AI in Banking: Orchestrated Multiagent Systems; Cross-border payments: Stablecoin Use Case; Optimizing authorization rates: How to reduce network declines;

Happy New Year, everyone! Let’s kick off 2025 with some exciting insights and trends shaping the fintech world.

Insights & Reports:

1️⃣ Cross-border payments: Stablecoin Use Case

2️⃣ AI in Banking: Orchestrated Multiagent Systems

3️⃣ Optimizing authorization rates: How to reduce network declines

4️⃣ Will stablecoins eat payments?

5️⃣ Costs to send $1,000 on leading blockchains

6️⃣ Banking and lending: GenAI gains momentum among banks after a late start

7️⃣ Wealthtech in India: Charting a New Frontier

8️⃣ Challenges in Open Finance

9️⃣ US banking giants capture biggest share of industry profits since 2015

TL;DR:

Happy New Year, everyone! Welcome to the very first Fintech Wrap Up of 2025. I hope this year brings you success, innovation, and plenty of fintech breakthroughs. Let’s dive into some exciting insights shaping the future.

Stablecoins are continuing to redefine cross-border payments. With instant settlements, low costs, and seamless 24/7 global operability, they’re becoming the go-to solution for remittances, business payments, and even low-margin transactions like those in corner shops and coffeehouses. The integration of blockchain and real-time fiat networks is eliminating intermediaries and reducing friction—truly transformative!

On the AI front, multiagent systems are stepping into the spotlight, orchestrating complex workflows in banking. These systems promise smarter fraud detection, better credit decision-making, and even personalized support via AI-powered copilots for employees and customers. It’s early days, but the potential for automation and efficiency is immense.

For those of you in payments, we’ve included actionable tips to boost authorization rates—think network tokens, card account updaters, and fraud prevention tools. Postmates, for instance, saw a $60M revenue uplift just by leveraging these strategies. Meanwhile, tokenization is creating waves on Wall Street, and the rise of hyper-personalized wealthtech solutions in India is further proof that fintech is moving at breakneck speed.

In curated news, US banking giants are dominating profits, MoonPay is thriving under Europe’s MiCA regulations, and stablecoins continue to outshine traditional payment methods with near-zero fees and instant settlements.

That wraps up our first edition of 2025! Here’s to a year of growth and innovation. As always, I’d love to hear your thoughts—let’s make 2025 a standout year for fintech!

Insights

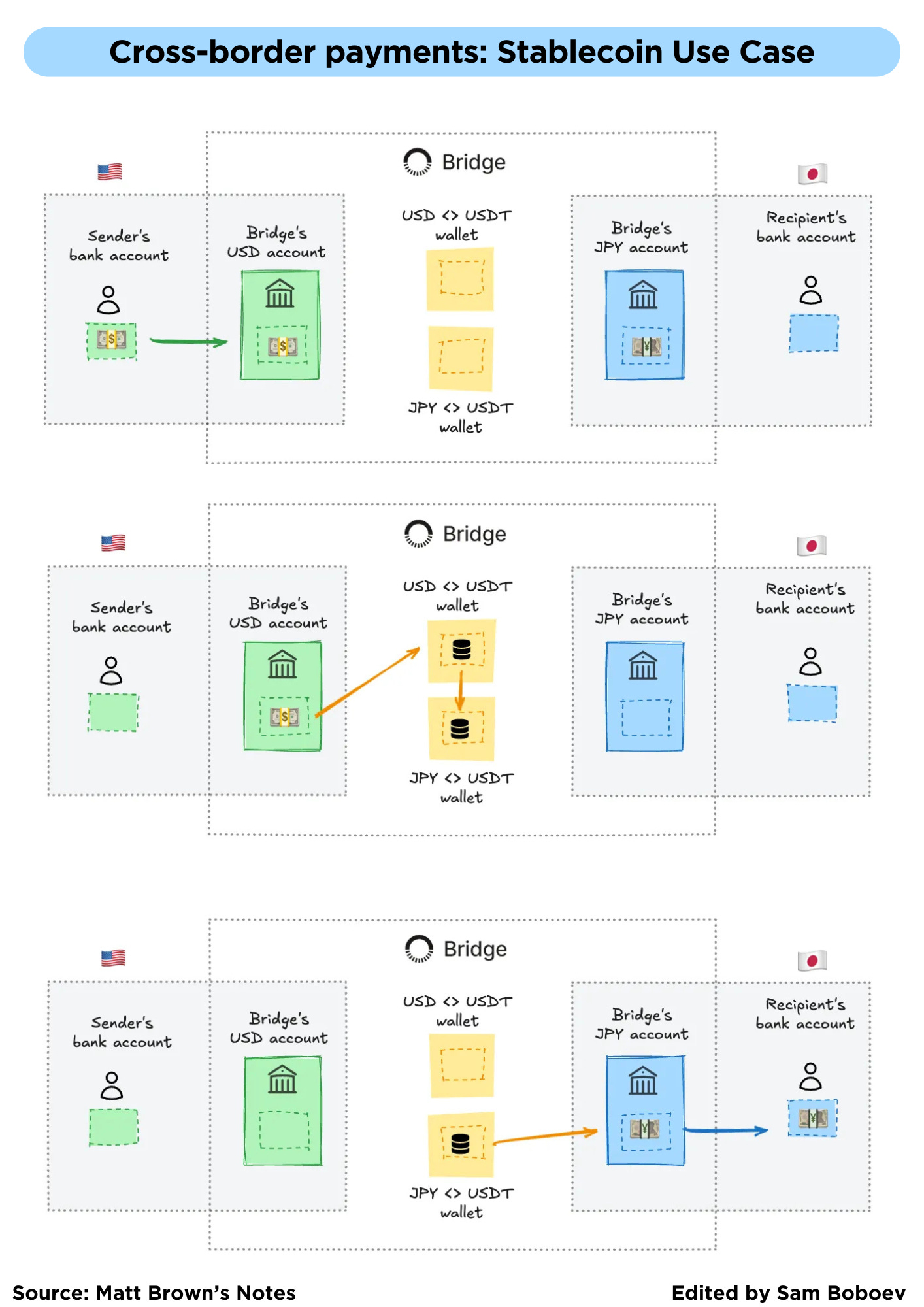

Cross-border payments: Stablecoin Use Case

Great article by Matt Brown

"Cross-border payments" are payments made between parties in different countries. While the concept is straightforward, the systems that move >$45 trillion annually across borders are anything but. That’s because cross-border payments (XBP) must account for things domestic payments take for granted.

Say I want to send $100 USD to a friend in Japan. Those funds need to somehow move between two banks that may not have a direct relationship with one another across different payment rails and regulatory regimes and eventually land as Japanese Yen (JPY) in an account around the world.

The various solutions to this involve two common parts: (1) acquiring and supporting local users on both ends of the transaction, including first/last mile of money movement and local regulatory compliance, and (2) the “middle mile” of moving money or value across borders, converting currencies, and managing FX and liquidity risks.

👉 Stablecoin Use Case

The newest kid on the XBP block is the stablecoin, which offers several improvements on all other XBP methods. A stablecoin is a digital currency backed 1:1 by fiat currency like USD, so its value is constant, and it’s tradable instantly and globally. Since the blockchain and exchanges never close, stablecoins can be converted almost instantly to/from fiat. When combined with burgeoning 24/7 fiat real-time payment networks, stablecoins enable near-instant fiat > stablecoin > fiat transactions.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.