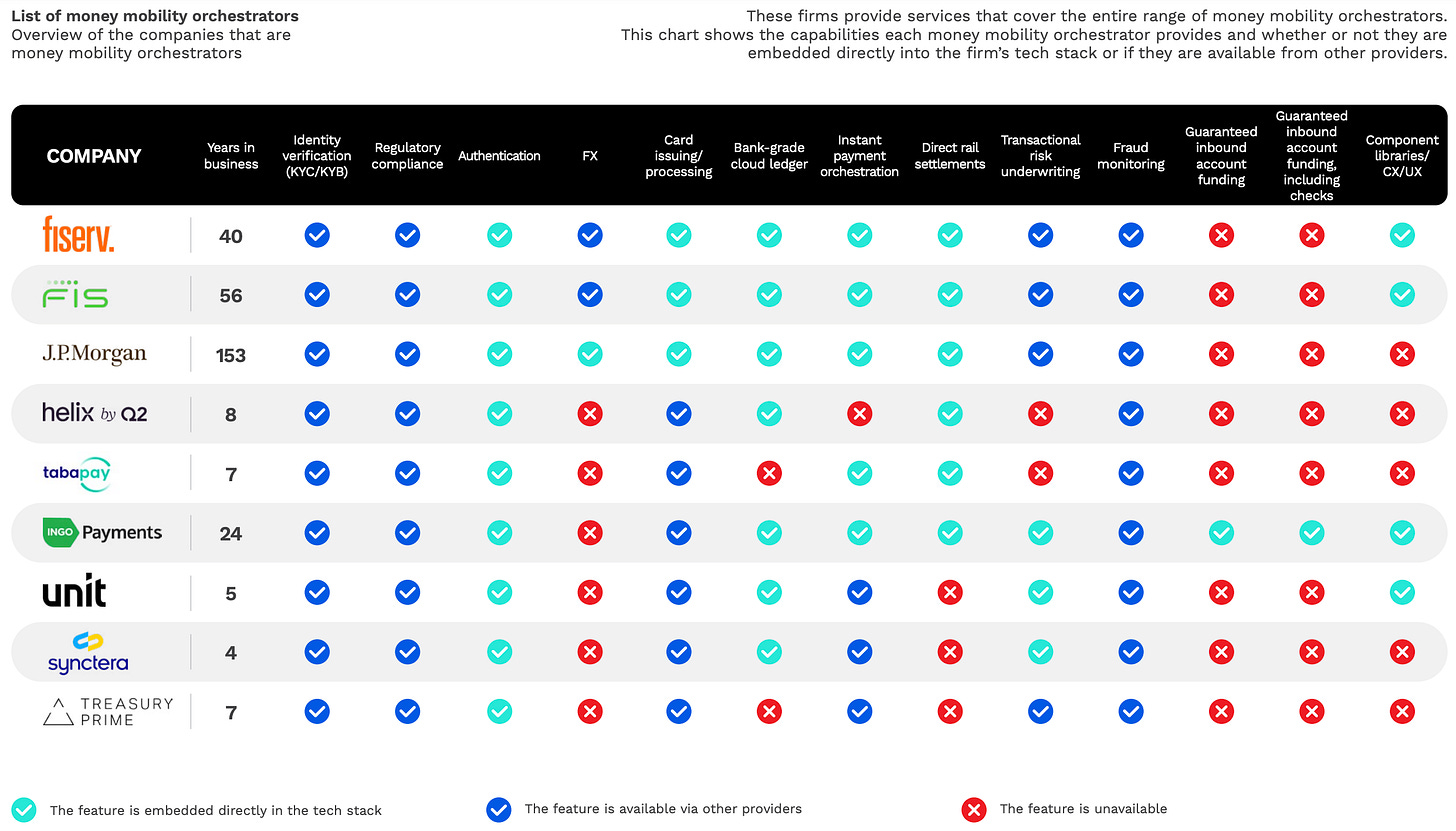

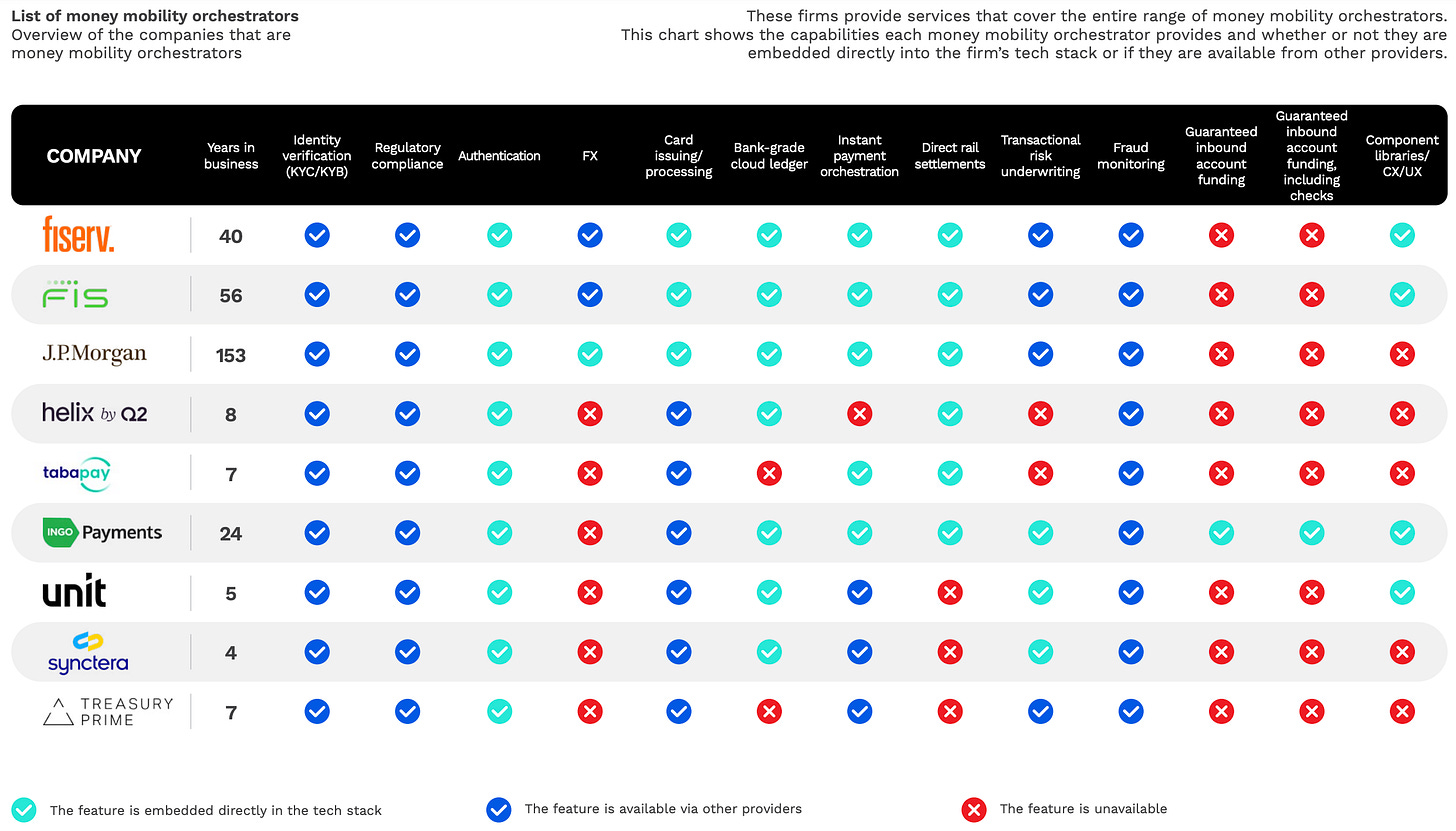

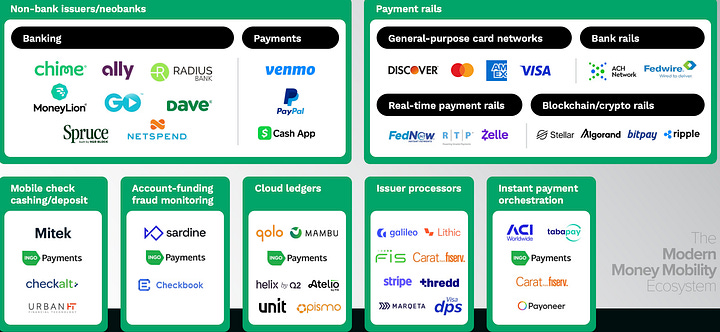

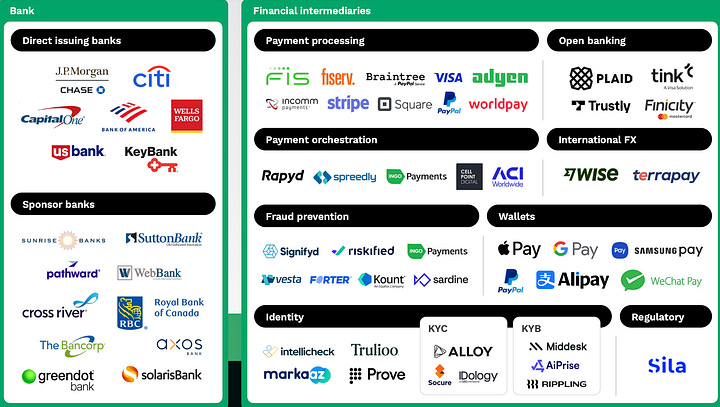

The following table provides a comprehensive overview of the various players in the financial technology and services ecosystem, categorized by their primary functions while acknowledging their presence in multiple areas of this ecosystem.

👉 The Future of the Money Mobility Ecosystem

The money mobility ecosystem has evolved into a complex and dynamic network of accounts, rails, intermediaries, and service providers. At its core, this ecosystem revolves around the seamless movement of funds into and out of accounts, facilitated by various rails and intermediaries. Banks and non-bank FinTechs leverage this infrastructure to create new account relationships and monetization opportunities, transforming simple transactions into deeper financial relationships.

As the ecosystem continues to evolve, businesses must carefully consider their approach to money mobility and their strategies for integrating it into their organizations. The choice between a single, integrated provider and a customized, multi-partner solution depends on factors such as business size, scope, and specific needs. Regardless of the chosen approach, a well-implemented money mobility strategy can provide significant competitive advantages, improve operational efficiency, and enhance customer satisfaction.

As technology continues to advance and consumer expectations evolve, the money mobility ecosystem is likely to see further innovations.

Key Trends Shaping the Future:

🔹 Increased adoption of real-time payments: Faster payment rails becoming the norm rather than the exception.

🔹 Regulatory technology advancements: Streamlining compliance processes through automation and data analytics.

🔹 Greater integration of AI and machine learning: Enhancing fraud detection, personalization, and predictive analytics.

🔹 Expansion of embedded finance: Financial services becoming seamlessly integrated into non-financial platforms and applications.

🔹 Growth of decentralized finance: Blockchain-based financial services challenging traditional banking models.

🔹 Enhanced cross-border capabilities: Improved solutions for international payments and currency conversions.

🔹 Focus on financial inclusion: Developing solutions to serve underbanked and unbanked populations.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.