Agentic AI Use Cases Across Financial Services; The forces behind the rise of real-time payments; Classification of Cryptoassets Case Study: EU – Residual Asset Class;

This week, we’re exploring how Payments as a Service (PaaS) is reshaping global business operations and how real-time payments (RTPs) are sparking a payment revolution worldwide

Insights & Reports:

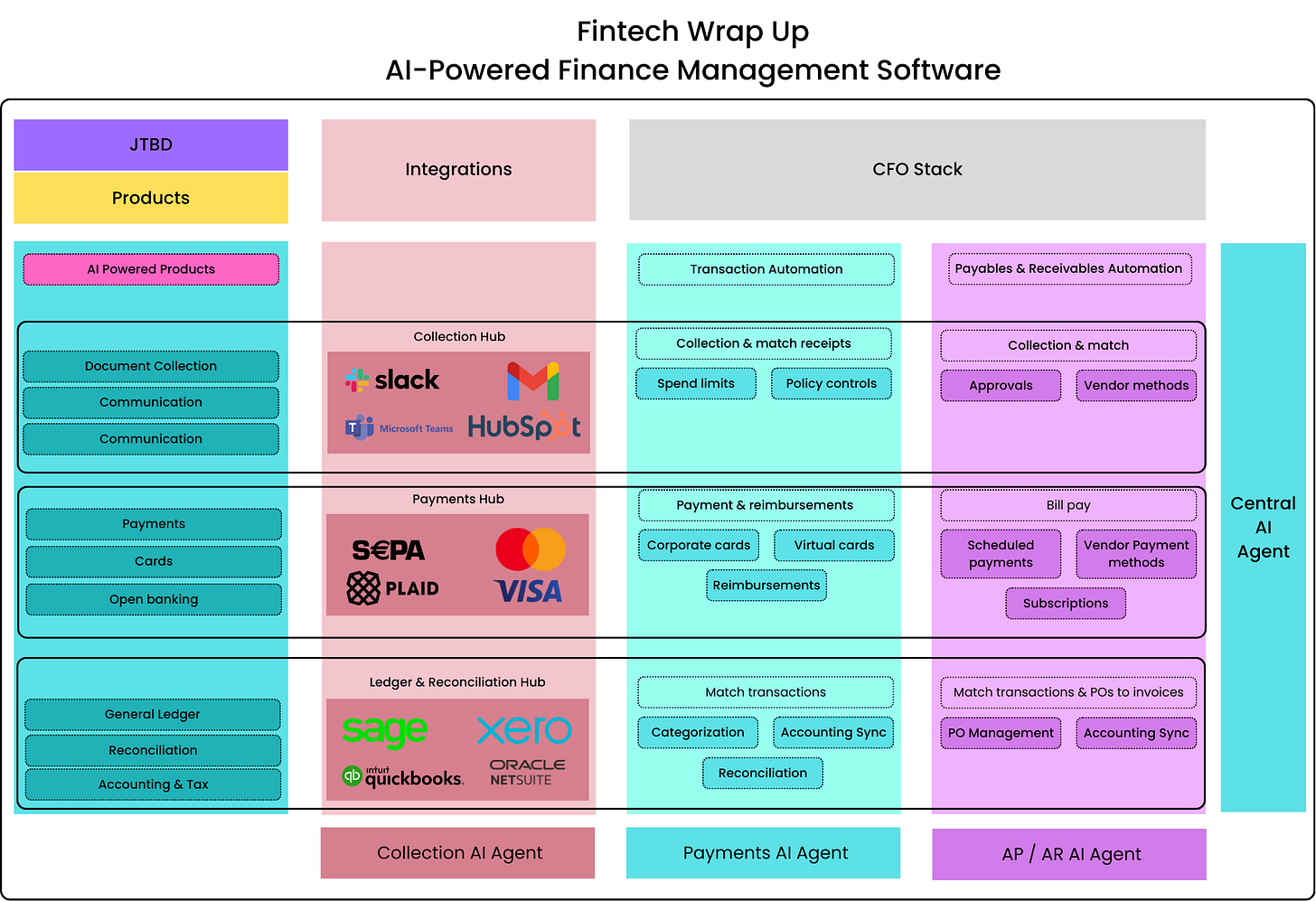

1️⃣ PaaS Revenue Opportunities for Financial Businesses and Their Corporate Clients

2️⃣ Classification of Cryptoassets Case Study: EU – Residual Asset Class

3️⃣ The forces behind the rise of real-time payments

4️⃣ The shift to paperless and digital B2B transactions appears inevitable

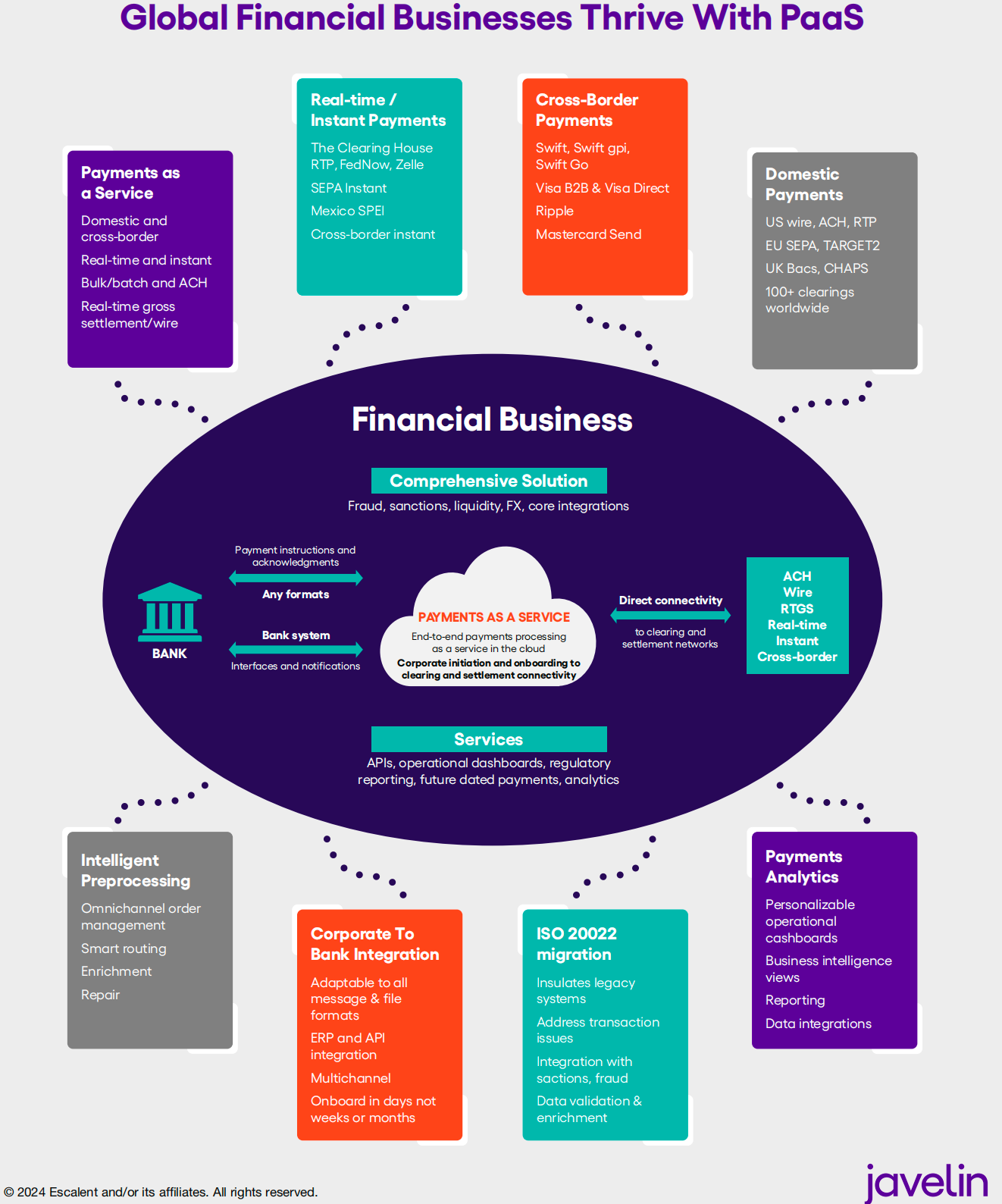

5️⃣ Banking: How generative AI can be put to work

6️⃣ AI and Its Precursors Are Not New To Fintech

7️⃣ Agentic AI Use Cases Across Financial Services

8️⃣ Checkout achieves 45% growth and sets stage for return to profitability

9️⃣ Ramp encroaches into digital bank territory with new treasury product

Waitlist is now open for our AI-powered financial platform

Our platform offers core AI features, including a Smart Ledger for real-time updates, anomaly detection, and payment tracking, an AI Invoice Manager for AP/AR automation, payments processing, and fraud detection, and a Cash Flow Manager that provides actionable projections and payment insights. Predictive analytics, audit-ready compliance reports, and a centralized dashboard enhance operational efficiency, payment management, and decision-making.

TL;DR:

This week, I’m diving into some big trends shaping payments, banking, and fintech—so grab your coffee (or chai) and let’s catch up on what’s making waves!

First up, Payments as a Service (PaaS) is transforming how businesses manage their finances. From seamless cross-border payments with real-time currency conversion to multichannel payment acceptance and fraud prevention powered by machine learning, PaaS is helping businesses cut costs, streamline processes, and drive growth. Whether it's automating accounts payable or using data to optimize cash flow, the opportunities here are endless for enterprises juggling global operations.

In the crypto world, the EU’s MiCA regulation is setting the stage for clearer classification of cryptoassets. Think of it as the safety net regulation for assets falling outside traditional financial frameworks. MiCA’s approach to asset-referenced tokens (ARTs) and e-money tokens (EMTs) is worth a closer look, as it could be a model for balancing innovation and oversight in the crypto space.

Real-time payments (RTPs) are booming globally, and stories like India’s UPI, Brazil’s Pix, and Thailand’s PromptPay show how infrastructure, consumer demand, and business buy-in create payment revolutions. The rise of RTPs reminds us how quickly new payment methods can reshape economies when the right conditions align.

B2B payments are also going digital faster than ever. With projections of $26 trillion in marketplace GMV by 2030, digital-first solutions like ISO 20022 and Swift GPI are making cross-border and domestic transactions faster, cheaper, and more transparent. But challenges persist—just ask corporate treasurers struggling with cash flow forecasting and operational inefficiencies.

And let’s talk about AI in banking—whether embedded in tools like Microsoft Copilot, transforming operations like call centers, or driving hyper-personalized experiences, generative AI is helping banks innovate and differentiate. From fraud detection to agentic contracts and even smarter onboarding, AI isn’t just a buzzword; it’s a game-changer.

In curated news, Checkout ended 2024 on a high note with 45% revenue growth, signaling a strong push toward profitability. Ramp is stepping into digital banking with its new Treasury product, offering businesses liquidity and higher yields. And Pluto just secured $4.1 million to fuel its expansion in KSA, further strengthening its position in the region.

There’s so much more to unpack, but I’ll save the rest for next time. As always, feel free to hit reply and share your thoughts—I’d love to hear what’s on your mind!

Insights

PaaS Revenue Opportunities for Financial Businesses and Their Corporate Clients

Here’s how they do it:

1. Cross-Border Transactions and Currency Conversion

Large commercial enterprises often engage in cross-border trade, necessitating efficient and cost-effective management of international payments. PaaS solutions streamline cross-border transactions by providing real-time currency conversion and competitive exchange rates. This capability helps businesses manage foreign exchange risks and reduce transaction costs. For example, a global manufacturing company can use PaaS to pay suppliers in many countries, ensuring supply chain diversification and timely and accurate payments in various currencies.

2. Multichannel Payment Acceptance

Enterprises that operate in multiple markets need to accept payments through various channels, including online, mobile, and on-premises. PaaS platforms offer a unified solution for integrating different payment methods, such as credit cards, digital wallets, and bank transfers. This flexibility enhances customer experience and increases sales opportunities. For instance, an international retailer can use PaaS to provide a seamless payment experience across its e-commerce site, mobile app, and physical warehouses worldwide.

3. Automated, Integrated Accounts Payable

Large enterprises have complex accounts payable processes involving numerous vendors and invoices. PaaS solutions can automate these processes, from invoice receipt to payment execution, ensuring accuracy and efficiency. By integrating PaaS, a global corporation can automate payments to its suppliers, improving cash flow management and liquidity and reducing the risk of errors or delays.

4. Fraud Detection and Prevention

As businesses manage an increasing volume of global payments, the risk of fraud also rises. PaaS platforms incorporate advanced security features like machine learning algorithms and real-time monitoring to detect and prevent fraudulent activities. A multinational company can leverage these capabilities to safeguard its transactions and comply with international security standards, thus protecting its financial assets and reputation.

Keep reading with a 7-day free trial

Subscribe to Fintech Wrap Up to keep reading this post and get 7 days of free access to the full post archives.